Last Update01 May 25Fair value Decreased 0.25%

Key Takeaways

- Strategic geographic expansion and tech infrastructure enhancement could boost revenue and improve operational efficiency, supporting sustainable growth and better net margins.

- Workforce reduction and new product offerings aim to align costs with growth strategy, potentially boosting net margins and earnings.

- The company's revenue is challenged by currency effects, reduced market volumes, declining margins, and increased costs, with future prospects hindered by regulatory delays.

Catalysts

About CAB Payments Holdings- Through its subsidiaries, provides foreign exchange (FX) and cross-border payments services to banks, fintech companies, development organizations, and governments in the United Kingdom and internationally.

- CAB Payments is focusing on diversifying its clients and geographies and integrating its business and products to drive volume growth in FX and Payments. This strategy is expected to generate more predictable and sustainable revenue growth.

- The company is planning to enhance its technology infrastructure and expand its geographic presence through new offices in London, Amsterdam, New York, and a proposed MENA office in Abu Dhabi. This tech-driven expansion is likely to support revenue growth and improve net margins by increasing operational efficiency.

- The company's cost efficiency initiatives, including a 20% reduction in workforce and upskilling in frontline areas, aim to better align the cost structure with its growth strategy, which is expected to positively impact net margins and earnings.

- CAB Payments is developing new products such as structured payment solutions, FX derivatives, and payment value-added services. These initiatives can create diversified and higher value-add revenue streams, potentially improving net margins and earnings.

- The focus on trade finance and enhanced Payments business, including leveraging relationships with central banks and local liquidity management, positions CAB Payments as a facilitator in emerging markets, anticipated to increase revenue through deeper client engagement and higher transaction volumes.

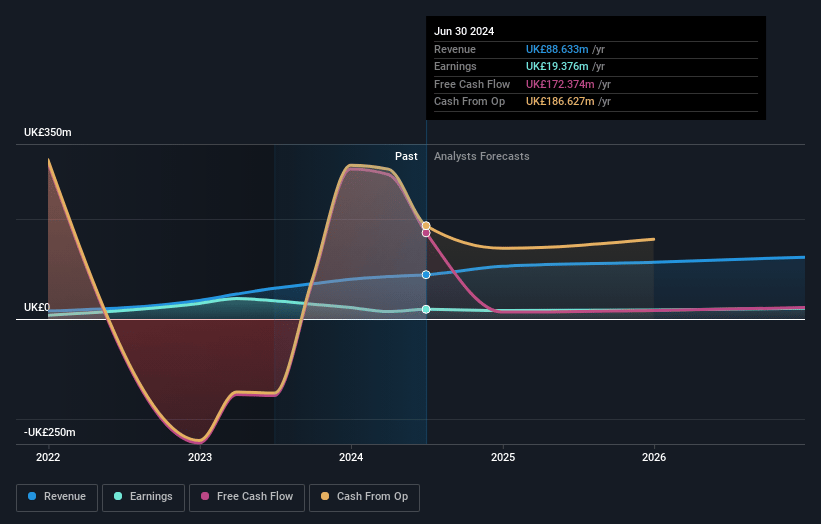

CAB Payments Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CAB Payments Holdings's revenue will grow by 14.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 19.3% in 3 years time.

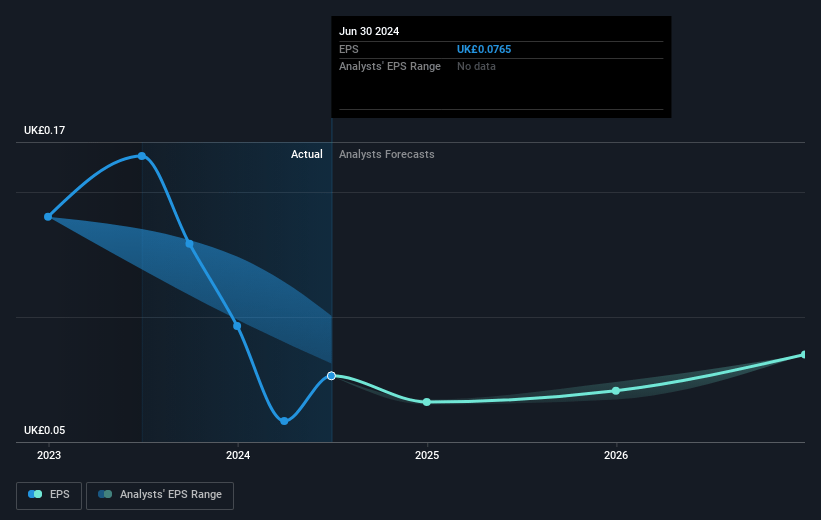

- Analysts expect earnings to reach £26.4 million (and earnings per share of £0.1) by about May 2028, up from £14.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £31.1 million in earnings, and the most bearish expecting £22.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.5x on those 2028 earnings, up from 7.9x today. This future PE is lower than the current PE for the GB Diversified Financial industry at 14.9x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.54%, as per the Simply Wall St company report.

CAB Payments Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced a material reduction in revenue versus 2023 due to lower flows from IDOs and a stronger dollar, which reduces average transaction values and subsequently affects income. This will likely impact revenue and earnings negatively.

- The fall in emerging market volumes and a decline in take rates, from 55 basis points to 29 basis points, primarily due to decreased demand for hard currency and competition operating outside regulations, pose a risk to revenue and net margins.

- The company's income in previous years was significantly affected by exceptional circumstances related to specific currencies (naira, XAF, XOF), and without such dislocations, revenue dropped considerably, indicating vulnerability to macroeconomic conditions which could impact earnings stability.

- The company's expansion into new offices and enhanced technology infrastructure has resulted in increased costs, but with a majority of operating costs being fixed, this led to negative operating leverage in 2024, potentially impacting net margins.

- There is a potential delay in obtaining a U.S. license due to regulatory processes, which could hinder market expansion efforts and impact future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £0.798 for CAB Payments Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.0, and the most bearish reporting a price target of just £0.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £137.1 million, earnings will come to £26.4 million, and it would be trading on a PE ratio of 9.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of £0.44, the analyst price target of £0.8 is 44.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.