Key Takeaways

- Advanced digitalization and AI-driven strategies position Speedy Hire for expanded margins, organic growth, and outsized market share as infrastructure and decarbonization trends accelerate.

- Diversification into higher-margin, less cyclical business streams and specialist services boosts earnings resilience and supports sustained returns amid evolving market and regulatory pressures.

- Automation trends, lagging digital investment, tighter environmental rules, and sector concentration threaten Speedy Hire's market size, profitability, and stability amidst industry and economic shifts.

Catalysts

About Speedy Hire- Provides tools and equipment hire and services to the construction, infrastructure, and industrial markets in the United Kingdom and Ireland.

- Analysts broadly agree that the Velocity strategy and digital transformation should drive operational efficiency and revenue growth, but this likely underestimates the step-change in asset utilization and pricing power that AI-driven dynamic pricing, advanced transport optimization, and end-to-end digitalization will enable, expanding both net margins and organic top-line growth beyond current forecasts.

- While analyst consensus expects the sustainable fleet and hydrogen solutions to capture incremental demand, the scale and early-mover advantage of Speedy Hire's investment in low

- and zero-carbon equipment, coupled with third-party recognition (e.g., EcoVadis, FT climate leader), positions the company to win outsized share of structurally growing infrastructure and decarbonization projects, expanding margins with premium pricing and accelerating revenue growth as regulatory and customer climate pressures intensify.

- The integration and expansion of the Lloyds British TIC business, now underpinned by its own sector-specific systems and strengthened engineering bench, is likely to not only accelerate organic growth but also serve as a platform for potential bolt-on acquisitions; this enables Speedy Hire to structurally diversify revenues into less cyclical, higher-margin and regulation-driven streams, enhancing earnings resilience and multiple re-rating potential.

- The launch and scaling of newly developed specialist businesses such as Temporary Site Solutions – leveraging Speedy's existing distribution, customer relationships, and supply chain management – creates highly incremental service revenue opportunities that carry higher margins, extend customer lifetime value, and support overall EBITDA expansion not currently captured in consensus expectations.

- As global infrastructure and housing underinvestment converges with governments' stimulus and the private sector's move towards asset-light models, Speedy Hire's robust national network, capital allocation flexibility, and proven pricing discipline allow it to capture disproportionate share of a structurally expanding addressable market; this supports sustained revenue acceleration and growing return on capital as competitors struggle to keep pace with the required technological and ESG investments.

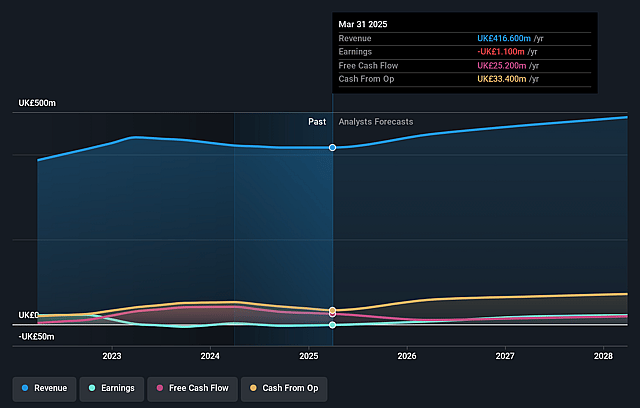

Speedy Hire Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Speedy Hire compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Speedy Hire's revenue will grow by 6.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.3% today to 5.4% in 3 years time.

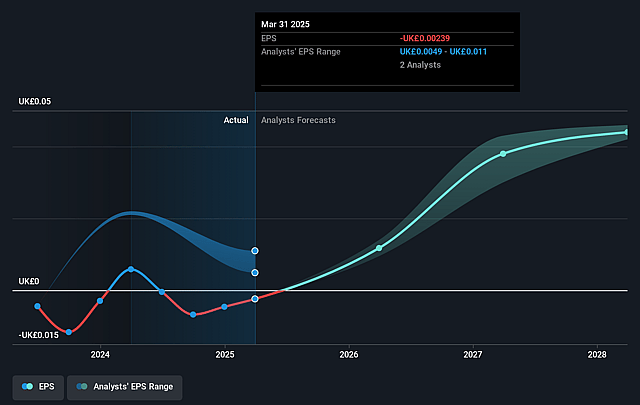

- The bullish analysts expect earnings to reach £27.4 million (and earnings per share of £0.06) by about September 2028, up from £-1.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from -100.1x today. This future PE is lower than the current PE for the GB Trade Distributors industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.94%, as per the Simply Wall St company report.

Speedy Hire Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating automation and robotics on construction sites could diminish the need for manual and traditional hire equipment, which would decrease Speedy Hire's addressable market and put long-term pressure on revenue growth.

- Persistent underinvestment in fleet modernization and digital platforms, especially relative to more technologically advanced and digitally-enabled competitors, risks eroding Speedy Hire's market share and could lead to lower revenue and compressed margins.

- Growing environmental regulations and stricter carbon emission policies may increase costs for companies relying on legacy diesel-powered rental fleets, raising capital expenditure requirements and putting downward pressure on net margins.

- Shifts towards off-site, modular, and prefabricated construction methods may structurally reduce demand for on-site equipment hire, potentially resulting in underutilized fleet assets and decreased earnings over time.

- The company's revenue base remains heavily concentrated in the UK construction sector, making Speedy Hire earnings highly vulnerable to macroeconomic cycles, ongoing industry insolvencies, construction project delays, and Brexit-related uncertainty-this could increase volatility and risk of revenue and earnings declines in extended downturns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Speedy Hire is £0.6, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Speedy Hire's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.6, and the most bearish reporting a price target of just £0.35.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £508.6 million, earnings will come to £27.4 million, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 12.9%.

- Given the current share price of £0.24, the bullish analyst price target of £0.6 is 60.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.