Key Takeaways

- Accelerated innovation in AI, digitalization, and premium product strategy is driving significant margin improvement and transformative long-term profitability for Nexans.

- Structural macro trends and strategic expansion into new markets position Nexans for unprecedented revenue growth, sustainable demand, and enhanced global market share.

- Intensifying competition, technological shifts, and structural liabilities threaten Nexans' margins, revenue stability, and financial flexibility amid uncertain demand and constrained market conditions.

Catalysts

About Nexans- Manufactures and sells cables in France, Canada, Norway, Germany, and internationally.

- Analyst consensus expects strong mid-single-digit organic growth in Electrification, but with Nexans' accelerating innovation in AI-driven operational efficiency, real-time dynamic pricing, and premium product rollout, sustained double-digit EBITDA margin expansion and a multi-year step-change in profitability look likely to outpace even the most optimistic forecasts, rapidly compounding net earnings.

- Analysts broadly agree that backlog growth underpins revenue visibility, but are underestimating the transformative effect of high-margin project wins such as the RTE frame agreement and Malta-Sicily interconnector, which lock in super-normal returns and position Nexans for visibility into record €8 billion-plus order backlogs, fundamentally de-risking long-term topline growth.

- Nexans' sector-leading reinvestment rate and robust €2.8 billion of liquidity, combined with a strategic pipeline of accretive M&A in high-growth grid and Connect assets or entry into untapped geographies such as Southeast Asia and the US, create a platform for exponential revenue growth and an uplift in global market share far beyond current expectations.

- Structural global electrification, renewable grid connection, and grid modernization trends-especially the urgent push for decarbonization and resilient energy networks-are entering a super-cycle, providing Nexans with guaranteed multi-year demand tailwinds, sustained order intake, and elevated pricing power, directly supporting both revenue and margin expansion.

- The integration of AI and digitalization (via the SHIFT program) marks an inflection point, with operational data utilization increasing from 5% to over 90%, enabling unprecedented cost reductions, predictive demand planning, and smart manufacturing-unlocking structurally lower SG&A and supply chain costs, thus driving step-changes in net margin and free cash flow generation.

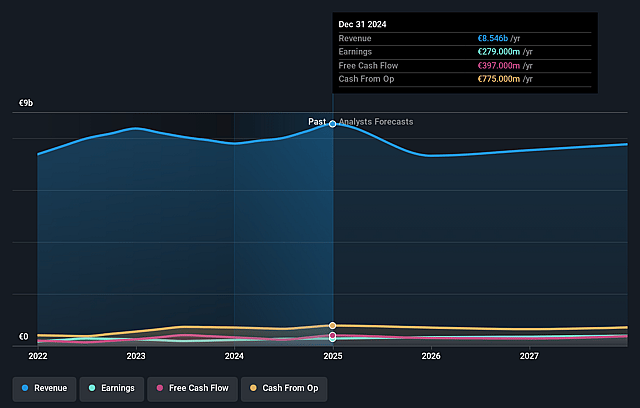

Nexans Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nexans compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nexans's revenue will decrease by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.3% today to 6.1% in 3 years time.

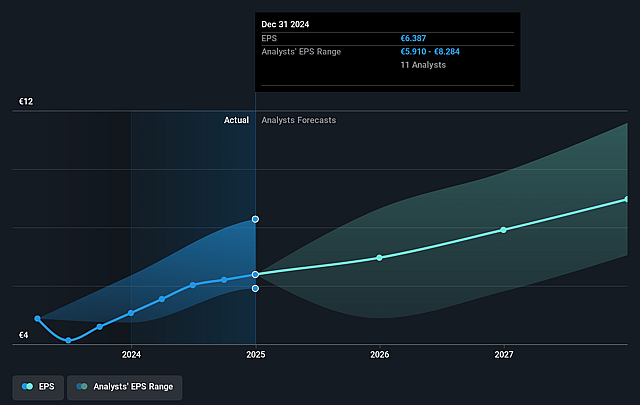

- The bullish analysts expect earnings to reach €475.3 million (and earnings per share of €10.68) by about September 2028, down from €477.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, up from 11.8x today. This future PE is greater than the current PE for the GB Electrical industry at 14.7x.

- Analysts expect the number of shares outstanding to decline by 1.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.21%, as per the Simply Wall St company report.

Nexans Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying global competition from lower-cost Asian manufacturers, combined with new capacity entering the renewable supply chain, is likely to apply sustained pricing pressure in Nexans' key cable markets, potentially eroding group net margins and constraining long-term profitability.

- The accelerating shift toward wireless and alternative transmission technologies in multiple sectors may steadily reduce demand for traditional copper cabling-Nexans' core business-threatening future revenue streams and shrinking the addressable market.

- Nexans' strategy relies heavily on lumpy, large-scale transmission and grid infrastructure projects; any disruption, delay, or reduction in infrastructure spending-exacerbated by long-term macroeconomic headwinds and demographic stagnation-could trigger volatile revenue and impair visibility over sustained top-line growth.

- Fluctuating raw material costs, especially for copper and aluminum, together with a historical difficulty in fully passing rising input prices to customers, could compress gross margins and negatively impact earnings, particularly if inflationary trends persist or intensify.

- Nexans retains sizeable legacy pension and environmental remediation liabilities concentrated in Europe, which may structurally compress free cash flow and limit its ability to flexibly invest in growth, shareholder returns, or defensive strategic pivots, ultimately impairing net profit and balance sheet resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nexans is €160.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nexans's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €160.0, and the most bearish reporting a price target of just €100.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €7.8 billion, earnings will come to €475.3 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 9.2%.

- Given the current share price of €131.1, the bullish analyst price target of €160.0 is 18.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives