Key Takeaways

- Investments in capacity expansion, innovation, and premium CDMO projects position Euroapi for increased high-value API market share and resilient, higher-margin revenue growth.

- Structural cost reductions, site divestments, and regionalization trends are expected to strengthen profitability, operating efficiency, and long-term earnings stability.

- Intensifying competition, customer concentration, operational restructuring, and rising regulatory costs threaten revenue stability, margin improvement, and long-term growth prospects.

Catalysts

About Euroapi- Develops, manufactures, markets, and distributes active pharmaceutical ingredients and intermediates used in the formulation of medicines for human and veterinary use in France, Europe, Rest of Europe, North America, the Asia Pacific, and internationally.

- Significant investments in capacity expansion (e.g., Pristinamycin, PLLA, prostaglandin) and innovation (biotechnological processes, fermentation platform) are expected to enhance Euroapi's ability to supply high-value, complex APIs, positioning the company to capture a larger share of the growing pharmaceutical demand and support top-line revenue growth.

- The ongoing shift towards healthcare sovereignty and regionalization, reinforced by government subsidies like the €140 million IPCEI contract, is likely to drive higher plant utilization and long-term, stable demand for European-based API production, improving sales visibility and supporting sustained earnings growth.

- Increasing demand for APIs related to chronic diseases (e.g., opioids, prostaglandin, Vitamin B12) aligns Euroapi with expanding global pharma pipelines, creating opportunities for recurring revenues from both legacy and new drug launches.

- Structural cost reductions, improved operational efficiency, and divestment of unprofitable sites (e.g., Haverhill) are setting a foundation for sustained improvement in net margins and EBITDA, enhancing the company's ability to return to profitability.

- Strategic focus on high-margin, late-stage CDMO projects with blue-chip clients, along with rebuilding the commercial organization and moving away from legacy contracts, is expected to improve the mix and resilience of revenues, supporting margin expansion and higher long-term earnings quality.

Euroapi Future Earnings and Revenue Growth

Assumptions

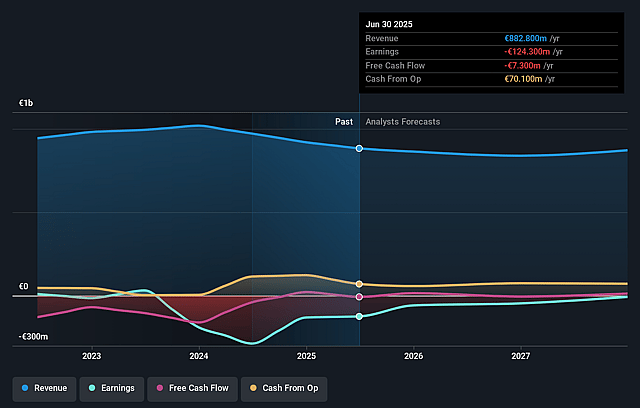

How have these above catalysts been quantified?- Analysts are assuming Euroapi's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -14.1% today to 1.1% in 3 years time.

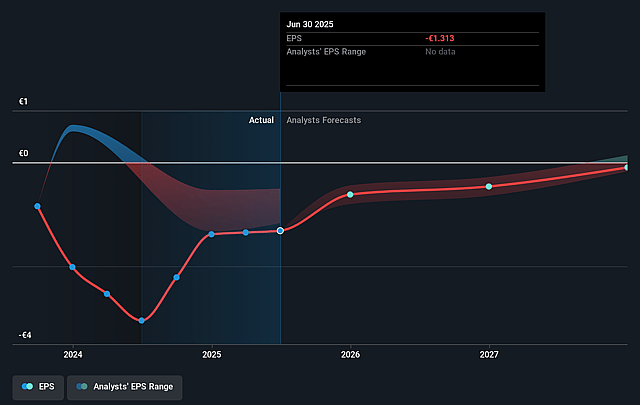

- Analysts expect earnings to reach €10.0 million (and earnings per share of €0.1) by about September 2028, up from €-124.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €12.7 million in earnings, and the most bearish expecting €-16.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.8x on those 2028 earnings, up from -2.3x today. This future PE is greater than the current PE for the FR Pharmaceuticals industry at 18.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

Euroapi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent pricing pressure and heightened competition from low-cost Asian producers in key segments such as Vitamin B12 could continue to erode revenue and compress margins, especially if price wars intensify and process improvements do not deliver sufficient cost advantage.

- Customer concentration risk remains elevated, with Sanofi still representing a major share of sales, and legacy Sanofi-inherited contracts within the CDMO business now in decline; further attrition, consolidation, or client loss could lead to significant revenue decreases and increased earnings volatility.

- Euroapi's CDMO segment is experiencing right-sizing and project attritions, with a delay in rebuilding commercial momentum and an overall decrease in RFPs market-wide; this could hinder revenue growth and limit the company's ability to offset declining legacy business in the medium to long term.

- Execution risks tied to ongoing restructuring (e.g., FOCUS-27), large-scale CapEx, and technology/process upgrades could result in disruption, cost overruns, or recurring operational lapses, weighing on productivity and thus limiting improvements in net margins and long-term earnings.

- Increased regulatory scrutiny, environmental requirements, and sustainability standards across Europe may drive up Euroapi's operating costs faster than cost-saving initiatives or market growth can compensate, ultimately impacting margin competitiveness and net income over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €3.08 for Euroapi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €3.5, and the most bearish reporting a price target of just €2.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €902.1 million, earnings will come to €10.0 million, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 6.0%.

- Given the current share price of €2.97, the analyst price target of €3.08 is 3.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Euroapi?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.