Key Takeaways

- Expansion of distribution strategy and enhanced analytics are aimed at increasing client reach and assets under management.

- Streamlining operations and focusing on UK core business may lead to improved efficiencies and stronger financial results.

- Regulatory changes, competition, and economic uncertainties could pressure Brooks Macdonald's revenue consistency, profitability, and growth strategy, impacting overall earnings and profit margins.

Catalysts

About Brooks Macdonald Group- Through its subsidiaries, provides a range of investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees in the United Kingdom, and the Channel Islands.

- The company plans to broaden and deepen client reach by expanding its distribution strategy, which includes leveraging enhanced data analytics for effective lead generation. This is expected to drive higher revenues from new clients and expand the assets under management (AUM) base.

- Brooks Macdonald aims to improve operational efficiency through a focus on scale and cost optimization, having already delivered significant annualized cost savings. These efficiencies are likely to enhance net margins and contribute to a stronger bottom line.

- The sale of the international business to focus on core operations in the UK is a strategic step that simplifies the business model and allows for better resource allocation, potentially improving earnings through a more streamlined approach.

- Management has announced new medium-term targets of achieving annualized net flows of 5%, emphasizing growth momentum. Meeting these flow targets is expected to increase AUM, which should positively impact revenue and profit.

- The continuation and expansion of the successful managed portfolio services (MPS), which has shown strong growth, suggest a potential for higher margins and increased earnings from one of the fastest-growing segments within the wealth market.

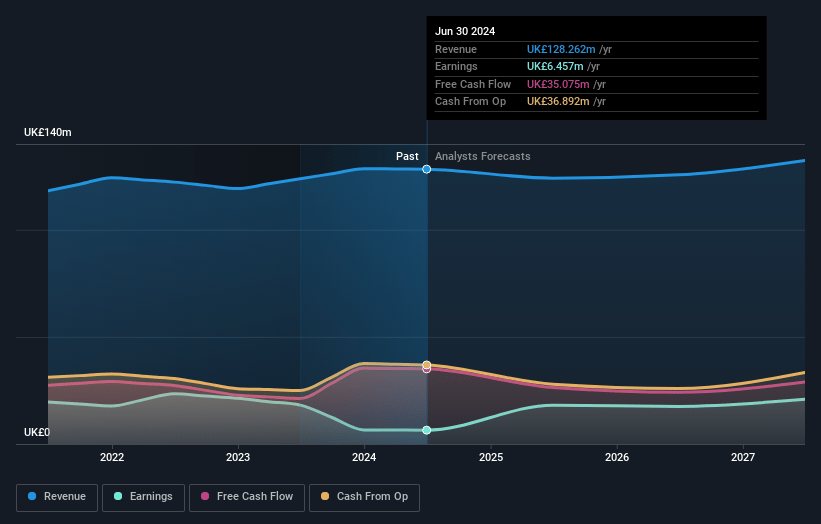

Brooks Macdonald Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Brooks Macdonald Group's revenue will decrease by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 15.9% in 3 years time.

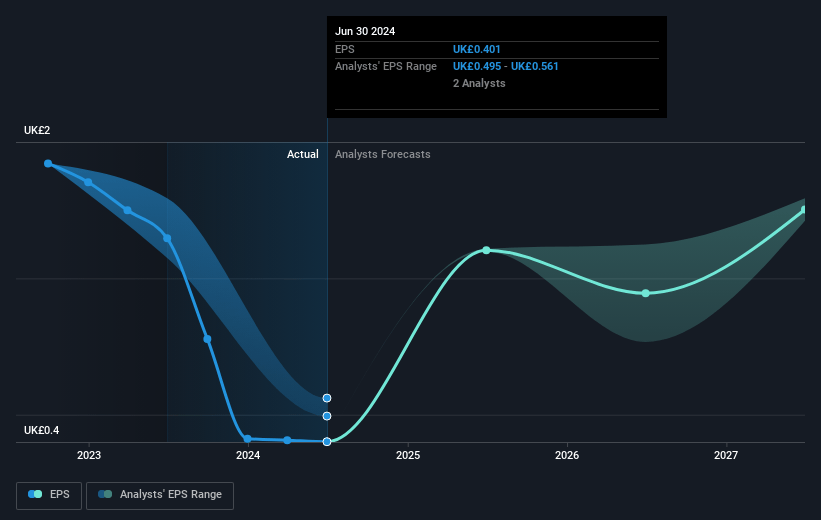

- Analysts expect earnings to reach £20.9 million (and earnings per share of £1.25) by about February 2028, up from £6.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.5x on those 2028 earnings, down from 35.4x today. This future PE is greater than the current PE for the GB Capital Markets industry at 12.0x.

- Analysts expect the number of shares outstanding to grow by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.13%, as per the Simply Wall St company report.

Brooks Macdonald Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The firm's current growth is partially driven by its Managed Portfolio Service (MPS), but any potential shift of funds from BPS to MPS could impact advisor fees and the company's revenue mix. This change in asset allocation might influence revenue consistency.

- Regulatory changes, such as the consumer duty, could increase operational compliance costs or alter business dynamics. This could potentially impact net margins if the company is unable to adapt swiftly and cost-effectively.

- Increased competition within the wealth management sector could pressure Brooks Macdonald to spend more on marketing and client acquisition, potentially impacting net earnings if revenue growth does not outpace marketing and client retention costs.

- The divestment of its international business exposes Brooks Macdonald to risk if they lose global diversification benefits or if domestic growth does not compensate for the £2 million profit loss in the last quarter, thereby impacting overall earnings.

- Future economic uncertainties, such as expected reductions in interest rates by the Bank of England, might decrease interest income, impacting earnings and overall profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £21.779 for Brooks Macdonald Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £26.0, and the most bearish reporting a price target of just £19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £132.0 million, earnings will come to £20.9 million, and it would be trading on a PE ratio of 20.5x, assuming you use a discount rate of 7.1%.

- Given the current share price of £14.2, the analyst price target of £21.78 is 34.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives