Key Takeaways

- Rising competition from digital and fintech payment solutions is eroding traditional fee income and threatening future revenue growth potential.

- Heavy reliance on large clients and intensifying regulatory pressures are increasing earnings volatility and challenging the company's ability to sustain profitability.

- Expansion into new regions, technology investment, and tailored product offerings are driving more stable revenues and deepening customer relationships amid supportive emerging market trends.

Catalysts

About CAB Payments Holdings- Through its subsidiaries, provides foreign exchange (FX) and cross-border payments services to banks, fintech companies, development organizations, supranationals, and governments in the United Kingdom and internationally.

- Persistent declines in high-margin FX activity within emerging market corridors, heightened by central bank interventions and weakened take rates, are likely to lead to ongoing revenue contraction and erode overall profitability, as seen in the sharp drop in emerging market take rates from 55 basis points to 29 basis points year-on-year.

- Rapid advances in digital and blockchain-based cross-border payment solutions threaten to bypass traditional correspondent banking models, exposing CAB Payments to long-term competitive pressures that could compress fee income and stall future revenue growth.

- Intensifying regulatory scrutiny and rising compliance demands in cross-border payments, especially for operations spanning high-risk jurisdictions, risk driving up operating expenses, further squeezing net margins and reducing overall earnings resilience.

- Customer concentration remains significant, and the company's reliance on a small number of large clients makes it vulnerable to abrupt swings in transaction volumes-if top clients reduce activity or switch providers, this could generate heightened earnings volatility and undermine EPS stability.

- Ongoing margin pressure from new fintech entrants offering ultra-low transaction fees, combined with CAB Payments' fixed cost base and negative operating leverage during periods of revenue decline, creates a scenario where net margins remain structurally challenged and future operational leverage is muted despite cost-cutting efforts.

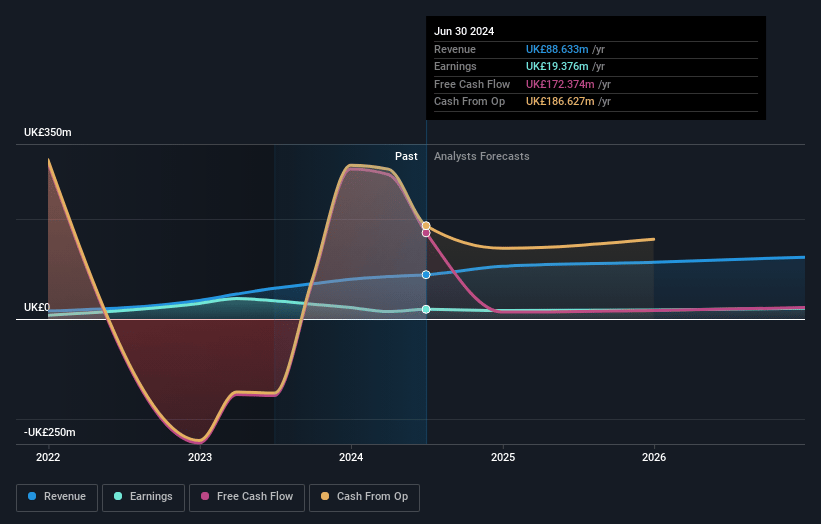

CAB Payments Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on CAB Payments Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming CAB Payments Holdings's revenue will grow by 13.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.6% today to 18.6% in 3 years time.

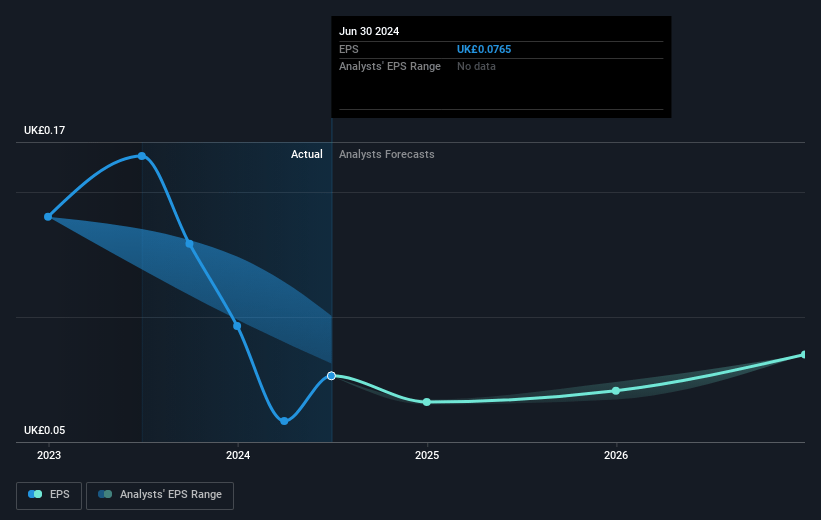

- The bearish analysts expect earnings to reach £24.6 million (and earnings per share of £0.1) by about July 2028, up from £14.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, down from 9.1x today. This future PE is lower than the current PE for the GB Diversified Financial industry at 16.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.75%, as per the Simply Wall St company report.

CAB Payments Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is successfully diversifying both its client base and geographic reach, expanding into markets beyond Sub-Saharan Africa such as MENA and Latin America, which should drive long-term volume growth and contribute to more stable and growing revenues.

- Investments in technology, automation, and product innovation-including enhanced B2B payment products, FX derivatives, and guaranteed deposits-are positioning CAB Payments to benefit from the secular growth in global cross-border and B2B digital payments, potentially increasing margins and recurring revenues.

- The strategic shift toward integrating FX, Payments, and Banking services into a one-stop-shop platform is strengthening customer loyalty and enabling higher-value, stickier client relationships, which should result in steadier transaction volumes and improved earnings resilience.

- The company's ability to develop new products tailored for emerging market needs-such as solutions that address trapped funds and local currency repayment for trade finance-differentiates CAB Payments from competitors and could create additional fee income streams, supporting long-term net margin expansion.

- Structural trends like increasing financial inclusion, underbanked economic growth, and global trade flows in emerging markets provide a strong secular tailwind, expanding CAB Payments' total addressable market and underpinning sustained revenue and earnings growth over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for CAB Payments Holdings is £0.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of CAB Payments Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.0, and the most bearish reporting a price target of just £0.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £132.6 million, earnings will come to £24.6 million, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 7.8%.

- Given the current share price of £0.51, the bearish analyst price target of £0.5 is 2.2% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.