Key Takeaways

- Expansion into digital platforms and connected wellness services is set to generate high-margin, recurring revenues while enhancing overall earnings quality.

- Strategic US growth, flexible operations, and rising commercial B2B demand position the company for accelerated and diversified revenue expansion.

- Urbanization, regulatory changes, overreliance on North America, rising competition, and lack of digital revenue streams threaten Harvia's long-term growth, margins, and market position.

Catalysts

About Harvia Oyj- Operates in the sauna industry.

- Analyst consensus recognizes Harvia's US growth opportunity as sauna adoption rises, but with Harvia's market share still below 10% and penetration only 1 sauna per 350 people, a rapid mainstreaming of home wellness in the US could drive revenue growth far ahead of current expectations, especially as urbanization and high disposable incomes in key regions accelerate adoption.

- While analysts broadly expect the ThermaSol integration to lift margins and cross-selling, management is already ahead of their synergy schedule and is now positioning ThermaSol's digital and IoT platform as the backbone for new high-margin software and service recurring revenues, potentially driving a structural step-change in group net margins.

- Harvia is on the cusp of expanding beyond hardware sales, with a rising installed base of connected saunas and smart controls enabling scalable wellness software, digital content, and service subscriptions, which could introduce high-margin recurring revenue streams and meaningfully enhance earnings quality over time.

- With the global shift towards preventive health, the aging population in developed markets, and a strong wellness tourism recovery, Harvia stands to benefit from powerful new B2B commercial demand surges for spas, hotels, and real estate installations, driving broader volume growth and more diversified long-term revenue streams than currently assumed by the market.

- The company's flexible manufacturing footprint, strategic local inventory builds in Asia-Pacific and the US, and nimble operational investments create significant optionality: Harvia is positioned to increase production in key regions in response to demand spikes or trade shifts, supporting resilient margins and the ability to rapidly capture market share, which will directly feed into top-line and bottom-line growth.

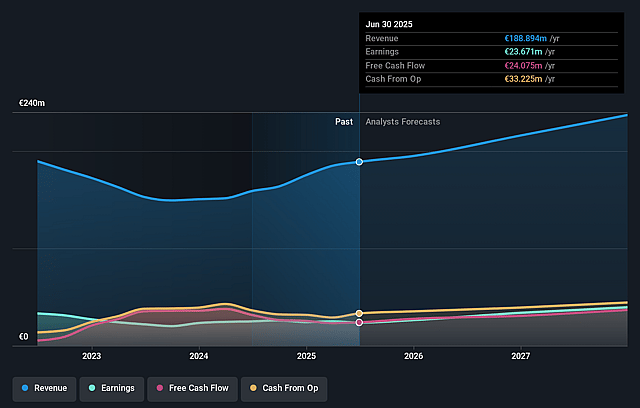

Harvia Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Harvia Oyj compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Harvia Oyj's revenue will grow by 11.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.6% today to 18.1% in 3 years time.

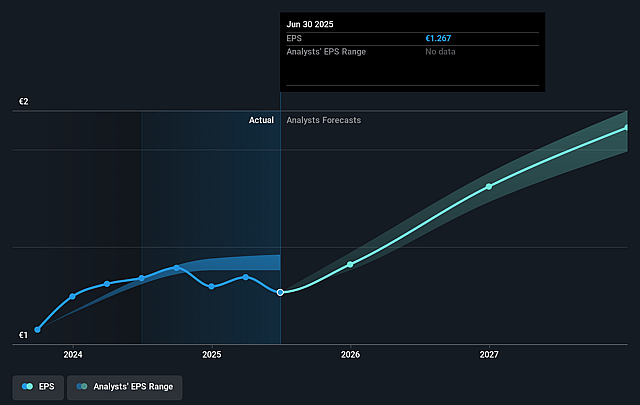

- The bullish analysts expect earnings to reach €46.6 million (and earnings per share of €2.49) by about July 2028, up from €25.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, down from 37.5x today. This future PE is lower than the current PE for the FI Leisure industry at 37.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.76%, as per the Simply Wall St company report.

Harvia Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demand for Harvia's traditional sauna offerings could structurally decline over time as urbanization reduces available living space in major markets like Europe and Asia, constraining the company's revenue growth trajectory.

- Increasing focus on sustainability and decarbonization, coupled with stricter energy regulations on electric and wood-burning saunas, may lead to higher compliance costs and shrinking demand, potentially compressing net margins and reducing overall earnings.

- Harvia's heavy reliance on North America for growth exposes it to heightened risk from region-specific economic downturns or cyclical declines in US consumer confidence and discretionary spending, which can negatively affect revenue and profitability.

- The sauna and wellness industry is facing intensifying competition from low-cost Asian and Eastern European manufacturers, raising the risk of industry-wide price pressure and margin erosion, which could hurt Harvia's earnings and market share over the long term.

- Despite efforts to innovate, a significant portion of Harvia's business remains tied to equipment and replacement sales in mature markets; failure to build meaningful digital or recurring revenue streams exposes its long-term earnings to stagnation as demand for high-ticket non-essential home upgrades weakens in economic slowdowns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Harvia Oyj is €56.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Harvia Oyj's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €56.0, and the most bearish reporting a price target of just €41.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €257.6 million, earnings will come to €46.6 million, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 5.8%.

- Given the current share price of €50.4, the bullish analyst price target of €56.0 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.