Catalysts

About Trainline

Trainline operates the leading digital rail ticketing and travel platform across the U.K. and Europe.

What are the underlying business or industry changes driving this perspective?

- Accelerating rail liberalization in core European markets such as France, Spain and Italy is expanding high speed carrier competition, increasing the volume of routes Trainline can aggregate and monetize, which should support sustained double digit international net ticket sales growth and higher group revenue.

- Growing modal shift from air and car to rail for both leisure and corporate travel, supported by decarbonization policies and corporate ESG commitments, is driving structurally higher demand for rail content on Trainline Solutions and international consumer, underpinning long term growth in B2B distribution revenue and group earnings.

- Rising adoption of digital and mobile ticketing, together with Trainline’s market leading U.K. app scale and AI driven features like disruption management and an in app travel assistant, is deepening customer engagement and frequency, which should lift lifetime value, support higher ancillary revenue and expand net margins.

- Emerging traffic from generative AI search and agent ecosystems, where Trainline is already the most cited rail app in key markets, provides a growing, low incremental cost acquisition channel that can replace legacy search headwinds and enhance revenue growth without proportionate marketing spend, supporting EBITDA margin expansion.

- Scaling of newer revenue streams such as digital railcards, insurance, hotels, advertising and Sponsored Journeys for carriers is increasing high margin ancillary mix, which can drive faster growth in gross profit and EBITDA than in net ticket sales, amplifying earnings power over time.

Assumptions

This narrative explores a more optimistic perspective on Trainline compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

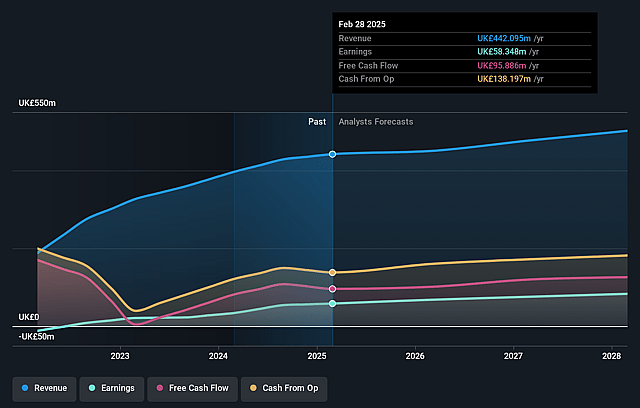

- The bullish analysts are assuming Trainline's revenue will grow by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.3% today to 16.4% in 3 years time.

- The bullish analysts expect earnings to reach £84.7 million (and earnings per share of £0.24) by about December 2028, up from £73.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £75.3 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.4x on those 2028 earnings, up from 12.1x today. This future PE is greater than the current PE for the GB Hospitality industry at 15.7x.

- The bullish analysts expect the number of shares outstanding to decline by 4.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.06%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The creation of Great British Railways and its own retail unit and app, combined with unresolved issues like operator self preferencing and restrictions on features such as loyalty schemes and automated delay repay, could structurally weaken third party retailers' competitive position in the U.K., which may pressure commission economics and slow revenue growth over the long term.

- Changes in digital traffic dynamics, including ongoing headwinds from Google search result changes and uncertainty over how agentic AI ecosystems will ultimately route and monetize travel queries, could reduce high intent inbound traffic or shift it to competing platforms, which may dampen international net ticket sales growth and compress earnings.

- The strategy of concentrating investment in liberalizing corridors like Southeast France and Spain while de prioritizing Germany and the rest of Europe leaves growth highly dependent on a handful of markets, so any delay to further carrier competition or sustained downward pressure on fares in these markets could cap net ticket sales growth and weigh on group revenue expansion.

- The push to normalize marketing spend in Spain and rebalance growth and profitability, while simultaneously increasing marketing investment in France, may not translate into durable market share gains if competitors or national operators respond aggressively, which could limit operating leverage benefits and constrain EBITDA margin improvement.

- Structural changes in the U.K. ticketing landscape, including the expansion of pay as you go schemes like Project Oval and the uncertain commercial model for Trainline's digital pay as you go solution, could accelerate a shift toward products where Trainline captures a lower take rate or is not the primary interface, which may pressure long term revenue yield and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Trainline is £5.8, which represents up to two standard deviations above the consensus price target of £3.88. This valuation is based on what can be assumed as the expectations of Trainline's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.8, and the most bearish reporting a price target of just £2.3.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be £516.8 million, earnings will come to £84.7 million, and it would be trading on a PE ratio of 31.4x, assuming you use a discount rate of 9.1%.

- Given the current share price of £2.21, the analyst price target of £5.8 is 61.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Trainline?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.