Key Takeaways

- Rising regulatory costs and slow SaaS adoption are putting sustained pressure on profit margins and delaying returns on investment in product development.

- Intensifying competition from agile start-ups and open-source alternatives threatens market share, fueling price pressure and straining efforts to sustain revenue growth.

- Accelerating SaaS momentum, strong integrations, sustained R&D, and expanding geographic reach position 74Software for resilient, diversified, and steadily growing profitability.

Catalysts

About 74Software- Operates as a software company in France.

- The increasing complexity and cost of complying with evolving data privacy regulations such as GDPR and new European reporting frameworks is set to materially escalate ongoing operating expenses and delay product upgrades, eroding future profit margins as 74Software must reengineer offerings for region-specific compliance.

- The accelerating pace of AI and automation innovation poses a fundamental threat to the differentiated value of standard software features in 74Software's portfolio, likely causing price pressure and limiting the ability to maintain or grow average revenue per user over the coming years.

- Over-reliance on a small number of flagship core banking and integration products leaves the company highly vulnerable to shifts in customer preferences and competitive disruption, heightening the risk of revenue concentration and undermining long-term top-line stability.

- Customer churn rates in legacy on-prem offerings remain high and the transition to SaaS is slow and protracted, resulting in sluggish recurring revenue growth and a drawn-out payback period on R&D investments, which will drag on both revenue recognition and net margins through at least 2027.

- The rapid expansion of agile cloud-native start-ups and open-source alternatives in core European and North American markets threatens to erode 74Software's market share, forcing potential price cuts and increased R&D spend merely to maintain competitive parity, ultimately compressing earnings growth and depressing return on invested capital.

74Software Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on 74Software compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming 74Software's revenue will grow by 20.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.5% today to 10.2% in 3 years time.

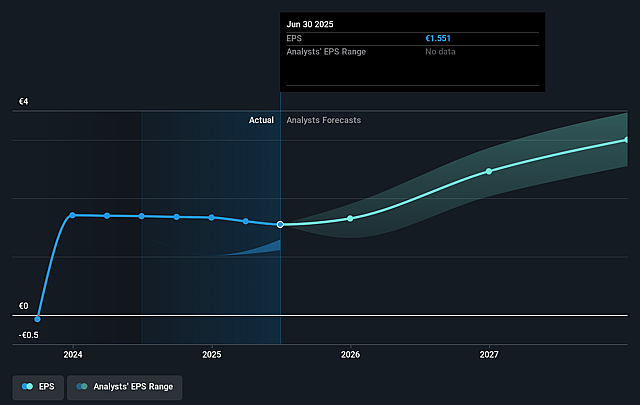

- The bearish analysts expect earnings to reach €82.0 million (and earnings per share of €2.7) by about July 2028, up from €39.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, down from 28.9x today. This future PE is lower than the current PE for the GB Software industry at 29.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

74Software Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating shift toward cloud-based and SaaS solutions in the enterprise and banking software markets positions 74Software to capture growing demand, as evidenced by increasing SaaS and recurring revenue, which is likely to drive long-term revenue growth and improve visibility for earnings.

- The company's successful integration of Axway and SBS has resulted in operational synergies and a resilient product portfolio, improving margins and creating the potential to scale efficiencies as the business grows, thus supporting higher EBITDA and net income over time.

- Robust and improving customer satisfaction and employee engagement scores, alongside a high rate of customer retention and repeat business, suggest durable customer relationships that can fuel recurring revenue and maintain or expand profitability.

- Sustained investment in R&D and new digital-native, cloud-first product lines (such as the Amplify Fusion platform and specialized regulatory SaaS solutions) increases 74Software's ability to address evolving customer needs, drive cross-sell, and generate incremental revenue from both existing and new clients.

- Strong positions in key growth regions, including North America and niche banking markets in Europe and Africa, as well as a growing international footprint, are likely to diversify the revenue base, reduce geographic risk, and support consistent long-term top-line expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for 74Software is €35.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of 74Software's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €53.0, and the most bearish reporting a price target of just €35.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €801.6 million, earnings will come to €82.0 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of €38.9, the bearish analyst price target of €35.0 is 11.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.