Key Takeaways

- New product innovations, digital integration, and leadership hires are expected to improve user engagement, operational efficiency, and boost long-term revenue growth.

- Expansion of value-added services and effective upselling are driving margin improvements and increasing revenue per customer through enhanced platform monetization.

- Persistent market softness, digital adoption challenges, margin pressures, and heightened macroeconomic uncertainty threaten Auction Technology Group's revenue visibility and bottom-line growth prospects.

Catalysts

About Auction Technology Group- Operates online auction marketplaces in the United Kingdom, North America, and Germany.

- The continued rollout and adoption of ATG's new product innovations-such as atgXL cross-listing, shipping integration (atgShip), and AI-driven search/recommendation improvements-are expected to drive higher user engagement, improve conversion rates, increase marketplace transaction volumes, and ultimately accelerate top-line revenue growth.

- Strong growth in value-added services (up 14% YoY) like marketing and shipping, combined with rising take rates in both Arts & Antiques and Industrial & Commercial segments, indicates a pathway for further margin expansion and increased revenue per customer via upselling and improved platform monetization.

- ATG's cross-marketplace integration and push to create a seamless, e-commerce-like buying and selling experience positions the company to capitalize on the ongoing migration from offline to online auctions, benefiting from growing acceptance of digital B2B and B2C transactions and expanding its total addressable market-positively impacting long-term revenue growth.

- Recent additions to executive leadership with deep marketplace and technology expertise (including a CTO from eBay and board members from leading digital platforms) are expected to accelerate execution on technology upgrades and data analytics, strengthening ATG's competitive position, reducing operational costs, and supporting further net margin improvement.

- ATG's ability to generate strong free cash flow and maintain a robust balance sheet enables optionality for further share buybacks, continued organic technology investment, and selective M&A, all of which can serve as catalysts for higher future earnings per share (EPS) and long-term shareholder value creation.

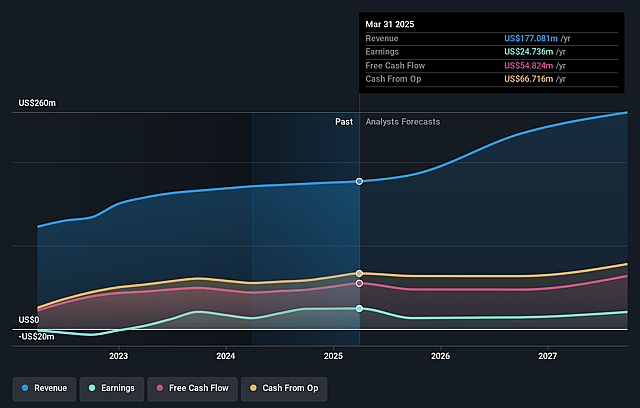

Auction Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Auction Technology Group's revenue will grow by 17.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.0% today to 5.9% in 3 years time.

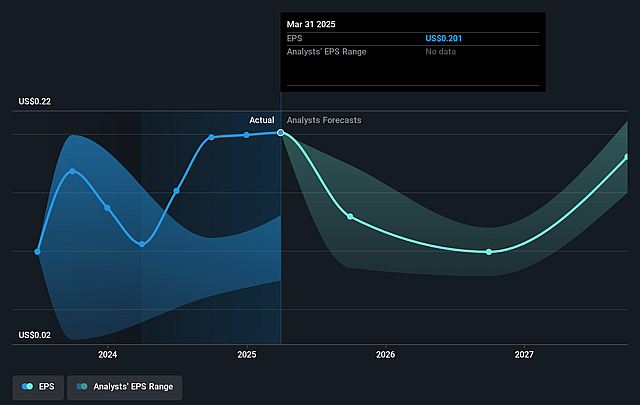

- Analysts expect earnings to reach $16.9 million (and earnings per share of $0.18) by about September 2028, down from $24.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 70.4x on those 2028 earnings, up from 21.7x today. This future PE is greater than the current PE for the GB Consumer Services industry at 14.0x.

- Analysts expect the number of shares outstanding to decline by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

Auction Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Auction Technology Group's core Arts & Antiques (A&A) vertical continues to experience market sluggishness, with GMV down 1% and management explicitly warning of potential ongoing softness in A&A pricing if the U.S. economy weakens-this creates risk of stagnating or declining commission and fee revenue from a key business segment.

- There is a structural challenge in driving meaningful adoption of new digital products (such as atgXL, atgShip, and conversion optimization): management repeatedly highlighted the slow-moving nature of the auction industry and "gradual" adoption, which could limit near-term and even long-term growth in user engagement, GMV, and take rates.

- The transition away from real estate within the Industrial & Commercial (I&C) segment eliminates a volatile and low-margin business but also recognizes exposure to the underlying cyclicality and potential price volatility of industrial asset classes-which management notes are subject to external shocks such as tariffs and supply constraints, adding significant unpredictability around future top-line growth.

- Although value-added services (VAS) are growing strongly and driving margin expansion, the VAS growth mix is shifting more toward lower-margin shipping and payments over high-margin marketing; unless ATG can lock in more digital marketing wallet share from its base, this mix change could ultimately compress gross margins and limit bottom-line earnings growth.

- The outlook is highly sensitive to macro factors (tariffs, U.S. economic strength, supply constraints, asset price trends), with management cautioning that "the world is a lot less predictable" and explicitly refusing to make bold long-term predictions; this level of external risk and uncertainty around pricing and demand poses a structural threat to sustained revenue, margin, and EPS growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £5.966 for Auction Technology Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £8.15, and the most bearish reporting a price target of just £3.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $288.1 million, earnings will come to $16.9 million, and it would be trading on a PE ratio of 70.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of £3.32, the analyst price target of £5.97 is 44.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.