Key Takeaways

- Digital platform expansion and data-driven services are expected to boost recurring, high-margin revenues through cross-selling and deeper customer engagement.

- Geographic growth, regulatory trends, and industry consolidation position W.A.G to increase market share and scale efficiently across Europe.

- Technological shifts, execution risks, and rising competition threaten W.A.G's growth opportunities, margins, and long-term earnings against a backdrop of industry and macroeconomic uncertainty.

Catalysts

About W.A.G payment solutions- Operates integrated payments and mobility platform that focuses on the commercial road transportation industry in Europe.

- The company's strategic shift towards an integrated, digital platform (Eurowag Office) is set to accelerate wallet share per customer via cross-selling and subscription bundling, enabled by rising demand for digitalization and end-to-end solutions in B2B mobility payments-likely to boost both recurring revenue and net margins as more customers migrate in 2025–2026.

- Geographic expansion and new indirect sales channels, especially through OEM truck manufacturer partnerships, will allow W.A.G to access underserved markets across Europe and scale rapidly at lower customer acquisition costs, with impact expected to become meaningful next year-supporting long-term top-line growth and incremental margin improvement.

- Increasing regulatory momentum towards cashless, transparent payment solutions benefits W.A.G's compliant digital offerings over legacy systems; this secular regulatory tailwind should continue driving conversion from cash to digital, widening the addressable market and structurally supporting market share and revenue growth.

- Heavy investment in data-centric services, hardware, and e-wallet infrastructure positions W.A.G to ride the growing trend of integrated fleet management, enabling future rollouts like digital receivables financing and value-added AI services-these initiatives are aimed at deepening customer stickiness and generating higher-margin fee income.

- Ongoing industry consolidation and the need for interoperable, compliant payment platforms favor scaled players; recent successful acquisitions and roll-out of recurring subscription revenues (targeting a rise from 27% to 60%) suggest W.A.G is gaining competitive leverage, potentially leading to operating leverage and expanding EBITDA margins as the market rationalizes.

W.A.G payment solutions Future Earnings and Revenue Growth

Assumptions

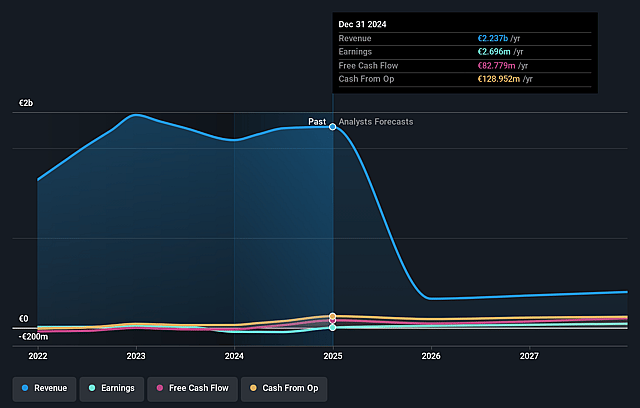

How have these above catalysts been quantified?- Analysts are assuming W.A.G payment solutions's revenue will decrease by 43.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.1% today to 11.4% in 3 years time.

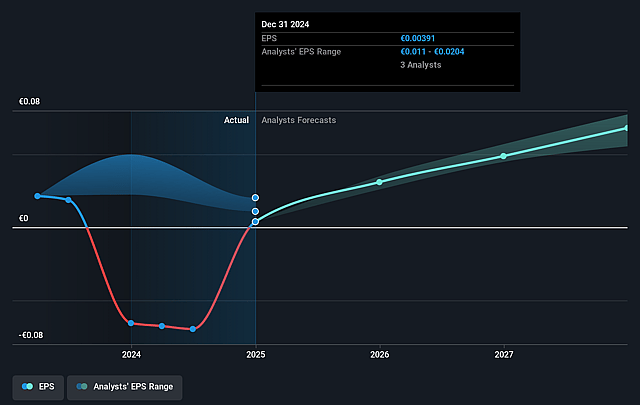

- Analysts expect earnings to reach €45.4 million (and earnings per share of €0.07) by about September 2028, up from €2.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €56.6 million in earnings, and the most bearish expecting €33 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, down from 279.1x today. This future PE is greater than the current PE for the GB Diversified Financial industry at 20.1x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.93%, as per the Simply Wall St company report.

W.A.G payment solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated industry shift toward electric vehicles (EVs) and alternative fuels could reduce the relevance or demand for traditional fuel payment solutions, potentially shrinking W.A.G's addressable market and negatively impacting long-term revenues.

- Heavy and ongoing capitalized R&D and platform investments, while capped, may compress net margins if revenue growth does not accelerate as projected, or if integration of acquired businesses and platform rollouts face delays or higher costs than expected.

- Slow digital migration and customer adoption risks: The migration of existing products and customers onto the integrated Eurowag digital platform is still in progress and subject to execution risk; delays, customer resistance, or unforeseen complexity could limit cross-sell, retention benefits, and revenue per customer, slowing top-line and subscription growth.

- Increased competition from both large scaled competitors via industry consolidation and from tech-centric new entrants leveraging open digital payment APIs may put downward pressure on transaction fees and net margins, risking market share and profitability.

- Heightened credit losses, particularly among SME customers facing insolvencies in key markets, and ongoing macroeconomic headwinds (e.g., trade wars, regional downturns), present risks to receivables, cash flow generation, and ultimately, earnings stability in the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.131 for W.A.G payment solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.35, and the most bearish reporting a price target of just £0.89.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €398.4 million, earnings will come to €45.4 million, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 8.9%.

- Given the current share price of £0.95, the analyst price target of £1.13 is 16.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.