Last Update 11 Sep 25

Fair value Increased 2.35%Analysts have raised Nexans’ price target to €133.79, citing strong order backlog growth, increased confidence in mid-term demand, and improved operational resilience.

Analyst Commentary

- Bullish analysts highlight Nexans' strong return to growth in order backlog as a driver for increased confidence.

- Improved visibility on medium-term supply and demand utilization, particularly post-2026, is supporting more optimistic outlooks.

- Raised price targets reflect increased optimism around Nexans’ ability to capture new projects and market share in the energy sector.

- Brokerages cite overall operational improvements and resilience within core segments as key reasons for their upward revisions.

- Persistent positive momentum in the company’s fundamentals and execution is contributing to sustained Buy ratings and higher price objectives.

What's in the News

- Nexans announced a partnership with Crowley Wind Services to develop and operate a Jones Act compliant U.S.-flagged cable lay barge, supporting subsea transmission line installation for offshore wind energy and other industrial uses.

- The 300-foot barge, built in Louisiana, features advanced positioning systems and a large-capacity carousel for cable lay and burial, currently supporting Equinor's Empire Wind offshore wind farm, with flexibility for other subsea projects.

- Nexans announced the upcoming departure of Chief Financial Officer Jean-Christophe Juillard and has initiated a search for a high-profile successor, emphasizing its commitment to strong financial governance and strategic growth.

Valuation Changes

Summary of Valuation Changes for Nexans

- The Consensus Analyst Price Target has risen slightly from €130.71 to €133.79.

- The Consensus Revenue Growth forecasts for Nexans has fallen slightly from -5.0% per annum to -5.2% per annum.

- The Net Profit Margin for Nexans remained effectively unchanged, moving only marginally from 5.56% to 5.65%.

Key Takeaways

- Strategic focus on electrification and high-value grid solutions, supported by infrastructure investments and digitalization trends, drives long-term growth and margin improvement opportunities.

- Robust financial position and innovation in AI and sustainable cables enhance operational efficiency, enabling flexible investment and supporting future earnings expansion.

- Margin pressure, revenue volatility, and rising compliance risks threaten profitability as Nexans navigates intense competition, volatile costs, integration challenges, and industry shifts toward innovative, sustainable solutions.

Catalysts

About Nexans- Manufactures and sells cables in France, Canada, Norway, Germany, and internationally.

- The ongoing acceleration of global electrification, renewable energy adoption, grid modernization, and significant investments in infrastructure (especially in Europe and emerging markets) continue to drive strong organic growth in Nexans' Electrification, Power Grid, and Transmission segments, supporting a robust order backlog and increased revenue visibility for coming years.

- Nexans' strategic transformation into a near pure-play electrification company, combined with sustained focus on high-value-grid, offshore wind, and specialty cabling solutions, positions the company to benefit from expanding high-margin market opportunities and structurally improve group net margins.

- Heavy investments in innovation-particularly through the adoption of artificial intelligence for dynamic pricing, predictive demand planning, and operational optimization-are expected to enhance cost efficiency and further boost net margins over time through reduced cost leakage and improved resource allocation.

- The rapid expansion of data centers and digital infrastructure (aided by urbanization and rising global data consumption) is driving ongoing demand for advanced power and connectivity solutions, providing long-term growth opportunities for Nexans' Grid and Connect businesses and supporting revenue growth.

- A strengthened balance sheet with near-zero net debt, strong free cash flow, and substantial liquidity creates flexibility for M&A, investments in green/recyclable cable production, and innovation, all of which support long-term earnings growth and higher return on capital employed.

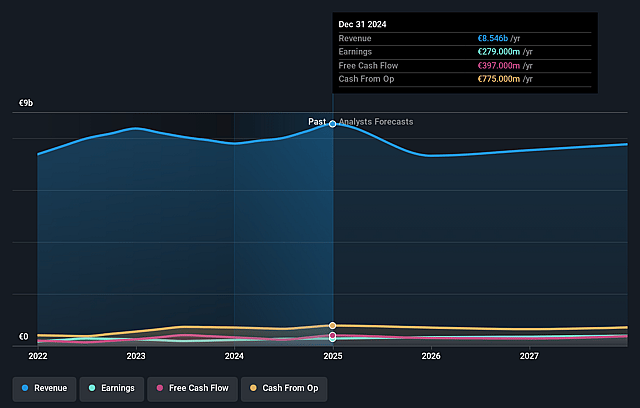

Nexans Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nexans's revenue will decrease by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 5.0% in 3 years time.

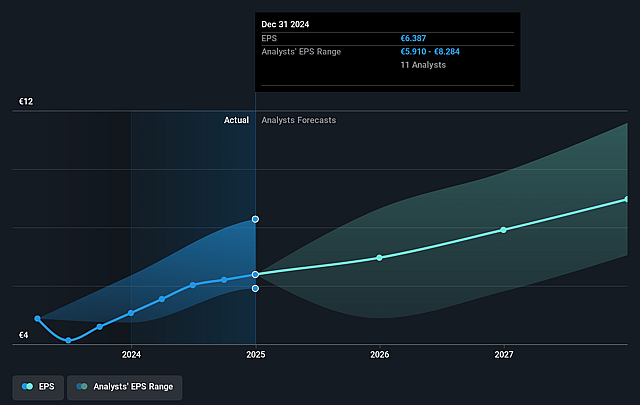

- Analysts expect earnings to reach €386.6 million (and earnings per share of €9.03) by about July 2028, up from €279.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €507 million in earnings, and the most bearish expecting €341 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, down from 20.1x today. This future PE is lower than the current PE for the GB Electrical industry at 17.6x.

- Analysts expect the number of shares outstanding to decline by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.02%, as per the Simply Wall St company report.

Nexans Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened competition and increasing industry capacity, particularly from renewable OEMs and established players, could pressure margins in Nexans' core Grid and Connect businesses, potentially eroding profitability despite recent structural improvements.

- Nexans' reliance on large M&A for growth and portfolio optimization introduces integration risks and possible short-term margin dilution, as seen with La Triveneta Cavi, which may weigh on group EBITDA and net margins before synergies materialize.

- Exposure to cyclical end-markets such as construction, automotive, and major infrastructure projects means Nexans could see pronounced revenue and earnings volatility if macroeconomic downturns, geopolitical instability, or project delays materially impact demand.

- Raw material price volatility (especially in copper and aluminum), in part driven by protectionist tariffs and geopolitical risks, remains a risk to Nexans' cost base; failure to pass these costs on to customers could compress net margins.

- Accelerating adoption of advanced (potentially wireless) power transmission technologies, stricter environmental regulations, and evolving customer preferences for innovative, integrated solutions may impose additional R&D and compliance costs, creating long-term headwinds for traditional cabling revenues and earnings if Nexans lags in adaptation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €117.714 for Nexans based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €136.0, and the most bearish reporting a price target of just €91.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €7.7 billion, earnings will come to €386.6 million, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 9.0%.

- Given the current share price of €127.9, the analyst price target of €117.71 is 8.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives