Last Update11 Sep 25Fair value Increased 1.61%

MERLIN Properties SOCIMI’s marginally increased price target reflects slightly improved revenue growth forecasts and a modest uptick in future P/E expectations, resulting in a new consensus fair value of €14.34.

What's in the News

- Held an Analyst/Investor Day.

Valuation Changes

Summary of Valuation Changes for MERLIN Properties SOCIMI

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from €14.11 to €14.34.

- The Consensus Revenue Growth forecasts for MERLIN Properties SOCIMI has risen slightly from 11.2% per annum to 11.7% per annum.

- The Future P/E for MERLIN Properties SOCIMI has risen slightly from 12.05x to 12.47x.

Key Takeaways

- Expansion into data centers and logistics, alongside disciplined asset rotation, is set to drive revenue diversification, portfolio quality, and sustained rental growth.

- Strong financial management and favorable office market dynamics support high occupancy, stable margins, and resilience against market or credit volatility.

- Heavy reliance on office assets amid changing work trends, capital-intensive data center expansion, and regulatory pressures heighten operational risks and limit near-term earnings growth.

Catalysts

About MERLIN Properties SOCIMI- We are the leading real estate company on the Iberian Peninsula, listed on both the Spanish (IBEX-35) and Portuguese stock exchanges.

- The rapid expansion and commercialization of data centers-fuelled by exponential demand for digital infrastructure and supported by the company's early-mover advantage (e.g., EU giga-factory competition)-is set to significantly diversify revenue streams and drive robust rental income growth and value appreciation starting from 2027, when data center income will materially ramp up.

- Tight supply and shrinking high-quality office stock, especially in Madrid due to residential conversions and limited new development, is supporting strong occupancy and rising rent levels for prime assets within the portfolio-sustaining high occupancy rates and underpinning rental growth and net margin expansion over the medium term.

- Persistent growth in e-commerce and logistics activity across Spain and Portugal continues to drive robust demand for modern logistics assets, resulting in consistently high occupancy, record pre-letting levels, and above-market yields on new developments, which in turn are boosting overall revenue and maintaining premium EBITDA margins.

- The company's disciplined asset rotation strategy, with the sale of non-core and lower-yield assets and reinvestment into premium offices, logistics, and digital infrastructure, is improving portfolio quality, enhancing gross asset value, and supporting both short

- and long-term increases in net margins.

- Strong financial management-underscored by low loan-to-value ratios, fully fixed-rate debt, no major maturities until late 2026, and abundant liquidity-positions the company to capitalize on growth opportunities, mitigate refinancing risk, and support stable long-term earnings accretion even in more volatile credit environments.

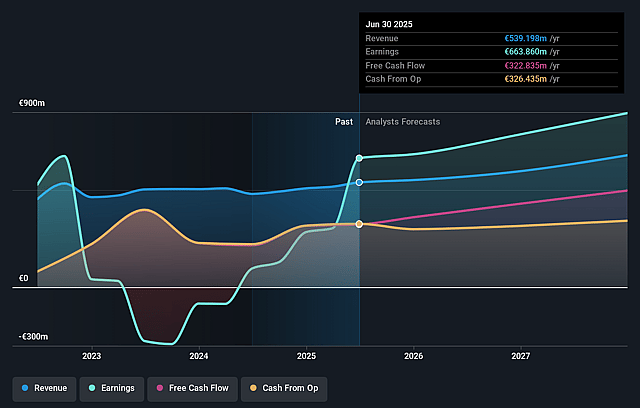

MERLIN Properties SOCIMI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MERLIN Properties SOCIMI's revenue will grow by 11.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 123.1% today to 91.7% in 3 years time.

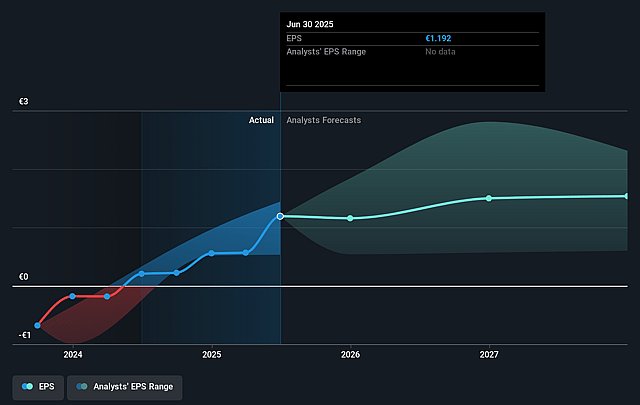

- Analysts expect earnings to reach €679.4 million (and earnings per share of €1.12) by about September 2028, up from €663.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €1.7 billion in earnings, and the most bearish expecting €339 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.0x on those 2028 earnings, up from 10.5x today. This future PE is lower than the current PE for the GB REITs industry at 28.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.67%, as per the Simply Wall St company report.

MERLIN Properties SOCIMI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy concentration in office assets (58% of portfolio) exposes MERLIN to ongoing structural risks from secular shifts toward remote/hybrid work, continued oversupply in cities like Barcelona, and potential tenant departures, which could lead to lower occupancy, weaker rent growth, and pressure on future revenue and net margins.

- Data center expansion is capital-intensive, reliant on significant (and rising) CapEx and additional external debt funding over the coming years; any inability to secure funding at favorable rates, or commercialize new capacity on schedule, risks delaying or reducing anticipated contributions to earnings and return on invested capital.

- Flattish forecast for FFO per share in 2026 reflects limited organic earnings growth ahead of full ramp-up from new development, while ongoing disposals of core income-producing assets to fund projects may temporarily suppress rental income and cash flow per share, impacting net margins in the near term.

- Appraised asset values and reported NAV are sensitive to continued high discount/cap rates (9–11%) and the pace of value recognition for data centers remains back-ended until stabilization, so any future shift in valuation methodology, market sentiment, or property sector yields could negatively affect reported asset values and balance sheet strength.

- Further increases in regulations or ESG retrofitting requirements (especially across retail and office portfolios), as well as intensifying competition in logistics and digital infrastructure, may drive higher operating/capex costs and challenge MERLIN's ability to maintain competitive rental yields and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €14.111 for MERLIN Properties SOCIMI based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.5, and the most bearish reporting a price target of just €12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €741.2 million, earnings will come to €679.4 million, and it would be trading on a PE ratio of 12.0x, assuming you use a discount rate of 8.7%.

- Given the current share price of €12.43, the analyst price target of €14.11 is 11.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives