Key Takeaways

- Restore's scale, automation, and integration uniquely position it to capture outsized public sector contracts and achieve best-in-class margins beyond industry expectations.

- ESG investments and digital platform innovation will fuel sustainable competitive differentiation, margin expansion, and long-term, self-funded earnings growth.

- Heavy reliance on legacy paper-based services and infrastructure exposes Restore to declining demand, competitive pressures, and operational risks, threatening future growth and margin sustainability.

Catalysts

About Restore- Provides secure and sustainable business services for data, information, communications, and assets primarily in the United Kingdom.

- Whereas analyst consensus anticipates incremental margin expansion from the integration of digital and records management and property consolidation, a more bullish view is that Restore's scale, customer overlap, and integration capabilities will unlock structural cost advantages and allow best-in-class margins, with operating margin potential far exceeding the 20 percent target as Restore becomes the default provider for major UK public sector and regulated industries.

- While analysts broadly agree the Synertec acquisition enables cross-selling and some public sector growth, this likely understates the transformative impact-Synertec's automation and acute under-penetration in large public sector bodies, combined with Restore's deep relationships and reach, could result in compounded, double-digit recurring revenue growth, expanding the company's total addressable market and earnings base far beyond expectations.

- The accelerating regulatory and compliance complexity around data privacy, storage, and destruction-especially with tightening government procurement standards-favours Restore's scale, trusted reputation, and full-spectrum offering, positioning the company to win a disproportionate share of long-term, high-value government and enterprise outsourcing contracts, materially boosting future contracted revenues and cashflow visibility.

- As organizations continue to face pressure to meet stringent carbon reduction and waste management targets, Restore's demonstrable investments in ESG-compliant solutions and circular economy practices in document and IT asset lifecycle management will differentiate it in tender processes, enabling sustainable price premiums, reduced churn, and expanded margin per customer.

- Restore's disruptive focus on automation, digital platform investments, and data-driven operational management is set to drive step changes in cost efficiency, scalability, and customer service, leading to ongoing margin expansion, stronger free cash flow generation, and the financial flexibility to self-fund further bolt-on acquisitions for outsized future earnings growth.

