Key Takeaways

- Revenue growth remains vulnerable to delays in government projects and rapid regulatory or technological change, potentially leading to stranded assets and margin erosion.

- Rising competition, compliance costs, and digitization threaten to compress rental rates, restrict market share gains, and pressure long-term profitability.

- Reliance on a sluggish UK market, high leverage, intense competition, and pressure to modernize heighten risks to Speedy Hire's margins, growth, and earnings stability.

Catalysts

About Speedy Hire- Provides tools and equipment hire and services to the construction, infrastructure, and industrial markets in the United Kingdom and Ireland.

- While government-led infrastructure projects and the push for net zero commitments could spur long-term equipment hire demand, Speedy Hire's heavy reliance on timely execution of these public sector initiatives leaves revenue growth highly exposed to persistent delays in government spending reviews and project cancellations, which can materially weigh on top-line performance.

- Despite increasing focus on sustainability and a growing eco-friendly fleet-over 70% of recent capital expenditure was on eco products-there is significant risk that rapid decarbonization policies could render portions of the traditional fleet obsolete before they are fully depreciated, leading to stranded assets and potential impairment charges that may erode net margins and return on capital.

- While digital transformation and use of AI-powered platforms should enhance operational efficiency and customer experience over the coming years, the accelerating shift toward digital procurement and online equipment-sharing marketplaces could intensify competitive pressures and disintermediation, placing downward pressure on both rental rates and customer retention, ultimately compressing earnings.

- Although consolidation in the hire and distribution industry could, in theory, benefit a scale player like Speedy Hire, heightened competition from both larger international rivals and disruptive new entrants risks limiting Speedy's pricing power and market share, undermining anticipated operating leverage benefits and margin expansion.

- While growing regulatory requirements around safety, emissions, and compliance may drive demand for well-maintained equipment, the rapidly rising compliance and upgrade costs associated with evolving ESG standards could outpace Speedy Hire's ability to invest, especially given its substantial debt load, potentially pressuring both cash flows and long-term profitability.

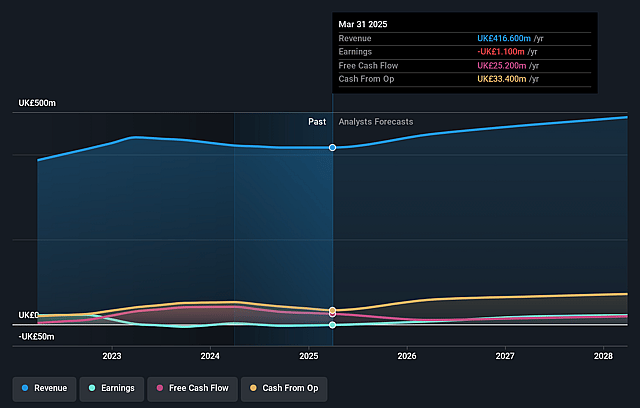

Speedy Hire Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Speedy Hire compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Speedy Hire's revenue will grow by 5.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.3% today to 4.8% in 3 years time.

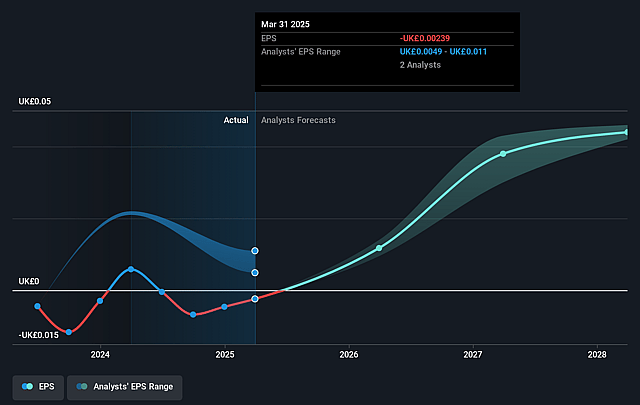

- The bearish analysts expect earnings to reach £23.4 million (and earnings per share of £0.05) by about September 2028, up from £-1.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, up from -100.7x today. This future PE is lower than the current PE for the GB Trade Distributors industry at 14.9x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.94%, as per the Simply Wall St company report.

Speedy Hire Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Speedy Hire's revenue growth remains highly exposed to weak UK construction market conditions, as evidenced by several references to challenging market backdrops, a persistently contracting PMI below 50, project delays, and construction output downgrades, all of which could depress equipment rental volumes and ultimately impact both revenue and net earnings in the long term.

- The business carries significant operational gearing and high leverage, highlighted by a bank net debt of 113 million pounds and the expectation to maintain elevated leverage ratios up to 2x, meaning that even marginal declines in revenue or volume could sharply reduce net profit and constrain future investment capacity, thereby pressuring margins and earnings.

- There is substantial competition and price pressure, especially in the regional customer segment, with ongoing concerns about customer insolvencies and highly competitive conditions, which may make it difficult for Speedy Hire to grow pricing and volume simultaneously in the medium term, resulting in compressed gross margin and uncertain revenue growth.

- Heavy concentration in the UK market and a focus on organic rather than acquisitive growth leaves Speedy Hire more vulnerable to local economic shocks, slower infrastructure stimulus realization, and regulatory or Brexit-related challenges, all of which could increase revenue volatility and risk to long-term earnings stability.

- Their sustained high capital expenditure on fleet upgrades, together with the transition to eco products and digital transformation initiatives, subjects the company to ongoing pressure to achieve high utilization rates and efficient asset management; any continued underutilization or inability to scale new business lines swiftly enough (such as hydrogen generators or Temporary Site Solutions) could lead to higher depreciation charges and a drag on net margins and return on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Speedy Hire is £0.35, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Speedy Hire's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.6, and the most bearish reporting a price target of just £0.35.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £484.1 million, earnings will come to £23.4 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 12.9%.

- Given the current share price of £0.24, the bearish analyst price target of £0.35 is 31.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Speedy Hire?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.