Key Takeaways

- Aggressive cost-cutting, advanced API technology, and government subsidies position Euroapi for substantial, sustained margin and revenue growth far beyond consensus expectations.

- Strategic expansion in both European and emerging markets, combined with a focus on high-value clients, strengthens global market share and ensures durable, compounding cash flows.

- Heavy dependence on major clients, commodity price pressures, and cost-cutting threaten profitability, R&D investment, and long-term competitiveness amid intensifying global pharmaceutical competition.

Catalysts

About Euroapi- Develops, manufactures, markets, and distributes active pharmaceutical ingredients and intermediates used in the formulation of medicines for human and veterinary use in France, Europe, Rest of Europe, North America, the Asia Pacific, and internationally.

- Analyst consensus recognizes Euroapi's margin improvement from differentiated, high-value APIs, but this likely underestimates the company's ability to uniquely dominate complex, high-potency and fermentation-driven APIs, especially with recent advances in enzymatic and biocatalysis, setting up for compounded revenue growth and EBITDA margin expansion as global demand for specialty APIs accelerates.

- While analysts broadly expect cost reductions from manufacturing footprint optimization, Euroapi's execution has been more aggressive and structural than expected, resulting in a sustainable lower cost base; when combined with increasing operational discipline and government-backed subsidies, this positions net margins for a step-change rather than incremental improvement.

- The company's new leadership in commercial operations and focused CDMO strategy is enabling rapid onboarding of large pharma and biotech clients, allowing for a shift toward late-stage, high-value projects that will stabilize and scale future revenues far above market expectations.

- Euroapi is exceptionally well-placed to benefit from the shift toward healthcare localization and domestic API sourcing in Europe, with recent IPCEI subsidies further solidifying its role as the preferred strategic partner for European pharmaceutical supply chains, which will translate into pricing power and contract visibility.

- The ongoing expansion in emerging markets, coupled with increased fermentation capacity and proprietary green processes, creates a scalable platform for market share gains and global client wins, driving long-duration, compounding revenue streams and resilient cash flow.

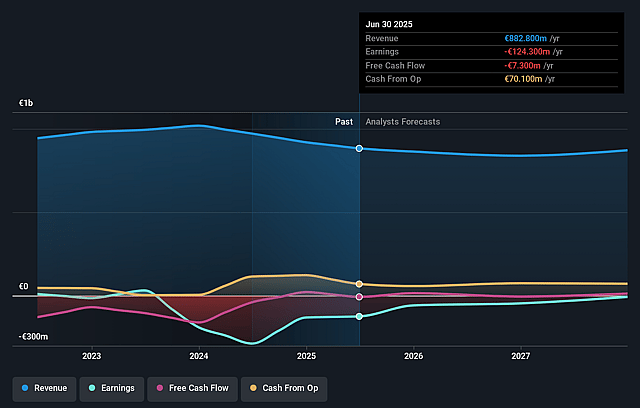

Euroapi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Euroapi compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Euroapi's revenue will decrease by 0.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -14.1% today to 2.0% in 3 years time.

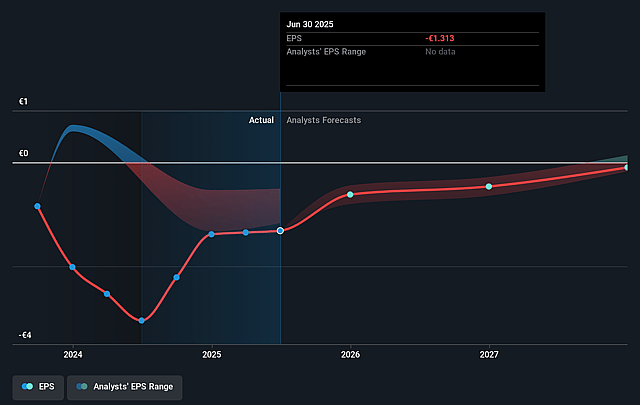

- The bullish analysts expect earnings to reach €18.2 million (and earnings per share of €0.2) by about September 2028, up from €-124.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, up from -2.2x today. This future PE is greater than the current PE for the FR Pharmaceuticals industry at 18.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

Euroapi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining sales to major clients like Sanofi, along with overall net sales decreasing 8.2 percent year-on-year, highlights significant client concentration risk and ongoing revenue volatility if large contracts are lost or renegotiated unfavorably.

- Reduced sales in key product lines such as Sevelamer and delayed or shifted Vitamin B12 shipments amid oversupply and price wars from Chinese competitors expose Euroapi to ongoing commodity price pressure, which is likely to weigh on revenue and gross margin in the years ahead.

- The company's core EBITDA margin has declined to 9.6 percent from 10.6 percent, and net income remains solidly negative, reflecting persistent profitability challenges that could deepen if environmental regulations further raise costs or if operational disruptions such as the social issue at Elbeuf recur.

- High reliance on cost cutting, personnel reduction, and structural OpEx savings to preserve profitability may limit the company's ability to adequately invest in R&D, modernization and capacity upgrades, increasing the risk of lagging behind global competitors and eroding long-term net margins and growth potential.

- Rising competition from consolidated global pharma buyers and ongoing consolidation in the pharmaceutical sector enhances client bargaining power, putting additional downward pressure on API pricing and making it harder for Euroapi to maintain steady earnings and top line growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Euroapi is €3.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Euroapi's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €3.5, and the most bearish reporting a price target of just €2.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €903.3 million, earnings will come to €18.2 million, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 6.0%.

- Given the current share price of €2.86, the bullish analyst price target of €3.5 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.