Key Takeaways

- SThree's position in STEM contract talent and AI-driven operations provides long-term pricing power, superior margins, and structural revenue growth far above industry averages.

- Expanding digital platform capabilities and focus on large enterprise clients enable scalable international growth and stable, recurring revenue streams with superior earnings visibility.

- Rising adoption of digital platforms, regulatory pressures, demographic shifts, and dependence on contract placements threaten SThree's market share, earnings stability, and long-term profitability.

Catalysts

About SThree- Provides specialist recruitment services in the sciences, technology, engineering, and mathematics markets in the United Kingdom, Austria, Germany, Switzerland, Netherlands, Spain, Belgium, France, the United States, Dubai, Japan, and the United Arab Emirates.

- Analyst consensus expects strong demand for STEM contract talent to benefit SThree as digital adoption accelerates, but this view likely understates the magnitude and duration of demand as persistent global skill shortages and structural demographic deficits in key markets should grant SThree long-term pricing power and unprecedented revenue growth visibility for at least a decade, well beyond the typical five-year horizon.

- While analysts broadly expect SThree's technology improvement program to incrementally boost efficiency and margins, the early proof points from its AI-enabled platform rollout suggest a much faster and larger step-change in operational leverage and cost-to-fill ratios, enabling sustained margin expansion that can far outpace industry peers and rapidly translate into higher long-term earnings growth.

- SThree's dominant contract staffing mix provides not just resilience, but also positions the company to capture a disproportionate share of post-cycle market recovery, as ongoing client bias towards flexibility and recurring contractor extensions are set to accelerate with an aging workforce and increased compliance complexity, driving higher recurring revenues and superior margins compared to permanent-heavy competitors.

- The company's first-mover advantage in digital transformation and proprietary AI-driven operations creates a formidable moat, allowing for scalable international expansion as globalization and remote working trends enable SThree to tap into new geographies, expand its client base, and structurally raise revenue growth rates above market averages.

- SThree's brand consolidation and successful penetration of high-value, large enterprise clients in core STEM verticals signal a forthcoming shift towards larger, multi-year outsourcing deals, which should further stabilize revenue streams and drive double-digit annualized growth in both net fees and operating profit as spending on specialist talent surges.

SThree Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SThree compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SThree's revenue will grow by 1.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 3.3% today to 1.8% in 3 years time.

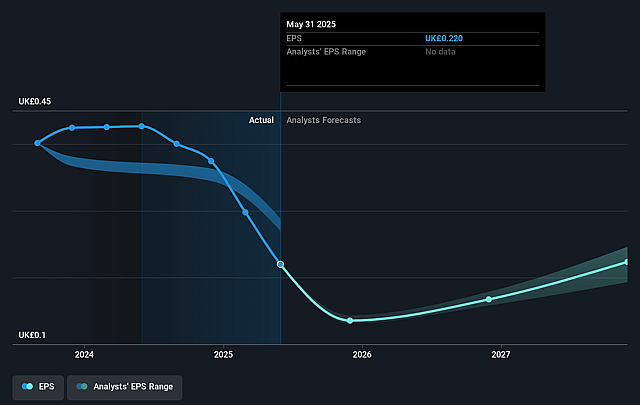

- The bullish analysts expect earnings to reach £28.3 million (and earnings per share of £0.22) by about July 2028, down from £49.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, up from 6.0x today. This future PE is greater than the current PE for the GB Professional Services industry at 22.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

SThree Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of AI, automation, and digital platforms in recruitment poses a significant risk, as even SThree's own technology investments may not fully offset the potential for client disintermediation and margin erosion if end-users increasingly turn to self-serve or direct-to-talent solutions, leading to a shrinking addressable market and impacting future revenue growth.

- The persistent trend towards gig economy participation and digital direct hiring platforms could enable clients to bypass agencies like SThree, compressing agency margins and reducing the revenue per placement, which, despite SThree's current sector-leading conversion ratio, could threaten its long-term earnings power.

- Demographic challenges-such as aging workforces in key client geographies and restrictive immigration policies-could limit STEM hiring in SThree's main markets, leading to stagnating or declining demand for contract and permanent placements, ultimately constraining SThree's future revenue and client base.

- SThree's heavy reliance on contractor and temporary placements, which now make up 84% of group activity, increases the company's exposure to cyclical downturns and revenue volatility, particularly as the contractor order book already declined by 10% year-on-year and new business activity remains persistently soft, putting pressure on both revenue predictability and earnings stability.

- Increasing competition from larger global staffing firms, vertically specialized MSPs, and digitally native recruitment providers-along with ongoing regulatory burdens (such as labor, privacy, and AI compliance requirements)-may drive up SThree's compliance costs, reduce market share, and erode net margins, depressing overall profitability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SThree is £4.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SThree's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.5, and the most bearish reporting a price target of just £2.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £1.5 billion, earnings will come to £28.3 million, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of £2.38, the bullish analyst price target of £4.5 is 47.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.