Last Update01 May 25Fair value Increased 0.56%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Strategic diversification across flagship strategies enhances net margins and profitability, attracting more investor capital allocations.

- Strong growth in management fee income, alongside increased transaction activity, signals potential future revenue growth as AUM expands.

- Competitive pressures and market dynamics could impede revenue growth and profitability, with challenges in fundraising, margin compression, and maintaining positive fee earnings in private markets.

Catalysts

About Intermediate Capital Group- A private equity firm specializing in direct and fund of fund investments.

- Intermediate Capital Group (ICG) has demonstrated strong growth in various metrics, including a 23% year-on-year increase in management fee income driven by nearly record fundraising and higher transaction activity. This indicates potential future revenue growth as AUM continues to expand.

- ICG's strategic focus on diversification across flagship strategies, such as European direct lending and GP-led secondaries, positions the company well in capturing disproportionate investor capital allocations, suggesting improved net margins and profitability.

- The successful final close of the SDP V strategy direct lending at nearly $17 billion exemplifies ICG's scale and incumbency in the market, providing a significant opportunity for earnings growth and value creation.

- ICG's ongoing investments in marketing and client relations, particularly in the Americas, suggest potential for revenue growth from expanded fundraising capabilities and geographic market penetration.

- Despite decreasing private equity deployment and realization in the industry, ICG's deployment and realization figures have increased, supported by high transaction activity in debt strategies and liquidity solutions, indicating potential for continued strong earnings performance.

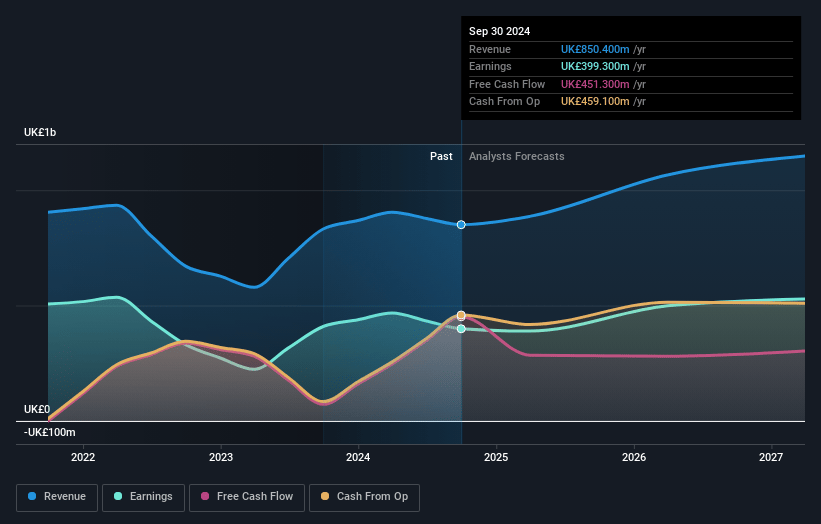

Intermediate Capital Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Intermediate Capital Group's revenue will grow by 11.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 47.0% today to 45.8% in 3 years time.

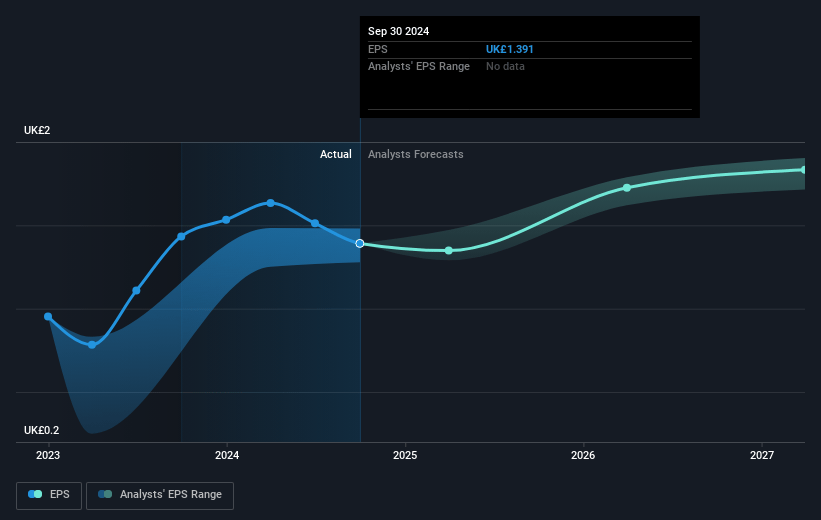

- Analysts expect earnings to reach £539.6 million (and earnings per share of £1.87) by about May 2028, up from £399.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £455.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, up from 13.5x today. This future PE is greater than the current PE for the GB Capital Markets industry at 11.0x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.15%, as per the Simply Wall St company report.

Intermediate Capital Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The disconnect between market perception and the reality on the ground, especially highlighted by limited private equity realizations (down over 25% compared to previous annual averages), could impede overall fundraising, impacting revenue growth from new investments.

- Competition for private market deals, particularly given limited deal flow, has led to margin compression in private credit, notably in the U.S., which could affect net interest margins and profitability.

- The increasing market pressure to return capital to investors before fundraising might challenge future capital raises for private equity strategies, potentially affecting earnings growth from management fees.

- New competition and consolidation in the private debt market could intensify competitive dynamics, potentially affecting future AUM growth and revenue from management fees if challenged by established players seeking market entry.

- High reliance on strong deployment and realization rates for positive fee earnings means any slowdown in deployment due to a sluggish private equity market could reduce future fee income and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £24.486 for Intermediate Capital Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £30.36, and the most bearish reporting a price target of just £19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.2 billion, earnings will come to £539.6 million, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 8.1%.

- Given the current share price of £18.76, the analyst price target of £24.49 is 23.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.