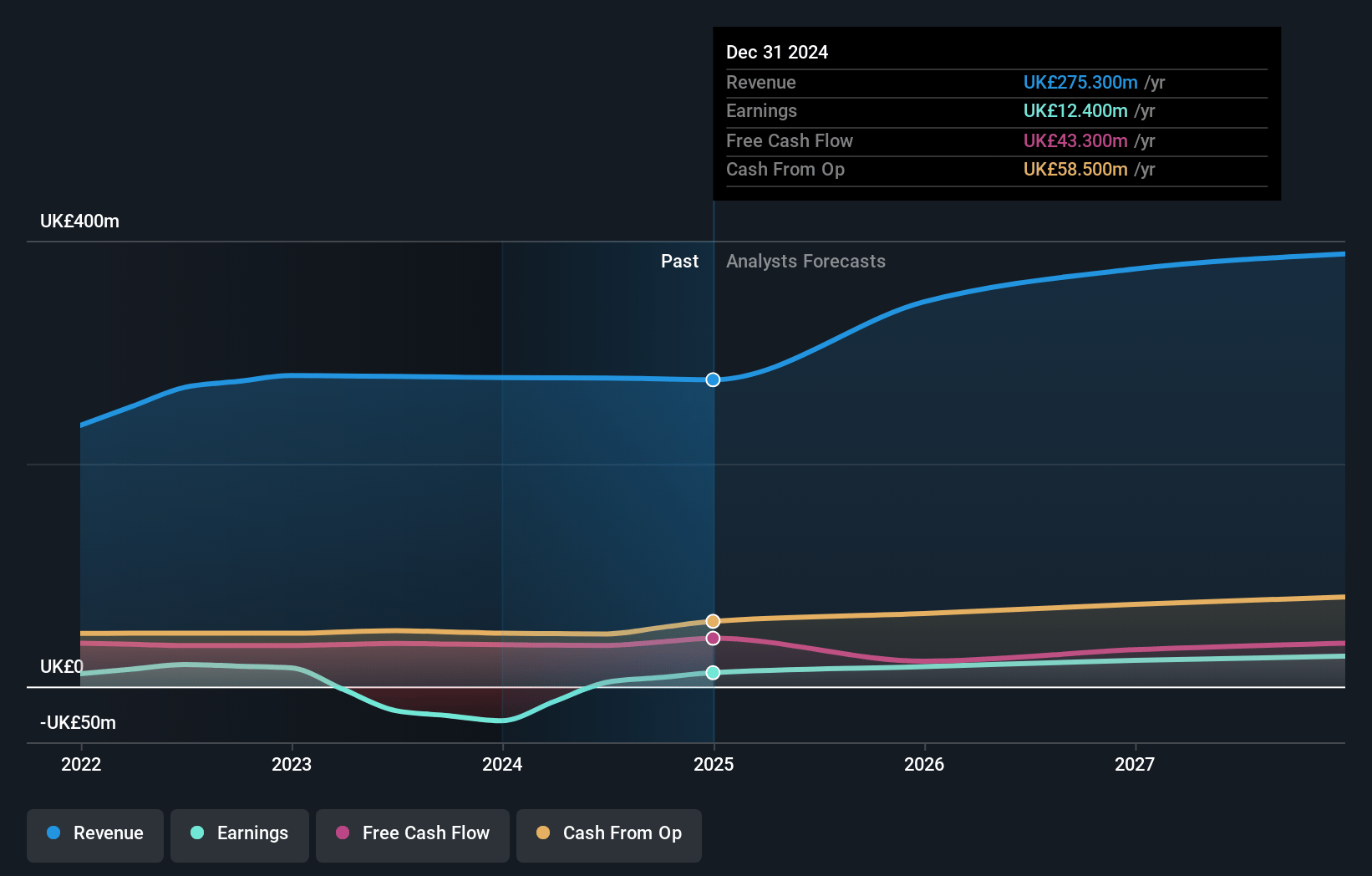

Restore Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Restore compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Restore's revenue will grow by 15.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.5% today to 8.2% in 3 years time.

