Key Takeaways

- Growing adoption of cloud-based, AI-driven SaaS solutions and successful cross-selling are fueling robust topline growth and expanding market opportunities.

- Operational efficiencies, improved profitability, and strong cash flow position the company for accretive acquisitions and premium valuation through inorganic growth.

- Revenue concentration, execution risks from recent mergers, escalating costs, and intensifying competition threaten long-term earnings, margin stability, and market positioning.

Catalysts

About 74Software- Operates as a software company in France.

- The ongoing shift by enterprises from on-premises to cloud-based solutions is expanding 74Software's recurring revenue base, evidenced by the increase in SaaS product adoption and recurring revenues rising from 71% to 75%. This transition is likely to further improve revenue predictability and gross margins as customers opt for managed services and subscriptions.

- Accelerating demand for digital transformation, data analytics, and compliance automation across sectors positions 74Software's expanding suite of cloud-native, regulatory, and AI-driven products for substantial long-term growth in its addressable markets, supporting higher future revenues and ARR.

- The successful cross-sell of new digital native SaaS products (like Modular and regulatory reporting services) into an existing large client base, as well as the ability to serve new geographies and verticals, demonstrates strong commercial momentum and supports topline growth as these incubated products scale.

- The recently achieved operational synergies, G&A cost efficiencies, and R&D focus following the Axway/SBS combination are driving improved profitability (margin expansion) and are expected to continue supporting higher net margins as the company standardizes and matures its product offerings.

- The completion of deleveraging and a below-2x leverage ratio, together with robust free cash flow generation, is expected to enable accretive M&A from 2026 onward-potentially accelerating earnings per share growth and supporting a premium valuation as inorganic growth opportunities materialize.

74Software Future Earnings and Revenue Growth

Assumptions

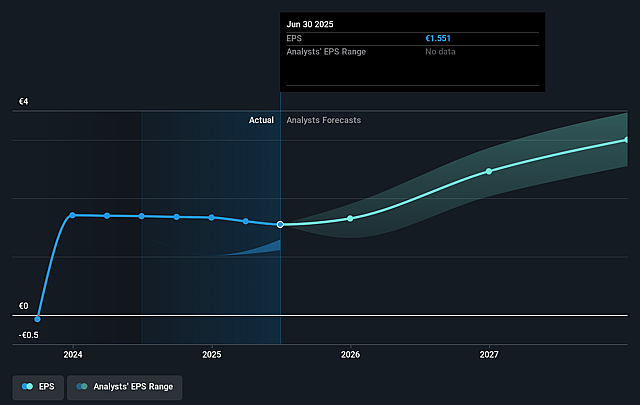

How have these above catalysts been quantified?- Analysts are assuming 74Software's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 11.1% in 3 years time.

- Analysts expect earnings to reach €83.4 million (and earnings per share of €3.47) by about September 2028, up from €42.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, down from 27.0x today. This future PE is lower than the current PE for the GB Software industry at 25.5x.

- Analysts expect the number of shares outstanding to grow by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.04%, as per the Simply Wall St company report.

74Software Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a limited number of flagship or core products and the slow ramp-up of newer offerings (such as Modular or full digital-native core banking) creates ongoing revenue concentration risk; should any major product line underperform or face delays in adoption, this could lead to volatile revenues and pressure long-term earnings.

- The transition towards recurring revenue (SaaS/subscription) is positive but has been partially driven by early customer-managed deals and upfront license signing in H1, creating significant seasonality and uncertainty about the sustainability of reported growth rates and margins; a weaker second half could reveal underlying volatility in organic revenue and net margin growth.

- Growing R&D and product development costs-particularly as multiple new solutions move from "incubation" to general availability and as ongoing investment is needed for cross-selling and integration-may outpace revenue growth in the medium term, threatening normalized net margins even as legacy R&D expenditure is expected to decline.

- Execution risks remain high following the recent large-scale merger of Axway and SBS, particularly around integrating systems, achieving projected cost synergies, and efficiently aligning portfolio and G&A functions; operational missteps or cultural friction could limit the realization of forecast profitability improvements and earnings growth.

- Intensifying industry competition from better-capitalized global players, industry consolidation, and the proliferation of vertical SaaS/industry-specific solutions-especially in core banking-could erode 74Software's pricing power and market relevance if its products fail to sufficiently differentiate, putting long-term revenue and gross margin expansion at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €49.467 for 74Software based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €53.0, and the most bearish reporting a price target of just €44.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €752.2 million, earnings will come to €83.4 million, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 8.0%.

- Given the current share price of €38.9, the analyst price target of €49.47 is 21.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on 74Software?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.