Key Takeaways

- EU market expansion and competition boost passenger volume, increasing net ticket sales and revenue growth, especially in Spain and Italy.

- Digitalization and ancillary services enhance operational efficiency and diversify income, projected to increase market share and revenue.

- Future growth and revenue may be challenged by U.K. market disruptions, international sales issues, and paused marketing due to carrier competition in France.

Catalysts

About Trainline- Engages in the operation of an independent rail and coach travel platform that sells rail and coach tickets the United Kingdom and internationally.

- The expansion of the third-party ticket retail market in the EU and increased carrier competition, particularly in Spain and Italy, are expected to drive more passenger volume, translating to higher net ticket sales and revenue growth.

- Digitalization and increased penetration of e-tickets in the U.K. are enhancing operational efficiencies and customer convenience, which can lead to increased market share in commuter rail, higher revenue, and better net margins.

- Cost optimization strategies, such as reducing headcount and increasing operating leverage, are projected to enhance net margins and EBITDA margins, impacting bottom-line earnings positively.

- The delay of Project Oval expansion potentially provides a tactical advantage by postponing competitive pressures in the U.K. market, helping maintain current revenue streams and market share.

- Trainline's innovation in ancillary revenue streams, through offering additional services like hotels and travel insurance within the booking flow, is diversifying income sources and is expected to drive additional revenue growth.

Trainline Future Earnings and Revenue Growth

Assumptions

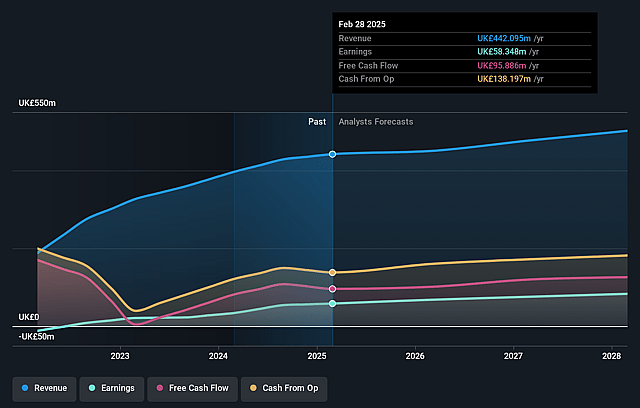

How have these above catalysts been quantified?- Analysts are assuming Trainline's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.2% today to 16.6% in 3 years time.

- Analysts expect earnings to reach £83.3 million (and earnings per share of £0.2) by about September 2028, up from £58.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £74.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.5x on those 2028 earnings, up from 18.3x today. This future PE is greater than the current PE for the GB Hospitality industry at 16.9x.

- Analysts expect the number of shares outstanding to decline by 2.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.07%, as per the Simply Wall St company report.

Trainline Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The mention of an expected headwind from Transport for London's Project Oval expansion suggests potential future disruptions or challenges in the U.K. market, which could impact growth rates and revenue in the coming years.

- There are industry-wide changes to the presentation of Google's search engine results that have subdued web sales in International Consumer, particularly for foreign travel, which could negatively affect international revenue and market share.

- The decision to pause brand marketing in France due to insufficient carrier competition could lead to slowed growth and reduced revenue in that market until more competition enables more aggressive market positioning.

- The reduction in net commissions in the U.K., agreed back in 2022, poses a risk to Trainline's margins as it directly impacts the profitability and revenue per ticket.

- The uncertainty and timeline associated with regulatory changes and nationalization plans in the U.K., including consolidation in online ticketing platforms and ticket simplification, could impact the competitive landscape and future revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.193 for Trainline based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.8, and the most bearish reporting a price target of just £2.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £502.0 million, earnings will come to £83.3 million, and it would be trading on a PE ratio of 24.5x, assuming you use a discount rate of 9.1%.

- Given the current share price of £2.64, the analyst price target of £4.19 is 37.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.