Last Update 25 Jan 26

EAPI: Execution Risks And Lower Outlook Will Shape Future Return Profile

Narrative update

Analysts have trimmed their price target on Euroapi by €0.50 to €2.00, citing updated assumptions on revenue growth, profit margins and forward P/E that keep their stance cautious on the shares.

Analyst Commentary

Recent research has reinforced a cautious stance on Euroapi, with bearish analysts trimming their price targets to €2.00. This level aligns with what they see as a more restrained view on the company’s ability to support higher valuation multiples given current assumptions on revenue, margins and P/E.

These moves underline a view that the risk and reward balance is still tilted toward execution challenges, rather than a clean growth story that could justify a higher share price.

Bearish Takeaways

- The reduction in the price target to €2.00 signals that bearish analysts see limited upside at current prices, given their updated assumptions on revenue growth and profitability.

- Keeping a Sell stance at the same time as lowering the target suggests they continue to see execution risks, for example around achieving margin improvements that would support a higher P/E.

- The repeated target cut to the same €2.00 level across recent notes highlights a consistent cautious sentiment, with concerns that growth expectations may be too optimistic relative to current fundamentals.

- By anchoring their valuation at €2.00, bearish analysts are effectively flagging that, in their models, potential setbacks on earnings delivery carry more weight than any possible re-rating of the shares.

What's in the News

- Euroapi lowered its full year 2025 net sales outlook. It now expects a mid single digit decline on a comparable basis instead of the previously indicated low single digit decline, citing a deteriorated overall business environment (Key Developments).

Valuation Changes

- Fair Value: Held steady at €2.00, with no change in the latest update.

- Discount Rate: Essentially unchanged at 6.18%, indicating a consistent required return in the model.

- Revenue Growth: Assumption adjusted slightly from 1.86% to about 1.88%.

- Net Profit Margin: Tweaked higher from roughly 3.00% to about 3.04%.

- Future P/E: Trimmed modestly from around 8.12x to about 8.02x, reflecting a slightly more cautious valuation multiple.

Key Takeaways

- Intensifying regulatory pressures and global deglobalization trends threaten profitability and export-driven growth, especially amid shifting mandates for local drug production.

- Heavy reliance on a few key clients and shrinking demand for traditional APIs expose the company to heightened revenue volatility and margin pressure.

- Operational efficiency, strategic investments in high-value products, government support, and innovation in advanced APIs are expected to drive more stable, higher-margin growth.

Catalysts

About Euroapi- Develops, manufactures, markets, and distributes active pharmaceutical ingredients and intermediates used in the formulation of medicines for human and veterinary use in France, Europe, Rest of Europe, North America, the Asia Pacific, and internationally.

- Ever-increasing regulatory scrutiny and compliance costs in the EU and globally are expected to weigh heavily on Euroapi, threatening to erode already thin profitability. As requirements expand, the company will need to commit even more resources to ensure compliance, which could drive operating costs materially higher and compress net margins for the foreseeable future.

- The rising threat of global deglobalization and intensifying political mandates for localized pharmaceutical manufacturing-particularly in the United States and China-pose a major risk to Euroapi's export-oriented revenue streams, potentially limiting access to key high-growth markets and undermining top-line growth prospects over the next decade.

- Persistent customer concentration, especially heavy reliance on Sanofi and a handful of major clients, exposes Euroapi to disproportionate revenue risk if key supply agreements are lost or renegotiated on less favorable terms. This structural vulnerability could result in sudden declines in revenue if contract losses or reductions occur.

- Mounting price erosion in the global API sector, driven by unrelenting generic competition and aggressive price wars (especially noted in the Vitamin B12 market with Chinese players), is likely to exert continued downward pressure on selling prices, threatening both revenue stability and gross margin expansion.

- The rapid pace of innovation in biologics, advanced therapies, and novel modalities (like cell, gene, and mRNA therapies) risks reducing demand for traditional small-molecule APIs, which make up much of Euroapi's portfolio. This secular decline in addressable market could eventually lead to revenue contraction and longer-term erosion in earnings quality.

