Last Update 11 Dec 25

Fair value Decreased 0.69%RNO: Negative Stub Pricing Will Reward Execution Amid EV Transition Costs

Analysts have modestly lowered their price target on Renault to EUR 36, trimming fair value from about EUR 46.00 to roughly EUR 45.68. They cite a balance between slightly improved growth expectations and pressures from Chinese competition, electric vehicle transition costs, and regulatory headwinds in Europe.

Analyst Commentary

Analyst views on Renault remain balanced, with valuation support tempered by structural and competitive risks across the European auto sector.

Bullish Takeaways

- Bullish analysts highlight that Renault trades at a discount, with its industrial business implied to have a negative stub valuation, suggesting the market is overly pessimistic relative to underlying assets and cash generation potential.

- They argue that current pricing embeds a worst case scenario on Chinese competition and electric vehicle execution, leaving scope for upside if Renault delivers on cost efficiency and maintains product pricing discipline.

- Improved visibility on electric vehicle programs and platform sharing could support margins over the medium term, helping narrow the valuation gap versus premium peers once near term transition costs normalize.

- Analysts see potential for multiple expansion if Renault demonstrates consistent free cash flow delivery and clearer capital allocation, including debt reduction and disciplined investment in EV and software capabilities.

Bearish Takeaways

- Bearish analysts remain cautious on execution risk in a period described as tumultuous for European automakers, with Renault needing to fund its electric transition while navigating softening demand and shifting consumer preferences.

- They flag intensifying competition from Chinese manufacturers in both EV and lower cost segments, which could pressure pricing power, market share and ultimately returns on invested capital.

- Regulatory and policy uncertainty in the European Union around emissions, tariffs and trade flows introduces additional volatility to earnings, potentially limiting near term visibility and justifying a more conservative valuation approach.

- Currency moves and input cost inflation are seen as ongoing headwinds that could erode margin recovery, making it harder for Renault to close the profitability and valuation gap with better positioned premium OEMs.

What's in the News

- Renault has ended its joint project with Valeo to develop a rare earth free EV motor and is now seeking a cheaper Chinese supplier for future electric powertrains (Reuters).

- Renault is considering cutting up to 3,000 jobs worldwide, mainly in support functions such as HR, finance and marketing, as it looks to simplify operations and reduce fixed costs in a highly competitive market (Bloomberg).

- European automakers including Renault are facing severe semiconductor shortages that risk halting production lines despite China lifting certain export restrictions, highlighting ongoing supply chain fragility in the sector (Financial Times).

- Renault is exploring ways to support France's defense efforts, with any potential contribution to be led by the defense ministry and carried out alongside domestic defense companies, though no final decision has been made (Bloomberg).

Valuation Changes

- Fair Value: reduced slightly from €46.00 to approximately €45.68, reflecting a marginal downgrade in the base case valuation.

- Discount Rate: unchanged at 12.3 percent, indicating no revision to the perceived risk profile or cost of capital.

- Revenue Growth: nudged up slightly from about 2.36 percent to roughly 2.40 percent, signaling a modest improvement in top line expectations.

- Net Profit Margin: edged down slightly from around 3.97 percent to about 3.91 percent, pointing to a small deterioration in projected profitability.

- Future P/E: increased marginally from 7.39x to about 7.44x, suggesting a modestly higher valuation multiple on forward earnings.

Key Takeaways

- Strategic brand realignment and product innovation drive Renault's competitiveness in the EV and hybrid market, potentially boosting revenue and improving net margins.

- Operational efficiency, strategic partnerships, and model expansions aim to enhance market penetration and financial health through cost synergies and increased market reach.

- Renault faces revenue unpredictability from volatile markets, regulatory cost pressures on margins, and strategic risks from joint ventures and negative associate contributions.

Catalysts

About Renault- Engages in the design, manufacture, sale, repair, maintenance, and leasing of motor vehicles in Europe, Eurasia, Africa, the Middle East, the Asia Pacific, and the Americas.

- Renault is leveraging its brand realignment and product innovation to capture market share in the EV and hybrid market, with a focus on making these vehicles more affordable and appealing to consumers. This strategy is expected to boost revenue and potentially improve net margins through enhanced product mix.

