Catalysts

About Iberdrola

Iberdrola is a global utility focused on regulated electricity networks and large scale renewable generation, including onshore and offshore wind, hydro and storage.

What are the underlying business or industry changes driving this perspective?

- Accelerating grid investment needs in the U.S., U.K. and Brazil risk colliding with tighter regulatory returns and draft determinations that may not fully remunerate higher capex and operating complexity. This would compress returns on the growing regulated asset base and slow net profit growth.

- Heavy capital allocation to offshore wind projects under construction in the U.K., U.S., Germany and France exposes Iberdrola to potential delays, cost overruns and auction budget constraints. These factors could erode project economics and weigh on future EBITDA and earnings despite the current build out momentum.

- Rapid electrification from data centers and new industrial demand in the U.S. could outpace timely network upgrades and renewable additions, leading to congestion, curtailment and reliance on higher cost generation. This would pressure margins in both Networks and Renewables rather than delivering the smooth revenue uplift implied by current valuations.

- Growing dependence on asset rotation, partnerships and capital increases to fund a record multi year capex plan heightens execution and refinancing risk. Any slowdown in disposals or partner appetite would force higher leverage or reduced investments, constraining future cash flow growth and dividend expansion.

- Rising system stability requirements and ancillary service costs in Iberia following recent blackouts highlight structural challenges of integrating variable renewables at scale. If cost pass throughs lag contractual commitments, this could structurally drag on net margins in the Renewables and Customers business even as volumes grow.

Assumptions

This narrative explores a more pessimistic perspective on Iberdrola compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

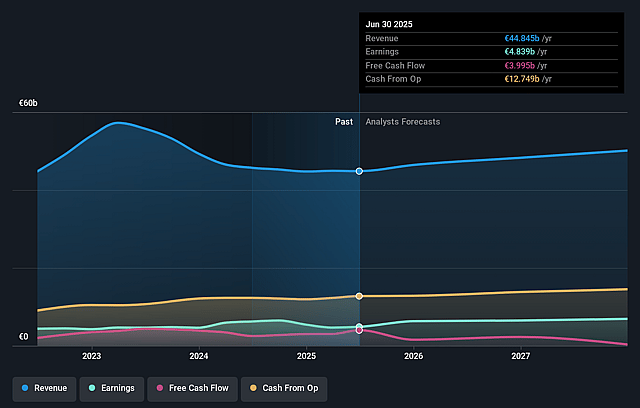

- The bearish analysts are assuming Iberdrola's revenue will grow by 1.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.5% today to 15.3% in 3 years time.

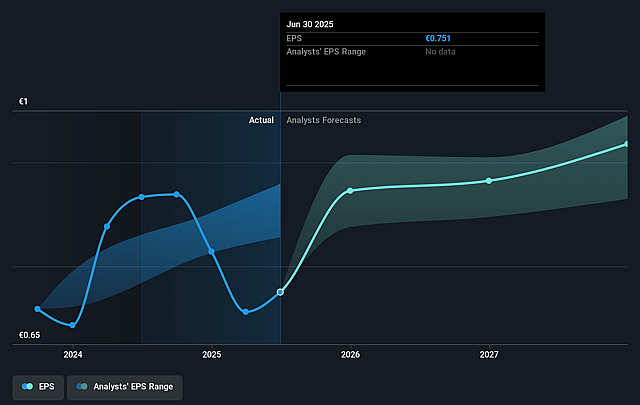

- The bearish analysts expect earnings to reach €7.3 billion (and earnings per share of €1.08) by about December 2028, up from €5.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, down from 22.1x today. This future PE is greater than the current PE for the GB Electric Utilities industry at 15.2x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Networks now drive most of Iberdrola's EBITDA, with a 26% increase supported by a 12% rise in the regulated asset base and tariff increases of around 10% in the United States and 8% in Brazil. If this regulated growth trajectory continues under supportive frameworks, it could sustain higher revenue and earnings than implied by a bearish view.

- A record EUR 9 billion of investment in 9 months, 5,500 megawatts under construction and a further 8,500 megawatts of advanced pipeline, including high visibility offshore projects like Vineyard Wind, East Anglia and Baltic Eagle, position Iberdrola to capture long term electrification demand. This could structurally lift revenue and operating margins.

- Strong balance sheet trends, including a 10% increase in operating cash flow to EUR 9,752 million, EUR 8 billion of asset rotation and partnerships, a EUR 3.2 billion reduction in net debt and leverage already below three times EBITDA, may reduce financial risk and funding costs. This could support resilient net profit growth.

- Growing demand from data centers and industry, particularly in the United States where power prices are rising and 30% of the fleet is merchant, creates an opportunity to reprice PPAs at higher levels and expand a 10,000 megawatt portfolio. This could drive stronger long term revenue and earnings than expected.

- Management is guiding to double digit adjusted net profit growth to around EUR 6.6 billion in 2025, already EUR 1 billion above the previous 2026 target, and is backing this with an 8.2% increase in interim dividend. If delivered, this would indicate a sustained positive earnings and cash flow trajectory inconsistent with a prolonged share price decline.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Iberdrola is €12.36, which represents up to two standard deviations below the consensus price target of €17.32. This valuation is based on what can be assumed as the expectations of Iberdrola's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.5, and the most bearish reporting a price target of just €9.7.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be €47.5 billion, earnings will come to €7.3 billion, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of €17.88, the analyst price target of €12.36 is 44.6% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Iberdrola?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.