Key Takeaways

- Digital banking and Super-App success have boosted efficiencies, but overvaluation and rising competition threaten future growth and margin expansion.

- Strong market position and economic tailwinds support growth, yet regulatory changes, credit risk, and moderating loan demand may pressure earnings and profitability.

- Rapid digital expansion, diversified services, dominant market position, and prudent risk management underpin Halyk Bank's long-term profitability and resilience despite regulatory headwinds.

Catalysts

About Halyk Bank of Kazakhstan- Provides corporate and retail banking services primarily in the Republic of Kazakhstan, Kyrgyzstan, Georgia, and Uzbekistan.

- The rapid growth in digital banking adoption and Halyk's dominant Super-App ecosystem have driven robust gains in non-interest fee income and cost efficiencies, but current overvaluation may reflect unrealistic optimism for further margin expansion as digital channel adoption matures and competition for digital services intensifies, with potential impacts on future revenue growth and net margins.

- Halyk's strong market share in consumer lending, mortgages, deposits, and payment services has been buoyed by a growing middle class and rising household incomes, yet current valuations could be incorporating overly aggressive assumptions about long-term loan growth and cross-selling, despite signals of moderating retail and SME loan demand-particularly in a high-inflation, high-interest-rate environment-which may constrain future revenue and earnings expansion.

- The anticipated economic formalization and diversification in Kazakhstan is supportive for longer-term deposit and SME lending growth, but recent trends of slowing retail loan book growth, elevated inflation (10–12%), and rising NPLs (exacerbated by a regulatory moratorium on selling bad retail loans) signal increasing credit risk and cost of risk, potentially resulting in compressed net margins and subdued earnings growth going forward.

- Ongoing digital transformation initiatives have delivered significant efficiencies and helped lower the cost-to-income ratio, but repeating such improvements will be increasingly challenging; if the bank's technological edge narrows as competitors accelerate their digital offerings, this could squeeze future net margins and operational leverage.

- Recent and pending regulatory changes-including increased reserve requirements, heightened taxation (a 10% windfall tax and future corporate tax hikes), and limits on NPL sales-risk driving up funding costs, reducing fee and interest income, and increasing credit provisions, which could collectively temper future earnings and pressure the sustainability of current profitability levels.

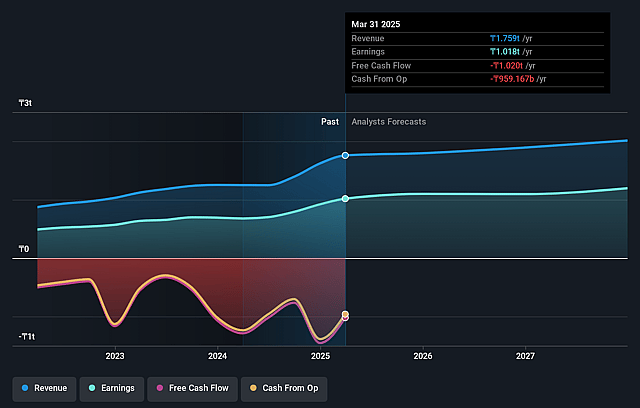

Halyk Bank of Kazakhstan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Halyk Bank of Kazakhstan's revenue will grow by 6.3% annually over the next 3 years.

- Analysts are assuming Halyk Bank of Kazakhstan's profit margins will remain the same at 57.9% over the next 3 years.

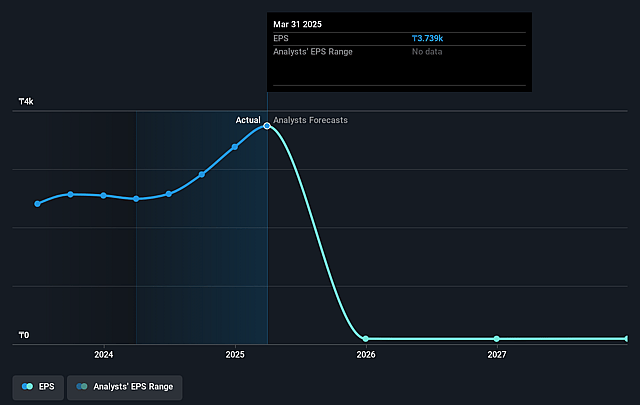

- Analysts expect earnings to reach KZT 1223.1 billion (and earnings per share of KZT 97.69) by about August 2028, up from KZT 1018.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting KZT1425.6 billion in earnings, and the most bearish expecting KZT1041.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.1x on those 2028 earnings, up from 3.5x today. This future PE is lower than the current PE for the GB Banks industry at 9.4x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.95%, as per the Simply Wall St company report.

Halyk Bank of Kazakhstan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Halyk Bank's accelerating growth in digital banking, as evidenced by a 30%+ increase in Super-App transaction volume and 7.7 million monthly active users, suggests strong long-term customer engagement and cost efficiencies, which can drive expansion of fee-based income and support net margin improvement going forward.

- The bank continues to gain market share in both the retail and commercial sectors (20% retail loan share, 52% of real economy lending, and 43% of active salary cards), indicating a dominant franchise with pricing power and resilience to competitive pressure, which can contribute positively to revenue and earnings over the long term.

- Diversification of revenue streams via robust expansion of digital marketplaces, insurance, and brokerage services (50%+ client growth in insurance, 34–37% GMV growth in marketplaces, and 54%+ increase in brokerage clients) positions Halyk to capture secular trends in financial product consumption and increase non-interest income, bolstering overall profitability.

- Strong capital adequacy (capital ratio of 19.3%), high liquidity, and operational discipline (cost-to-income ratio down to 16.5%) provide a significant buffer against regulatory tightening, cyclical downturns, or competition, and enable the bank to sustain stable earnings and potential shareholder returns.

- Despite rising NPL ratios due to regulatory changes (e.g., moratorium on NPL sales), Halyk demonstrated proactive risk management through tightened credit standards, strong loan coverage, and normalization within guidance; coupled with ongoing improvement in Kazakhstan's macroeconomic indicators (GDP growth 6%), this mitigates asset quality concerns and supports longer-term net interest and fee income stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of KZT25.933 for Halyk Bank of Kazakhstan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of KZT28.8, and the most bearish reporting a price target of just KZT24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be KZT2113.7 billion, earnings will come to KZT1223.1 billion, and it would be trading on a PE ratio of 4.1x, assuming you use a discount rate of 9.9%.

- Given the current share price of KZT24.75, the analyst price target of KZT25.93 is 4.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.