Key Takeaways

- Automation, AI, and digital platforms in recruitment are diminishing SThree's traditional role, compressing fees and pressuring long-term margins and earnings.

- Demographic shifts and regulatory costs, coupled with sector over-concentration, heighten revenue volatility and constrain sustainable growth prospects.

- Strong demand for STEM recruitment, recurring contract revenue, digital investments, and broad market diversification position SThree for resilient and stable long-term growth.

Catalysts

About SThree- Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan, and the United Arab Emirates.

- The accelerating adoption of automation and AI in recruitment, including SThree's own rollout of AI-enabled tools, risks eroding the company's traditional value-add as staffing intermediaries become less essential, likely leading to sustained fee compression and reducing group net fees over the medium to long term.

- Shrinking working-age populations in Europe, SThree's largest regional contributor representing 35% of net fees, threaten to constrain the pipeline of STEM candidates, directly capping revenue growth and undercutting SThree's ability to expand its addressable market in key geographies.

- Rising operating costs tied to compliance and regulatory tightening in cross-border placements and employment classifications will offset any margin gains from digital investments, putting persistent downward pressure on operating profit margins and ultimately reducing net income.

- SThree's outsized focus on technology and life sciences leaves the company increasingly exposed to cyclical slowdowns or disruptive shifts in these sectors, heightening revenue volatility and making operating profit more susceptible to external shocks.

- The rapid growth of large clients' in-house recruitment capabilities and the proliferation of digital-only staffing platforms are expected to reduce demand for SThree's services, resulting in persistent downward pressure on gross margins and long-term erosion of earnings per share.

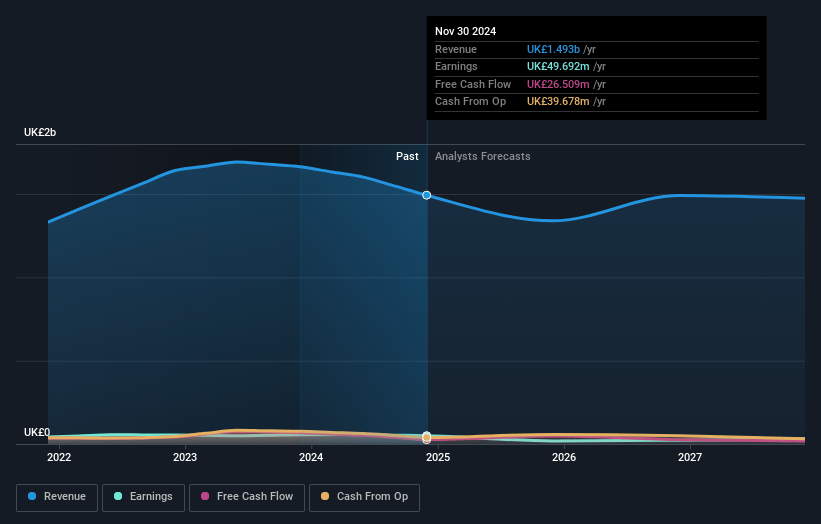

SThree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SThree compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SThree's revenue will decrease by 3.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 3.3% today to 1.5% in 3 years time.

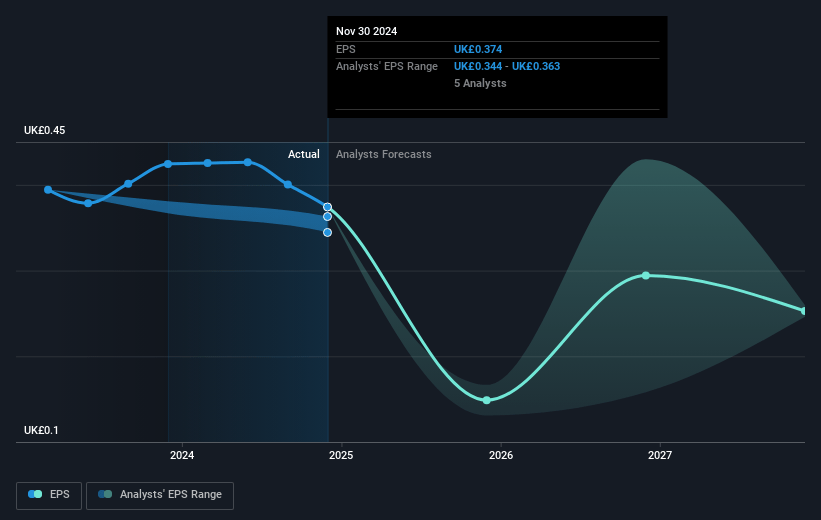

- The bearish analysts expect earnings to reach £20.9 million (and earnings per share of £0.17) by about July 2028, down from £49.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, up from 6.0x today. This future PE is lower than the current PE for the GB Professional Services industry at 22.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

SThree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent global trend of accelerating digitalization and growing dependence on STEM talent continues to drive strong, sustained demand for skilled professionals, which supports SThree's long-term revenue growth potential by expanding their core addressable market.

- Demographic shifts including aging workforces and the transition toward knowledge economies are increasing demand for high-skill recruitment, potentially boosting SThree's net fee income and offering resilience against economic slowdowns.

- SThree's high proportion of recurring contract revenue, with 84 percent of group net fees now from contracts, enhances revenue visibility and stability, which may help to support margins and underpin stable or growing earnings even during market volatility.

- Significant ongoing investments in proprietary recruitment technology platforms and in digital transformation are already delivering measurable productivity gains and cost efficiencies, which could improve operating leverage and net margins over the medium to long term.

- The company's broad diversification across geographic markets and STEM disciplines reduces exposure to sector or regional downturns, and the demonstrated ability to generate robust growth in segments like clean energy and in regions such as the Middle East and Asia could help to offset weaknesses elsewhere and support overall group-level revenue and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SThree is £2.4, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SThree's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.5, and the most bearish reporting a price target of just £2.4.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £1.4 billion, earnings will come to £20.9 million, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of £2.38, the bearish analyst price target of £2.4 is 0.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.