Key Takeaways

- Heavy reliance on discretionary spending and shifting European demographics pose significant risks to future growth and demand stability.

- Environmental regulations, rising competition, and supply chain volatility threaten margins, profitability, and predictable cash flow.

- Expansion fueled by wellness trends, innovation, digitalization, and premium products, with strong financial flexibility and strategic acquisitions supporting sustained global growth and shareholder returns.

Catalysts

About Harvia Oyj- Operates in the sauna industry.

- Despite recent strong growth, Harvia Oyj's heavy dependence on high-end consumer discretionary spending in North America leaves the company vulnerable to declining consumer confidence and rising living costs, which could sharply erode revenue growth in future downturns as luxury wellness installations become less accessible.

- The aging population and shrinking household sizes in Europe threaten long-term demand for large leisure products such as home saunas, raising the risk that Harvia's European revenues will stagnate or decline, undermining its growth narrative and potentially leading to operational overcapacity.

- Increasingly stringent environmental regulations and carbon-neutrality mandates across major markets are expected to raise production and installation costs for energy-intensive sauna solutions, compressing net margins as Harvia faces both higher operating expenses and potentially waning demand from eco-conscious buyers.

- Intensifying competition from lower-cost manufacturers and emerging technology players, especially as the wellness sector becomes a mainstream target for global brands, is likely to force Harvia into price reductions or increased promotional and development expenses, eroding both market share and operating profit margins over time.

- Persistent supply chain volatility and raw material cost spikes, coupled with ongoing geopolitical instability and tariff risks, could lead to unpredictable swings in production costs and working capital needs, ultimately creating volatile free cash flow and compromising Harvia's ability to deliver consistent earnings and dividend growth.

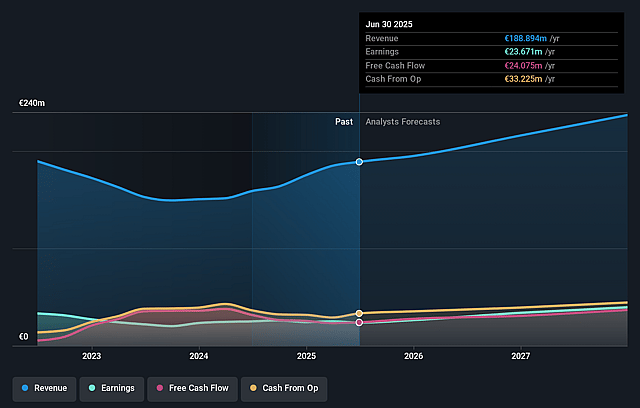

Harvia Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Harvia Oyj compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Harvia Oyj's revenue will grow by 10.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 13.6% today to 18.1% in 3 years time.

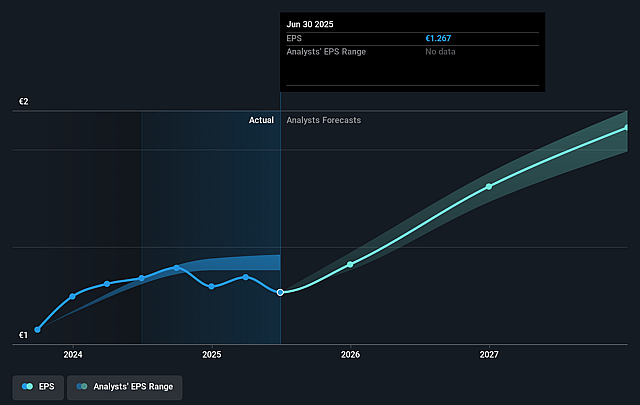

- The bearish analysts expect earnings to reach €45.1 million (and earnings per share of €2.41) by about July 2028, up from €25.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.4x on those 2028 earnings, down from 37.8x today. This future PE is lower than the current PE for the FI Leisure industry at 37.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.81%, as per the Simply Wall St company report.

Harvia Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong long-term secular growth trends such as health and wellness awareness and increasing demand for personal wellness solutions are fueling Harvia's expansion in both mature and emerging markets, underlining ample future revenue opportunities.

- The company is experiencing sustained double-digit growth in North America, and sauna penetration remains very low relative to potential, indicating a significant untapped addressable market and providing a runway for ongoing top-line increases.

- Strategic acquisitions like ThermaSol have enabled new product category growth, accelerated expansion in premium segments, and are delivering ahead-of-schedule cost synergies, directly supporting improvements in margins and profitability.

- Investments in production, digitalization, and product innovation-including eco-friendly solutions like solar-powered electric saunas and connected, software-enabled platforms-position Harvia to both increase average sales value and develop recurring digital revenue streams, bolstering future earnings and cash flows.

- Harvia's high gross margin business model, operational leverage through scale, and a healthy capital structure with low leverage and strong cash conversion give the company substantial financial flexibility to pursue further acquisitions, growth investments, and dividend increases, supporting long-term shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Harvia Oyj is €41.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Harvia Oyj's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €56.0, and the most bearish reporting a price target of just €41.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €249.4 million, earnings will come to €45.1 million, and it would be trading on a PE ratio of 19.4x, assuming you use a discount rate of 5.8%.

- Given the current share price of €50.8, the bearish analyst price target of €41.0 is 23.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.