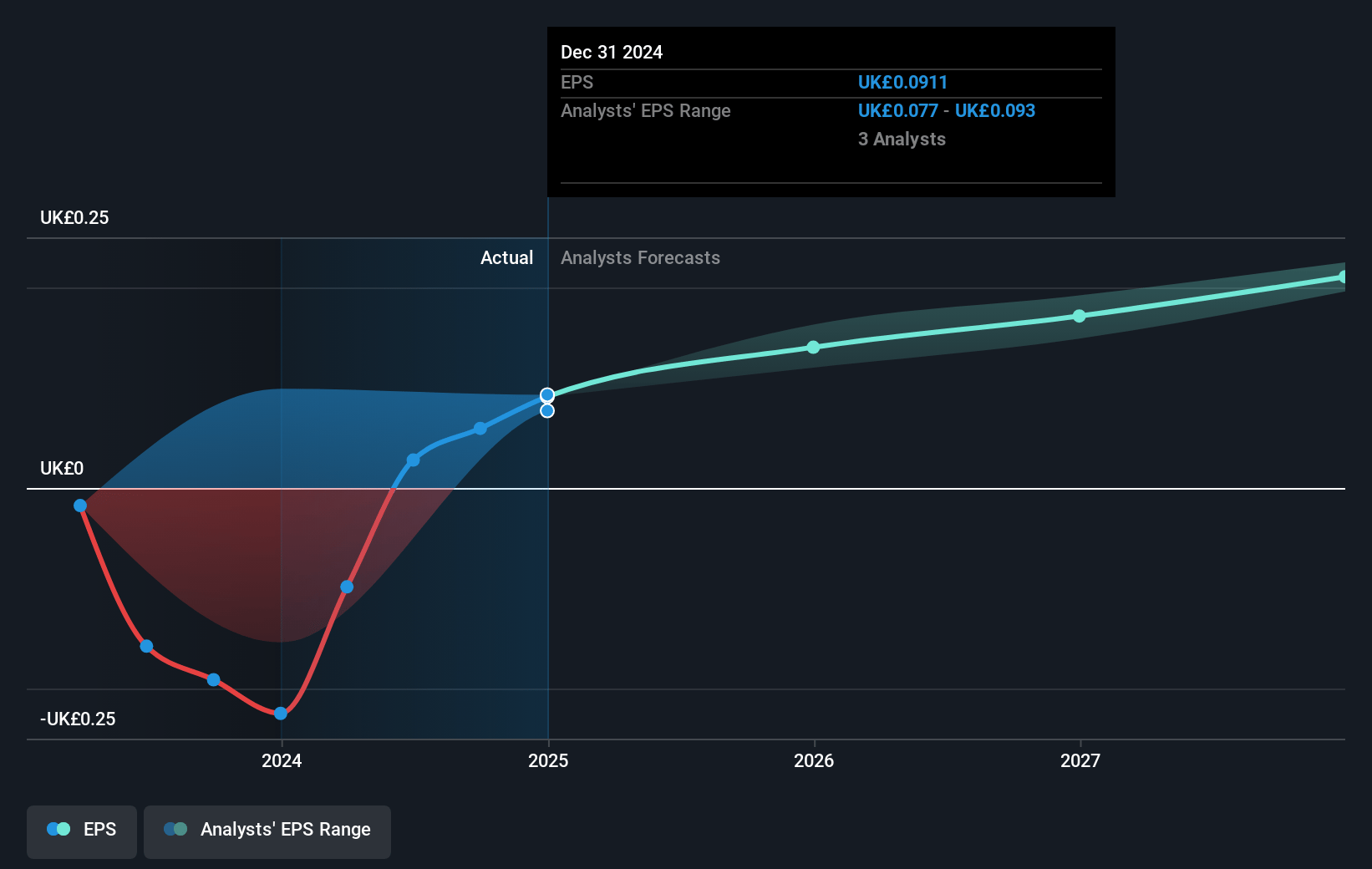

- The bullish analysts expect earnings to reach £34.6 million (and earnings per share of £0.25) by about July 2028, up from £12.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.6x on those 2028 earnings, down from 30.4x today. This future PE is lower than the current PE for the GB Commercial Services industry at 29.6x.

- Analysts expect the number of shares outstanding to grow by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.04%, as per the Simply Wall St company report.

Restore Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating shift towards digitization and cloud-based solutions across organizations poses a substantial risk to Restore's legacy document storage business, which has shown flat or declining volumes and could result in long-term revenue contraction as demand for physical storage diminishes.

- Restore's continued reliance on paper-based services (such as Synertec's core outbound letter volumes and the document storage "box" business) exposes the group to structural declines from environmental regulation and the broader secular move towards paperless operations, threatening both top-line growth and future margin sustainability.

- Persistent volatility and structural falls in the resale price of paper for shredding, along with increased competition from tech-enabled entrants and existing consolidators, could compress pricing power in the Datashred division, putting pressure on operating margins and reducing predictable cash flows.

- Integration risk from frequent acquisitions-illustrated by the rapid Synertec transaction and recent property consolidation-may lead to operational inefficiencies or cost overruns; if integration targets are missed, this could cause elevated costs and erode anticipated earnings, affecting both margins and free cash flow.

- High capital expenditure requirements for transitioning and maintaining physical infrastructure-combined with slow organic volume growth in core divisions and the risk of shorter mandatory record retention periods in the industry-may constrain Restore's ability to generate strong free cash flow and deliver consistent shareholder returns over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Restore is £5.49, which represents two standard deviations above the consensus price target of £3.85. This valuation is based on what can be assumed as the expectations of Restore's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.94, and the most bearish reporting a price target of just £3.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £420.3 million, earnings will come to £34.6 million, and it would be trading on a PE ratio of 27.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of £2.75, the bullish analyst price target of £5.49 is 49.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.