Key Takeaways

- Digital innovation and marketing expansion position PensionBee for long-term growth, improved margins, and increased market share against legacy providers.

- Demographic shifts and regulatory changes enhance customer acquisition, retention, and recurring revenue, supporting scalable and efficient operations.

- Heavy marketing spend, US expansion risks, and limited product diversification threaten profitability amid rising competition, regulatory compliance costs, and dependence on younger, lower-value customers.

Catalysts

About PensionBee Group- Provides online retirements saving services in the United Kingdom and the United States.

- The company's focus on acquiring younger customers, combined with ongoing demographic shifts toward an aging population, supports a long runway for asset and customer growth as new users are expected to remain on the platform for decades, directly impacting revenue and future retention-driven earnings.

- Increased consumer preference for digital and mobile-first financial services aligns with PensionBee's technology investments (AI assistant, enhanced customer interface, transfer automation), driving operational efficiency, customer satisfaction, and supporting improved net margins as the fixed cost base is leveraged across a growing user base.

- Regulatory trends such as pension dashboards and greater fee transparency are expected to lower barriers for pension transfers and favor digital disruptors like PensionBee, enabling market share gains from legacy providers, which should boost recurring revenue growth over time.

- The company is ramping up marketing investments, both in the maturing U.K. market (where brand awareness now rivals incumbents, supporting customer acquisition) and in the U.S. (with product nearing feature parity and significant pipeline opportunities), setting up for accelerated AUA and revenue growth in both geographies.

- Continued platform scalability and cost discipline (as evidenced by rising customers per staff and improving productivity) are expected to deliver higher incremental operating margins over time, supporting the company's long-term goal of achieving 50% adjusted EBITDA margins as revenue grows.

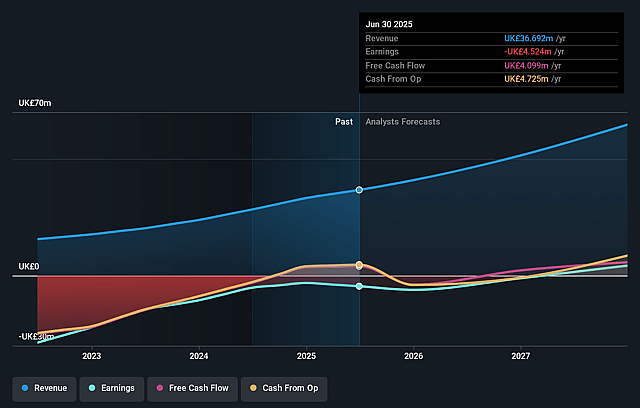

PensionBee Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PensionBee Group's revenue will grow by 23.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -12.3% today to 11.7% in 3 years time.

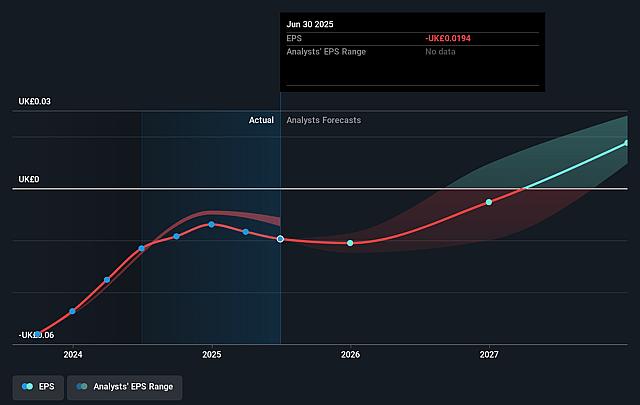

- Analysts expect earnings to reach £8.0 million (and earnings per share of £0.02) by about September 2028, up from £-4.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 77.2x on those 2028 earnings, up from -79.2x today. This future PE is greater than the current PE for the GB Capital Markets industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.2%, as per the Simply Wall St company report.

PensionBee Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent reliance on high marketing spend for both UK and US growth highlights sensitivity to rising customer acquisition costs and the risk that increased expenditure may not translate into proportional new customer or asset growth-potentially compressing net margins and undermining EBITDA targets.

- Expansion into the US pension market entails high execution risk, with product parity and automation still under development, uncertain RFP outcomes (e.g., for the 20,000 accounts), and intense competition from incumbent US providers-jeopardizing revenue scalability and increasing the potential for negative earnings if ramp-up falters.

- Shift towards a younger customer demographic, while potentially lengthening retention periods, could lead to a lower average account value over the medium term, suppressing near-term revenue per customer and possibly slowing asset-under-administration (AUA) growth rates.

- Heavy dependence on core pension consolidation as a product means limited revenue diversification, rendering PensionBee vulnerable to fee compression, regulatory change, or innovation from larger, established financial institutions-putting recurring revenue and long-term profitability at risk.

- Ambitious long-term margin and revenue guidance assumes sustained operational leverage and market share growth, but increasing regulatory costs, potential data/privacy compliance burdens, and a structurally competitive environment in digital wealth (including robo-advisors and fintech disruptors) threaten operational efficiency and sustainable earnings improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.038 for PensionBee Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £68.8 million, earnings will come to £8.0 million, and it would be trading on a PE ratio of 77.2x, assuming you use a discount rate of 8.2%.

- Given the current share price of £1.51, the analyst price target of £2.04 is 25.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.