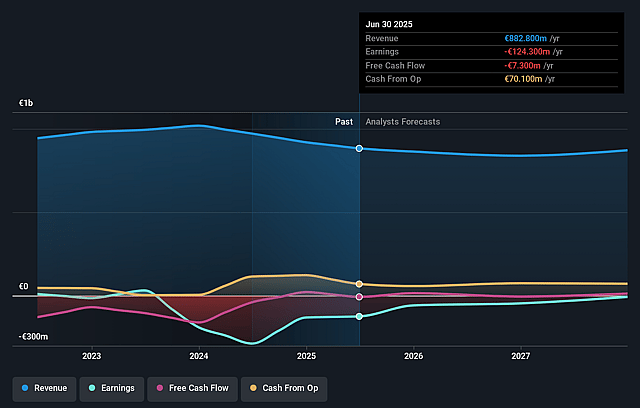

Euroapi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Euroapi compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Euroapi's revenue will decrease by 2.0% annually over the next 3 years.

- The bearish analysts are not forecasting that Euroapi will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Euroapi's profit margin will increase from -14.1% to the average FR Pharmaceuticals industry of 11.0% in 3 years.

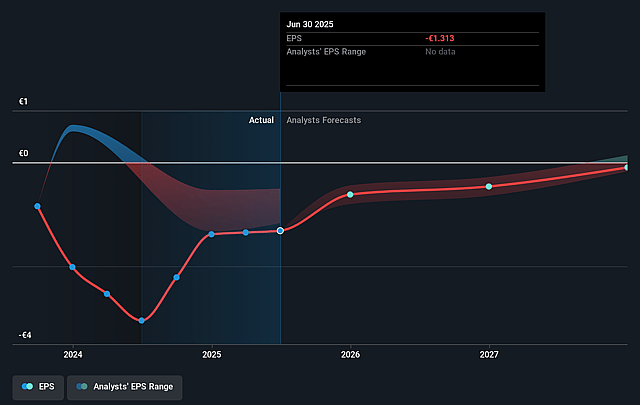

- If Euroapi's profit margin were to converge on the industry average, you could expect earnings to reach €91.4 million (and earnings per share of €0.96) by about September 2028, up from €-124.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 3.1x on those 2028 earnings, up from -2.3x today. This future PE is lower than the current PE for the FR Pharmaceuticals industry at 18.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

Euroapi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing cost discipline and structural efficiency improvements, as described by management, are expected to be long lasting, which could support sustained improvement in operating profitability and net margins.

- The company is investing 60% of its capital expenditures in growth projects, with a clear emphasis on expanding capacity for high-value APIs like Pristinamycin and Poly-L-Lactic Acid, alongside technological enhancements in fermentation. These investments position Euroapi to benefit from long-term industry trends and could drive revenue growth and gross margin expansion.

- Management highlighted robust late-stage CDMO projects and strategic focus on winning large, higher-value contracts with major pharma clients, which could result in increased operational visibility, more stable revenue streams, and improved earnings quality in the years ahead.

- Euroapi is benefiting from government backing, including a subsidy agreement of up to €140 million with the French government for innovation projects under the IPCEI framework, helping to offset investment risk, improve cash flow, and support net income over the coming years.

- The company's focus on innovation within fermentation and biocatalysis, as well as process optimization for advanced and specialty APIs, could enable Euroapi to capitalize on long-term secular trends toward complex biologics and green chemistry, supporting future revenue growth and potentially higher margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Euroapi is €2.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Euroapi's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €3.5, and the most bearish reporting a price target of just €2.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €829.9 million, earnings will come to €91.4 million, and it would be trading on a PE ratio of 3.1x, assuming you use a discount rate of 6.0%.

- Given the current share price of €2.97, the bearish analyst price target of €2.5 is 18.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Euroapi?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.