Catalysts

About Auction Technology Group

Auction Technology Group operates curated online marketplaces that connect professional sellers of unique and valuable secondary goods with buyers worldwide.

What are the underlying business or industry changes driving this perspective?

- Expansion of value-added services such as atgShip, digital marketing and payments across a large installed base of auctioneers is structurally increasing take rate and revenue per transaction, supporting sustained mid to high single digit revenue growth and growing absolute EBITDA.

- Rising global demand for high quality used goods and the shift of secondary markets from offline to online are funneling more Arts and Antiques and Industrial and Commercial volume onto ATG’s platforms, underpinning long term GMV growth and providing operating leverage to support net margin expansion.

- Scaling AI driven search, recommendations and auto categorization on LiveAuctioneers and, over time, across the group should lift bids, lots sold and conversion rate, which in turn drives higher GMV, commission revenue and earnings even without a cyclical market recovery.

- The integration of Chairish, including $8 million of identified operational synergies and future revenue synergies from cross listing and shared marketing, is set to lift group profitability and EPS as synergies annualize and the combined audience enhances the marketplace network effect.

- Strong, recurring free cash flow generation with a 96 percent cash conversion rate and a clear path to leverage well below 2 times by 2026 creates capacity for future capital returns, which can enhance per share earnings growth once deleveraging targets are achieved.

Assumptions

This narrative explores a more optimistic perspective on Auction Technology Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

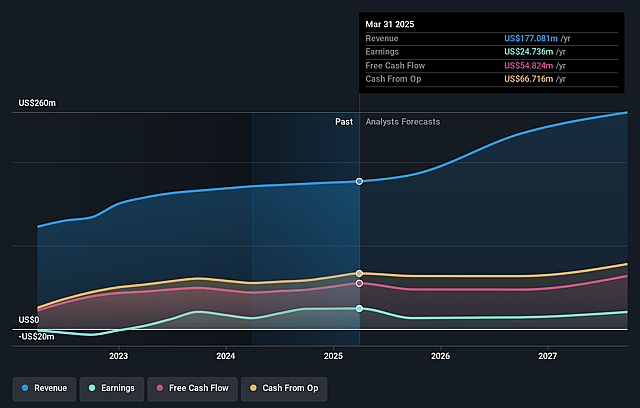

- The bullish analysts are assuming Auction Technology Group's revenue will grow by 17.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -76.0% today to 12.5% in 3 years time.

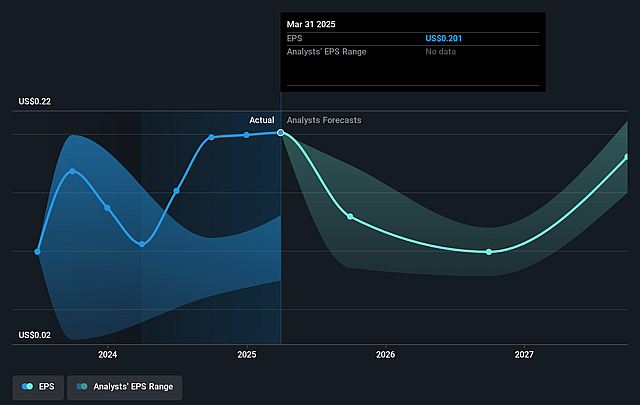

- The bullish analysts expect earnings to reach $38.4 million (and earnings per share of $0.31) by about December 2028, up from $-144.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $23.7 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.2x on those 2028 earnings, up from -3.2x today. This future PE is greater than the current PE for the GB Consumer Services industry at 15.1x.

- The bullish analysts expect the number of shares outstanding to decline by 0.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.09%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Sustained macroeconomic pressure on discretionary spending, already visible in weaker average lot values in Arts and Antiques, could cap growth in Total Hammer Value and GMV across both auctions and listed inventory, limiting the runway for revenue expansion and constraining earnings growth over time.

- The strategic shift toward lower margin value added services such as shipping structurally dilutes group gross margin and EBITDA margin. If mix continues to move in this direction faster than higher margin marketing and commission revenues grow, long term net margins and absolute earnings may fail to scale in line with bullish expectations.

- Dependence on executing technology upgrades and AI driven product improvements, including the Proxibid migration and LiveAuctioneers conversion initiatives, creates execution risk. Prolonged delays or underperformance in these initiatives would keep conversion rates flat and curb revenue and EBITDA growth from operating leverage.

- The Chairish acquisition embeds ongoing integration, synergy realization and revenue synergy risk. If operational savings or cross platform demand do not materialize as planned, or if goodwill impairments reoccur, group profitability, net margins and earnings per share could undershoot the narrative of accretive growth.

- Leverage remains elevated with net debt at 2.2 times EBITDA and a pathway to deleveraging that depends on sustained high cash conversion. Any slowdown in cash generation from weaker GMV, softer take rates or higher investment needs could delay balance sheet repair, increase finance costs and suppress future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Auction Technology Group is £8.15, which represents up to two standard deviations above the consensus price target of £5.17. This valuation is based on what can be assumed as the expectations of Auction Technology Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.15, and the most bearish reporting a price target of just £3.1.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $307.3 million, earnings will come to $38.4 million, and it would be trading on a PE ratio of 42.2x, assuming you use a discount rate of 8.1%.

- Given the current share price of £2.83, the analyst price target of £8.15 is 65.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Auction Technology Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.