Narratives are currently in beta

Key Takeaways

- Focus on high-margin, lower-emission projects and strategic CapEx management could enhance cash flows, margins, and net earnings.

- Expanding retail power and gas customer base through digital initiatives and renewable project progress may boost revenue and balance sheet health.

- Weaker refining margins, geopolitical risks, and increased net debt may hinder Repsol's profitability, revenue growth, and financial stability.

Catalysts

About Repsol- Operates as a multi-e energy company worldwide.

- Repsol plans to focus on selected high-margin and lower-emission projects in its upstream portfolio, including new production coming online from the U.S., Alaska, and Brazil, which could enhance cash flows and margins.

- The company is strategically managing CapEx through asset disposals and efficiency improvements, suggesting better capital allocation and potential positive impact on net earnings.

- The anticipated recovery in refining margins due to seasonal demand, LNG price effects, and reduced European imports, alongside efforts to handle VAT fraud, may boost future revenue and operating margins in refining.

- Growth in the retail power and gas customer base, driven by digital platforms like the Waylet app, is expected to contribute positively to revenue growth through increased transactions and customer engagement.

- Progress in renewable projects and asset rotation, particularly in the U.S. and Spain, supports Repsol's strategy to enhance future net cash flows and balance sheet health through expected divestments and optimized asset utilization.

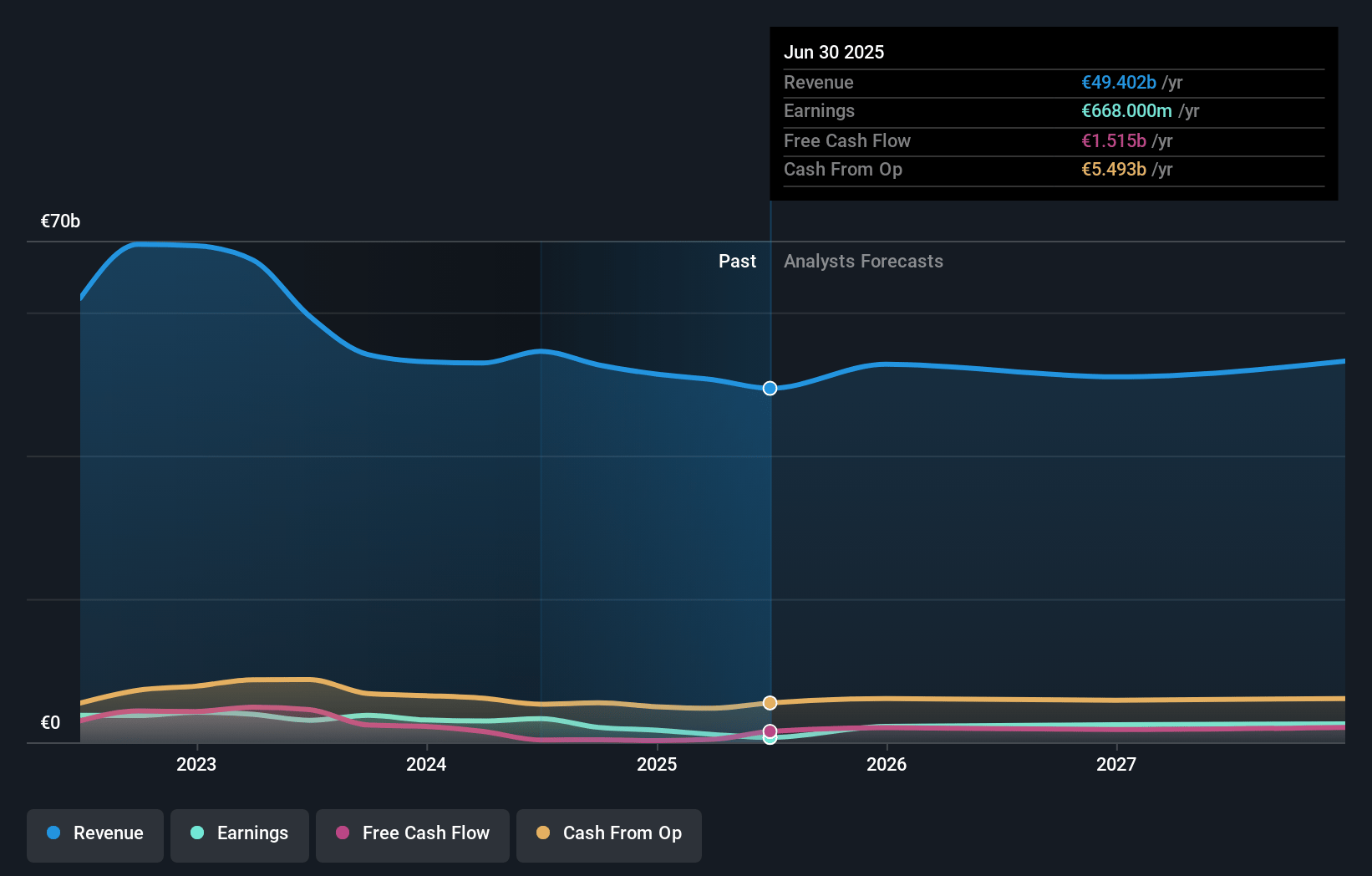

Repsol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Repsol's revenue will decrease by -1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.0% today to 5.3% in 3 years time.

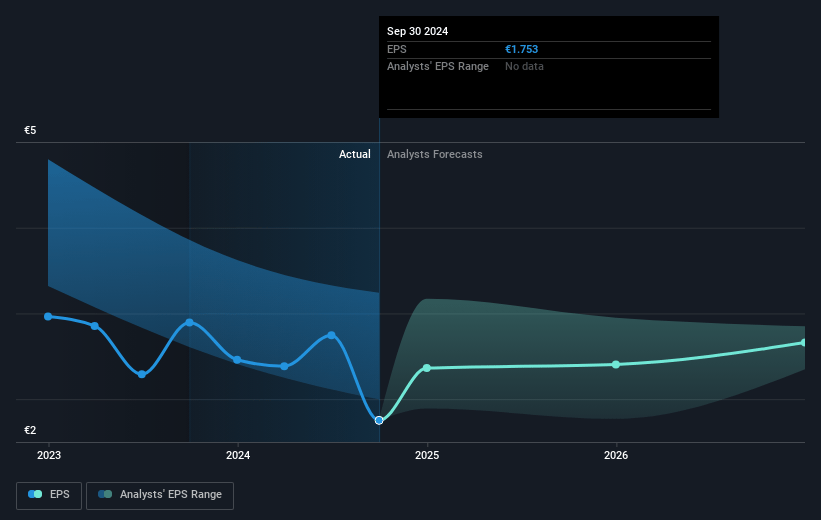

- Analysts expect earnings to reach €2.7 billion (and earnings per share of €2.47) by about January 2028, up from €2.1 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €3.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, up from 6.2x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 6.1x.

- Analysts expect the number of shares outstanding to decline by 1.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.46%, as per the Simply Wall St company report.

Repsol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in adjusted income by 49% year-over-year due to weaker refining margins and oil prices, as well as production interruptions in Libya, may impact Repsol's future earnings.

- Repsol's net debt has increased by €0.9 billion since June 2024 primarily due to payments related to dividends, treasury shares, and windfall taxes, which may affect the company's financial stability and net margins.

- The company's upstream development projects have faced disruptions and may be vulnerable to geopolitical risks, as evidenced by the interruption in Libya, which may hinder the company's revenue growth.

- In refining, the company's margins have been negatively impacted by weaker global demand and increased output capacity, which could continue to affect revenue unless there is a sustained recovery.

- Cost inflation in development projects, notably in Alaska, poses a risk to project budgets and could constrain cash flow, impacting Repsol’s ability to maintain profitability and invest in future projects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €13.99 for Repsol based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.0, and the most bearish reporting a price target of just €10.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €50.8 billion, earnings will come to €2.7 billion, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 11.5%.

- Given the current share price of €11.27, the analyst's price target of €13.99 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives