Key Takeaways

- Expansion into emerging markets and investments in infrastructure are diversifying revenue sources and positioning Harvia to capture demand from global wellness trends.

- Innovation in smart, energy-efficient wellness products and strategic partnerships support margin growth and premiumization, while aftermarket sales improve earnings predictability.

- Heavy reliance on stagnant core markets, limited product diversification, and mounting competition threaten margins and long-term growth, especially amid rising costs and shrinking urban demand.

Catalysts

About Harvia Oyj- Operates in the sauna industry.

- Harvia's forward investments in capacity, IT infrastructure, and logistics-especially in the US-are enabling the company to capture future demand driven by the growing consumer focus on health and wellness globally, which is expected to expand the overall customer base and drive sustained revenue growth.

- Rapid expansion and robust double-digit growth in APAC, Middle East, and Africa, combined with a focused strategy to increase presence in developing regions with rising disposable incomes and urbanization, position Harvia to benefit from new adoption of lifestyle amenities and diversify revenues beyond mature European markets.

- The strong innovation pipeline-including product launches around smart controls, energy efficiency, and a recent partnership with Toyota for hydrogen-based sauna heaters-provides levers for premiumization and margin expansion, while catering to evolving customer preferences for wellness and sustainability, supporting higher gross margins and ASPs.

- Ongoing replacement cycles as consumers who purchased or upgraded during the pandemic near the typical 5–7-year renewal window, coupled with industry trends toward upgraded energy-efficient products, underpins expectations for higher aftermarket and recurring sales, providing visibility for future revenue and improving earnings stability.

- Harvia's increasing operational leverage-from scale advantages in manufacturing, localized production in key markets, and enhanced D2C efforts-is likely to drive net margin improvement and earnings growth as top-line sales recover and expand through both organic means and selective M&A, particularly in faster-growing regions and product segments.

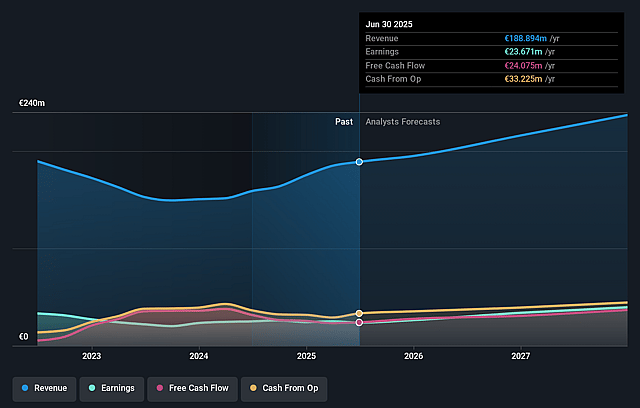

Harvia Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Harvia Oyj's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.5% today to 17.2% in 3 years time.

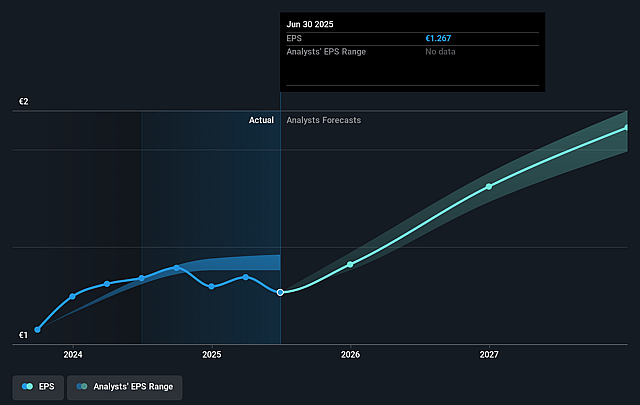

- Analysts expect earnings to reach €42.3 million (and earnings per share of €2.27) by about August 2028, up from €23.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, down from 30.5x today. This future PE is lower than the current PE for the FI Leisure industry at 31.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.06%, as per the Simply Wall St company report.

Harvia Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sluggish or flat growth in key European markets, especially Northern Europe and Continental Europe, which have shown little to no organic growth for several years, could signal saturation and long-term stagnation in Harvia's core addressable market, directly affecting revenue growth and limiting long-term earnings potential.

- Increasing competition in key segments, particularly in North America where market leaders note competition is heating up and many players are targeting Harvia's growth markets, may drive pricing pressure, erode market share, and force margin compression, negatively impacting net margins and profitability over time.

- High reliance on sauna heating equipment for over 50% of revenue and limited meaningful product diversification beyond sauna/spa solutions exposes Harvia to risk from shifting consumer wellness trends and alternative modalities, potentially stagnating revenue growth if industry preferences change.

- Ongoing urbanization and shrinking living spaces in core markets could limit the practicality of at-home sauna installations, gradually shrinking Harvia's potential customer base in urban demographics and reducing organic sales opportunities, particularly in mature markets.

- Persistent cost increases in areas such as personnel, inventory, and raw materials-combined with only limited demonstrated ability to fully offset inflationary and FX pressures through pricing-could constrain operating leverage and squeeze net margins if not managed carefully, with a pronounced impact already visible in periods with subdued sales growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €43.75 for Harvia Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €52.0, and the most bearish reporting a price target of just €41.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €246.0 million, earnings will come to €42.3 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 6.1%.

- Given the current share price of €38.65, the analyst price target of €43.75 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.