- The significant reduction in development time and costs due to the Ampere initiative allows Renault to bring competitive EVs to market more rapidly. This operational efficiency should contribute positively to earnings by decreasing production costs while maintaining high product quality.

- Renault's strategic partnerships, such as those with Geely and Aramco, are designed to enhance scale and competitiveness, particularly in regions where Renault seeks greater market penetration. These alliances are expected to enhance earnings through cost synergies and expanded market reach.

- The introduction of new models, such as the Renault 5 and Twingo, and the expansion into segments like C-segment SUVs and smaller urban vehicles are positioned to tap into unmet consumer demand, which should drive revenue growth.

- Renault is positioning itself for operational agility in a volatile market, with plans for cost reductions and productivity enhancements, such as shrinking fixed costs in collaboration with partners. This will likely support net margins and bolster free cash flow, ensuring robust financial health.

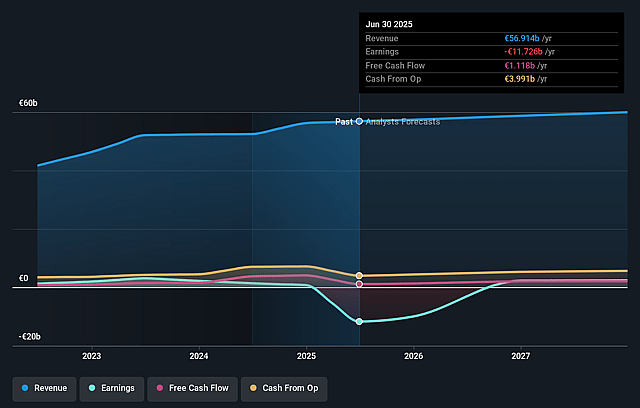

Renault Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Renault's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -20.6% today to 4.1% in 3 years time.

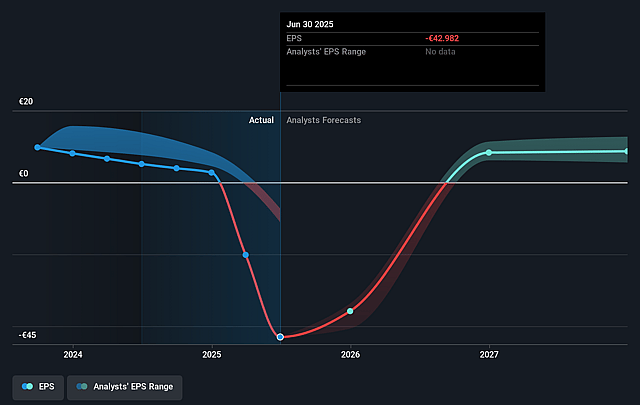

- Analysts expect earnings to reach €2.5 billion (and earnings per share of €8.92) by about September 2028, up from €-11.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €3.5 billion in earnings, and the most bearish expecting €1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.4x on those 2028 earnings, up from -0.7x today. This future PE is lower than the current PE for the GB Auto industry at 9.4x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.1%, as per the Simply Wall St company report.

Renault Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Renault's reliance on volatile markets such as Argentina and Turkey, with negative currency impacts from the Argentinian peso and Turkish lira devaluations, could affect revenue unpredictably, impacting the company's financial results.

- The company's need to incentivize EV sales to meet the strict CAFE (Corporate Average Fuel Economy) regulations in 2025 may lead to lower profit margins due to potential price cuts, thereby impacting net margins.

- Renault's joint ventures and partnerships, especially the reliance on Geely for certain platforms, may expose it to strategic risks, including integration challenges and potential for disagreements, which could affect earnings.

- The necessity to meet stringent regulatory requirements like CAFE within a short timeline could lead to increased costs, affecting Renault's ability to maintain robust net margins.

- Negative contributions from associated companies, like Nissan, and impairments, such as those on Nissan shares, might continue to impact Renault's net earnings if this does not stabilize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €47.333 for Renault based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €63.7, and the most bearish reporting a price target of just €38.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €59.9 billion, earnings will come to €2.5 billion, and it would be trading on a PE ratio of 7.4x, assuming you use a discount rate of 12.1%.

- Given the current share price of €32.56, the analyst price target of €47.33 is 31.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Renault?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.