Last Update 03 Dec 25

Fair value Decreased 8.91%CRST: Future Re Rating Potentially Emerging Despite Recent Index Removals

Analysts have trimmed their price target on Crest Nicholson Holdings to reflect slightly lower fair value estimates and more conservative assumptions for revenue growth and profit margins, while still allowing for a modest re rating in the future price to earnings multiple.

What's in the News

- Crest Nicholson Holdings plc has been removed from the FTSE 350 Index, signaling a diminished market capitalization standing relative to UK large and mid cap peers (Key Developments)

- The company has also been dropped from the FTSE 250 Index, further highlighting its exit from a key UK mid cap benchmark tracked by many institutional investors (Key Developments)

- Crest Nicholson has been removed from the FTSE 250 (Ex Investment Companies) Index, potentially reducing passive fund ownership focused on non investment company constituents (Key Developments)

- The group has been deleted from the FTSE 350 (Ex Investment Companies) Index, underscoring broad index level pressure on the stock across the FTSE family (Key Developments)

Valuation Changes

- Fair Value Estimate: reduced modestly from £2.12 to £1.93 per share, reflecting a slightly more cautious outlook

- Discount Rate: increased slightly from 9.7% to just over 10.1%, implying a marginally higher required return from investors

- Revenue Growth: lowered significantly from about 7.6% to roughly 4.9% annually, indicating more conservative top line expectations

- Net Profit Margin: trimmed moderately from around 8.0% to just over 7.1%, signalling a somewhat weaker profitability profile

- Future P/E: raised from approximately 11.7x to 13.2x, allowing for a modest re rating despite softer fundamental assumptions

Key Takeaways

- Operational improvements, strategic land holdings, and capital optimization are setting the stage for margin expansion and stronger long-term earnings quality.

- Enhanced mid-premium offerings and positive housing market signals could boost demand, pricing power, and revenue as consumer confidence returns.

- Margin pressure, planning delays, and geographic concentration pose ongoing risks to Crest Nicholson's earnings stability and growth despite some operational improvements.

Catalysts

About Crest Nicholson Holdings- Engages in building residential homes in the United Kingdom.

- The company is seeing progress in operational transformation (Project Elevate) around quality, customer service, and cost control, with improvements in build quality and a reduction in completed site costs and overheads, pointing to the potential for sustained gross and net margin expansion as operational efficiencies deepen in the next 2–3 years.

- Crest Nicholson's strong, well-located strategic landbank (with a ~19% embedded discount and over half in planning allocation) positions the company to benefit from the UK's persistent housing undersupply and growing population, supporting future revenue growth as these sites are brought through the pipeline.

- There are early signs of stabilization in mortgage rates, incremental easing of mortgage stress tests, and supportive government signals regarding planning and homeownership, potentially boosting housing demand, sales rates, and revenue as consumer sentiment improves.

- The company is actively upgrading and differentiating its mid-premium product offering, including a refreshed house type range reflecting consumer research and sustainability expectations, which could enhance achieved selling prices and margins, while aligning to evolving buyer preferences for higher-quality, sustainable homes.

- Successful fire remediation cost recoveries and disciplined land bank optimization (including strategic disposals) are unlocking capital and reducing legacy risks, improving cash flow and freeing up resources for growth, thus supporting earnings quality and longer-term return on equity.

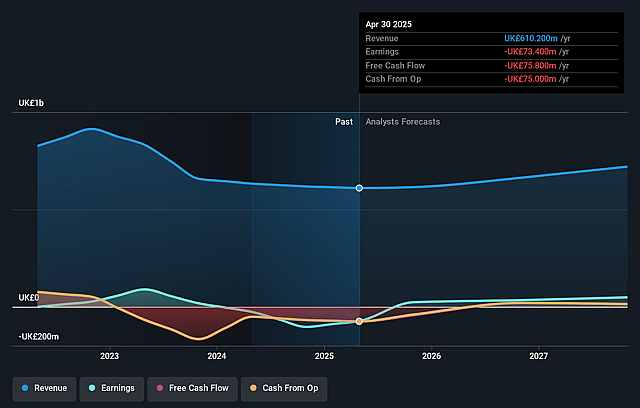

Crest Nicholson Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Crest Nicholson Holdings's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -12.0% today to 8.0% in 3 years time.

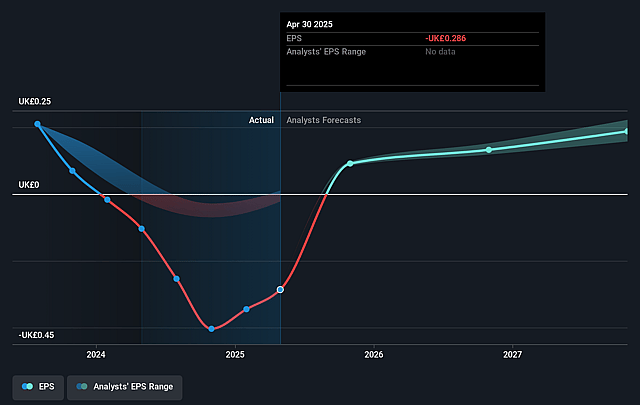

- Analysts expect earnings to reach £61.1 million (and earnings per share of £0.24) by about September 2028, up from £-73.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, up from -5.3x today. This future PE is lower than the current PE for the GB Consumer Durables industry at 13.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.72%, as per the Simply Wall St company report.

Crest Nicholson Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Crest Nicholson's revenue declined by 3% year-on-year in H1 2025, with a notable drop in land sales and a warning that the reduction in bulk unit sales will act as a headwind to total volume output until FY '27, signaling potential medium-term revenue and earnings pressure.

- Intense competition for land acquisitions (with 10–15 rivals per process) is pressuring Crest Nicholson's ability to achieve target margins on new sites, risking gross and net margin compression as the company balances between winning land and maintaining profitability.

- Persistent challenges and delays in the UK's planning system are constraining the pace at which strategic land can be brought into development-despite some recent improvement, these systemic issues could limit outlet growth and thereby restrict long-term revenue and volume expansion.

- The company is still unwinding zero-margin and legacy sites through FY '26, which continues to weigh on group margins and signals the risk that operational improvements may be slow to fully reflect in net earnings.

- Crest Nicholson's geographic focus on southern England, paired with industry reliance on government policy and support (e.g., planning reforms, Section 106 affordable requirements), exposes it to heightened volatility from regional downturns and policy changes, increasing the risk to both future revenue streams and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.122 for Crest Nicholson Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.54, and the most bearish reporting a price target of just £1.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £761.1 million, earnings will come to £61.1 million, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 9.7%.

- Given the current share price of £1.51, the analyst price target of £2.12 is 28.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Crest Nicholson Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.