Narratives are currently in beta

Key Takeaways

- NatWest's focus on disciplined growth and simplification could boost future income, revenue, and earnings through strategic acquisitions and market share expansion.

- Proactive capital and risk management alongside strategic partnerships may enhance balance sheet efficiency, leading to improved margins and scalability.

- Anticipated interest rate cuts, regulatory pressures, and credit quality concerns may impact NatWest Group's profitability, growth opportunities, and shareholder value.

Catalysts

About NatWest Group- Provides banking and financial products and services to personal, commercial, corporate, and institutional customers in the United Kingdom and internationally.

- NatWest Group's ongoing focus on disciplined growth, bank-wide simplification, and active balance sheet and risk management could lead to increased future income and returns, positively impacting future revenue and earnings.

- The acquisition of a £2.3 billion prime residential mortgage portfolio from Metro Bank, along with credit card market share growth from 8.5% to 9.3%, suggests potential for increased revenue and improved net interest margins.

- Completion of the Sainsbury’s transaction in the first half of next year is expected to be return on tangible equity-accretive, meaning it could positively impact earnings and shareholder returns.

- NatWest's proactive capital management and optimization of risk-weighted assets, such as their significant risk transfer transactions, can effectively manage capital usage and distributions, thereby improving net margins.

- Potential benefits from strategic partnerships in the private credit space, allowing for improved balance sheet efficiency and the ability to distribute through multiple channels, may drive revenue growth and operational scalability.

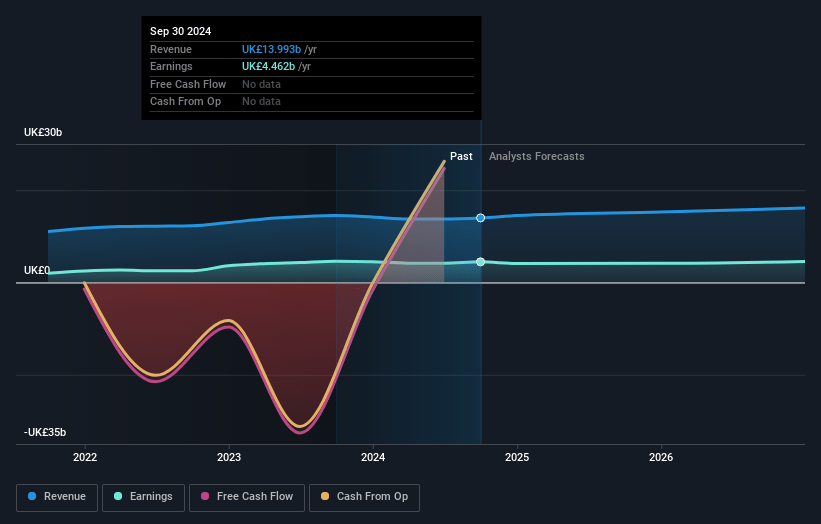

NatWest Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NatWest Group's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 31.9% today to 27.1% in 3 years time.

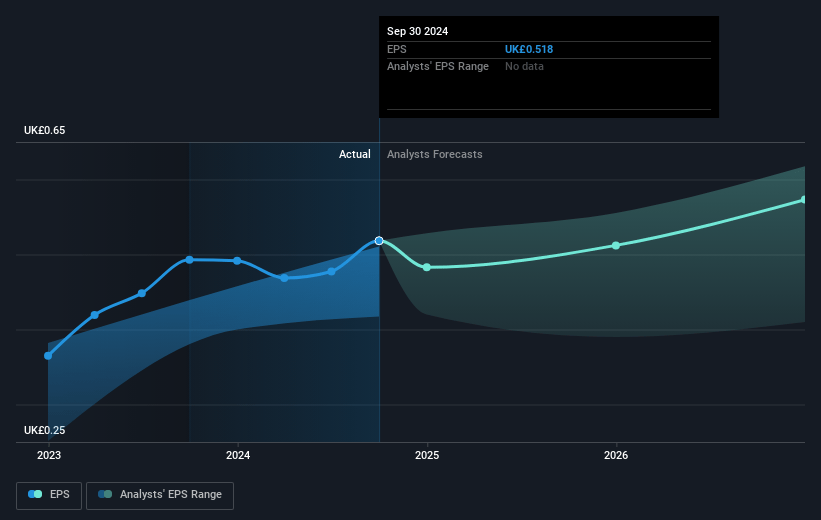

- Analysts expect earnings to reach £4.4 billion (and earnings per share of £0.53) by about January 2028, down from £4.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £5.3 billion in earnings, and the most bearish expecting £3.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, up from 7.5x today. This future PE is greater than the current PE for the GB Banks industry at 5.0x.

- Analysts expect the number of shares outstanding to grow by 1.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.64%, as per the Simply Wall St company report.

NatWest Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The anticipation of multiple base rate cuts (beginning in February 2025 and totaling five times by the year-end) could potentially impact the Group’s net interest income as the margin pressures increase due to the rate environment. This is crucial since interest income forms a substantial portion of their earnings.

- The RWA (Risk-Weighted Assets) inflation resulting from the upcoming Basel 3.1 regulations may impact the bank's profitability metrics and capital adequacy ratios, potentially pressuring the net margins if not successfully managed.

- The impairment charge, which includes a significant single name charge, raises concerns about credit quality in certain sectors. Any increase in credit risk over expected levels could adversely affect net profits through higher provisioning.

- The heightened capital management activities to contain RWA ostensibly might not be sustainable at current levels, potentially limiting growth opportunities if unable to manage risk assets efficiently, impacting the bank’s revenue outlook.

- The continued government exit through directed buybacks may lead to fluctuations in the stock price and influence shareholder value, with the CET1 ratio sensitivity in maintaining the capital target range impacting capital buffer and distributions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.67 for NatWest Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.36, and the most bearish reporting a price target of just £3.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £16.3 billion, earnings will come to £4.4 billion, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 11.6%.

- Given the current share price of £4.18, the analyst's price target of £4.67 is 10.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives