Key Takeaways

- Deglobalization, costlier inputs, and volatile raw material prices threaten supply chains, margins, and long-term earnings stability.

- Intensifying competition and stringent regulations risk project delays, eroding profitability despite a strong project pipeline and growth ambitions.

- Strategic focus on electrification, operational efficiencies, and value-added innovation positions Nexans for resilient earnings growth and industry leadership with flexibility for future investments.

Catalysts

About Nexans- Manufactures and sells cables in France, Canada, Norway, Germany, and internationally.

- Despite the current strong organic growth and record-high profitability, Nexans faces the risk that accelerating deglobalization and protectionist trade policies may disrupt its international supply chains, raise input costs, and restrict access to certain markets. This could undermine topline growth, create margin headwinds and ultimately erode net earnings in the medium to long term.

- Intensifying competition from Asian manufacturers with lower cost structures could trigger price wars and margin compression, especially in commoditized cable segments and as newly added capacity in global markets comes online. This structural profitability risk could reduce Nexans' EBITDA margins even if revenue holds steady.

- Increasing regulatory complexity and tightening environmental standards present a dual challenge: a rise in compliance costs and lengthier project approval timelines. While management touts a robust pipeline, the risk remains that project delays or cost overshoots will pressure incremental cash generation and slow earnings growth.

- High exposure to volatile raw material prices-particularly copper and aluminum, exacerbated by tariff uncertainty and limited hedging-threatens to compress gross margins and generate earnings volatility. Recent outperformances aided by favorable pricing and customer order acceleration may not recur, and adverse raw material swings could sharply cut into future profitability.

- Execution risk looms over Nexans' transformation into an electrification pure play. Should the company struggle to integrate acquisitions, optimize underperforming assets, or maintain pricing discipline as it chases sustainable growth, it could suffer from lost market share, stagnant revenue, and declining net margins in coming periods.

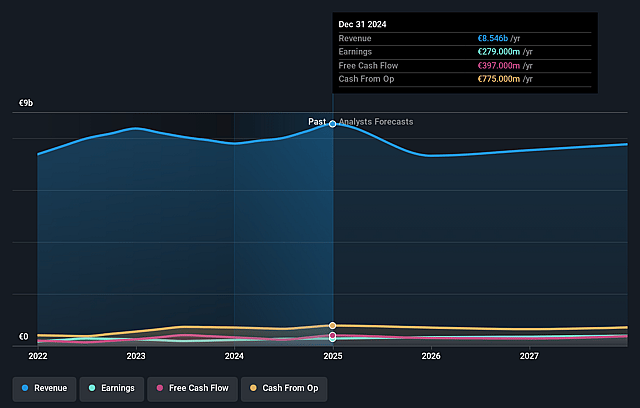

Nexans Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Nexans compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Nexans's revenue will decrease by 7.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 5.3% today to 4.7% in 3 years time.

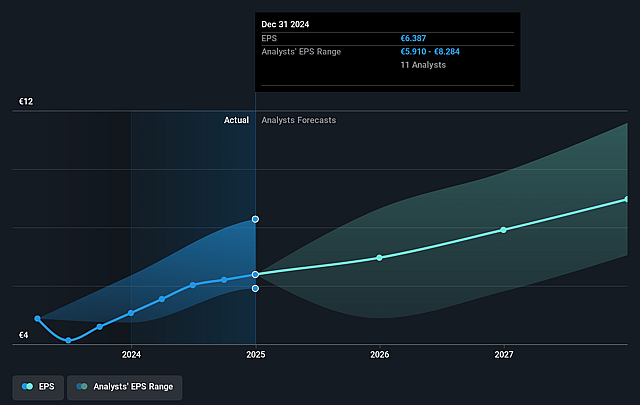

- The bearish analysts expect earnings to reach €331.9 million (and earnings per share of €7.4) by about September 2028, down from €477.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from 11.8x today. This future PE is greater than the current PE for the GB Electrical industry at 14.7x.

- Analysts expect the number of shares outstanding to decline by 1.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.21%, as per the Simply Wall St company report.

Nexans Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nexans' strategic transformation towards electrification pure play, supported by divestments, acquisitions, and capital discipline, is leading to consistently high organic growth, robust EBITDA margins near 12 percent, and record capital returns above 20 percent, providing fundamental support for long-term revenue and earnings growth.

- Global infrastructure and energy transition trends-including grid modernization, renewable energy integration, and electrification in key geographies-are resulting in strong, recurring demand, as evidenced by a growing order backlog (expected above 8 billion euros) and ongoing double-digit organic growth in power transmission, supporting visibility for future revenue and profit streams.

- Nexans' investments in operational efficiency, digitization, and advanced AI-driven pricing and demand management tools are structurally improving cost competitiveness and margin discipline across product lines and geographies, enabling further upside to net margins and EBITDA even in fluctuating market conditions.

- High liquidity (in excess of 2 billion euros in cash plus undrawn credit lines) combined with a net debt position close to zero enables Nexans to pursue high-value M&A, strategic investments, and shareholder returns, reducing financial risk and enhancing flexibility to drive long-term earnings growth.

- The successful rollout of value-added innovations (such as the Easy Joint system in grid accessories and AI-based transformation programs), in combination with premiumization and market share gains in growing regions, positions Nexans to further expand gross margins and strengthen earnings resilience over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Nexans is €100.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nexans's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €160.0, and the most bearish reporting a price target of just €100.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €7.0 billion, earnings will come to €331.9 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 9.2%.

- Given the current share price of €131.1, the bearish analyst price target of €100.0 is 31.1% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives