Key Takeaways

- Ongoing shift to digital and cloud-based solutions threatens the sustainability of Restore's core physical storage business and limits long-term growth prospects.

- High fixed costs, regulatory risks, and integration challenges from acquisitions may prevent margin gains and threaten earnings resilience.

- Reliance on legacy services amid digital disruption, frequent acquisitions, and regulatory pressures threaten margins, growth, and long-term sustainability against more agile digital competitors.

Catalysts

About Restore- Provides secure and sustainable business services for data, information, communications, and assets primarily in the United Kingdom.

- While Restore is positioned to benefit from rising data volumes and regulatory focus on data privacy-which should ensure recurring demand for compliant information management-the accelerating industry transition toward digital-first and paperless workflows continues to erode the company's core physical storage growth, raising concerns about long-term revenue sustainability as traditional admin outsourcing declines.

- Despite margin improvements from property consolidation and operational efficiencies, Restore's high fixed cost base and exposure to environmental compliance costs leave the business vulnerable if regulatory requirements escalate or revenue shrinks, putting persistent pressure on net margins in the medium term.

- Although Restore is leveraging ESG and sustainability trends to capture client loyalty, stricter environmental regulation and rising consumer expectations for eco-friendly operations could require significant new capital outlays, eroding the free cash flow benefits from recent efficiency programs.

- While bolt-on acquisitions (like Synertec) may present short-term growth and cross-selling opportunities, Restore's strategy brings ongoing execution risk and potential integration challenges, risking increased costs and weaker-than-expected margin expansion, especially as digital disruptors accelerate industry transformation.

- Even though recurring government and public sector contracts suggest some revenue stability, the emergence of innovative cloud-based competitors and sector consolidation among large clients threatens Restore's pricing power and addressable market, potentially softening topline growth and constraining future earnings momentum.

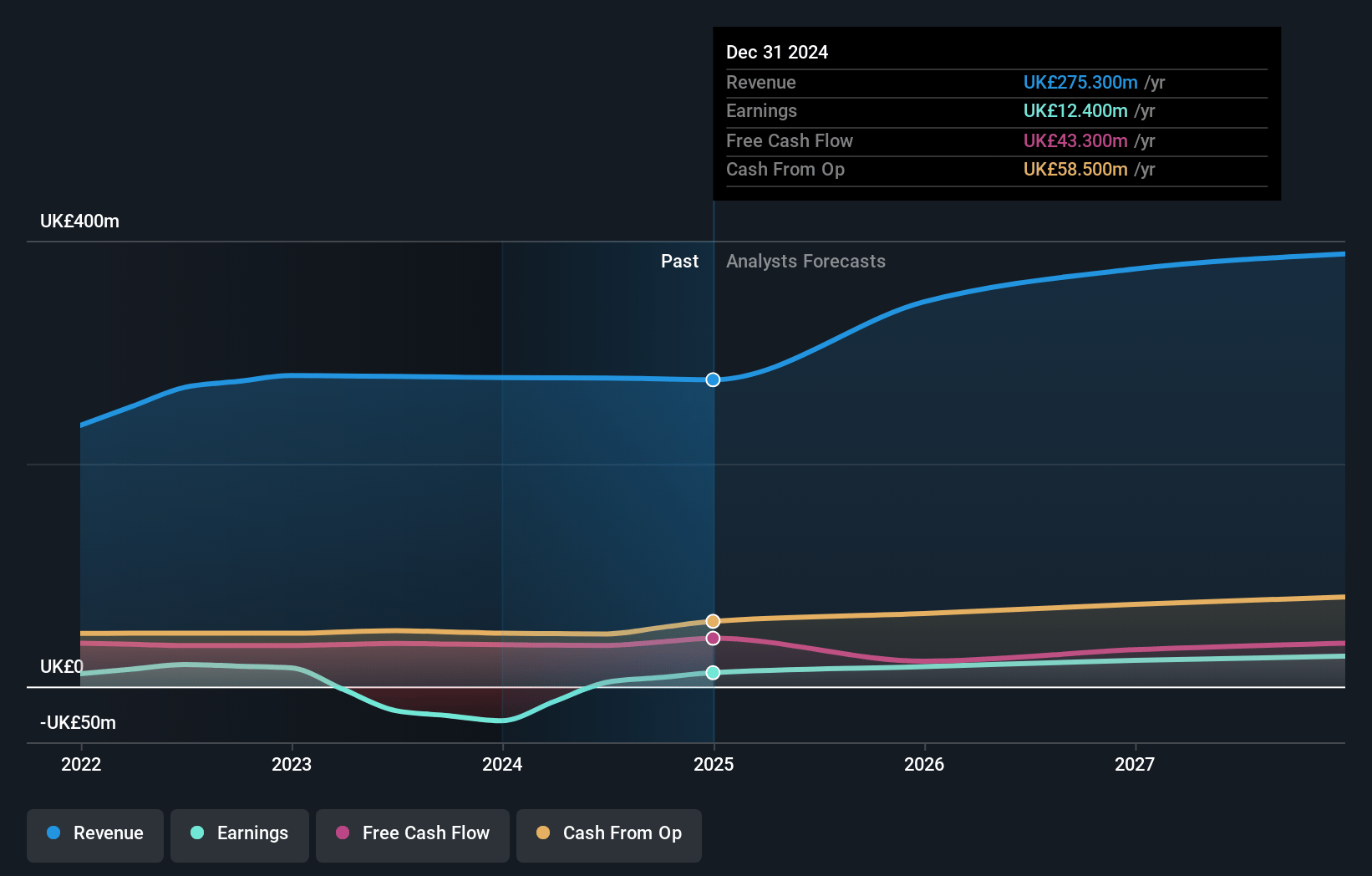

Restore Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Restore compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Restore's revenue will grow by 13.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.5% today to 6.8% in 3 years time.

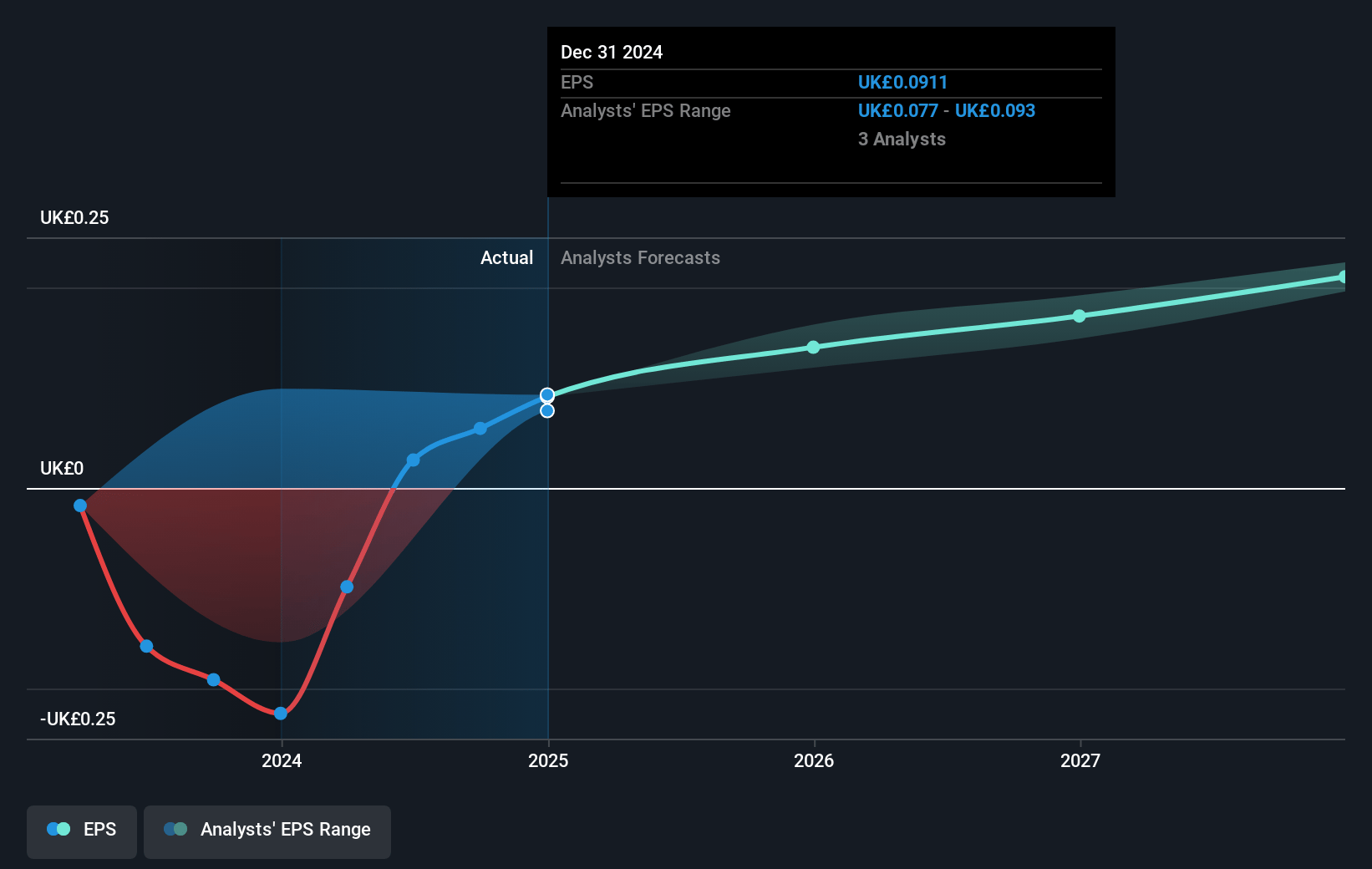

- The bearish analysts expect earnings to reach £26.9 million (and earnings per share of £0.22) by about July 2028, up from £12.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, down from 29.5x today. This future PE is lower than the current PE for the GB Commercial Services industry at 28.9x.

- Analysts expect the number of shares outstanding to grow by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

Restore Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid digital transformation and shift to paperless workflows across public and private sectors is causing ongoing weakness in bulk scanning sales and limiting organic growth in the core records management business, which risks long-term revenue decline as physical storage and document management become less essential.

- Overreliance on recurring revenues from traditional records and document storage, as well as outbound letter communications (e.g., Synertec), exposes the group to secular decline and client migration to digital-first, cloud-based solutions, which may erode topline growth and compress net margins over time.

- Execution risk remains high with the group's frequent acquisitions and integration programs, as evidenced by operational challenges in digital businesses and the need for significant cost rationalization, which could lead to higher integration costs, operational inefficiencies, and lower-than-expected earnings.

- Margin pressure may increase due to rising regulatory and sustainability requirements on physical logistics, legacy property portfolios, and increased capital expenditure for ESG initiatives, which could impact net margins and free cash flow if prices cannot be sufficiently passed through to customers.

- Industry disruption risk persists from more scalable, automated digital competitors and large clients consolidating outsourcing, leading to greater bargaining power and pricing pressure, which could undermine Restore's ability to sustain revenues and maintain profitability in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Restore is £3.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Restore's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.94, and the most bearish reporting a price target of just £3.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £397.0 million, earnings will come to £26.9 million, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 8.1%.

- Given the current share price of £2.68, the bearish analyst price target of £3.0 is 10.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.