Key Takeaways

- Strategic focus on premium offerings, digitalization, and an asset-light expansion model is expected to boost margins and revenue growth across high-potential regions.

- Enhanced financial flexibility from deleveraging and targeted investments supports sustained earnings growth and future expansion opportunities.

- Heavy reliance on Mediterranean resorts heightens vulnerability to regional disruptions, while labor cost pressures, diversification challenges, and currency exposure threaten stable growth and margins.

Catalysts

About Meliá Hotels International- Owns, operates, manages, leases, and franchises hotels worldwide.

- The company continues to benefit from robust global tourism demand, especially from the growing middle class and increasing disposable incomes, with occupancy and on-the-book reservations for resort hotels up over 5% versus last year-poised to support higher revenue growth and future RevPAR expansion.

- Meliá's strategic expansion in high-growth regions (such as Southeast Asia, the Caribbean, and continued penetration in Europe) and a strong pipeline of 35+ new hotels annually under an asset-light model is expected to drive higher revenue while improving net margins through lower capital intensity and fee-based income streams.

- Growing preference for premium/luxury and experiential travel aligns with Meliá's repositioning of its hotel offerings (especially in premium/luxury segments, which represent 20% of rooms but generate nearly 40% of revenue), likely supporting future ADR (Average Daily Rate) increases and margin expansion.

- Major advances in digitalization and direct booking channels, alongside investment in proprietary loyalty programs, are expected to enhance customer acquisition efficiency, lower distribution and OTA-related costs, and increase repeat visits-favorable for net margins and earnings growth.

- Significant deleveraging and lower refinancing costs have improved the company's financial flexibility and credit profile, reducing interest expenses by 40%, which should translate to stronger earnings and support future expansion.

Meliá Hotels International Future Earnings and Revenue Growth

Assumptions

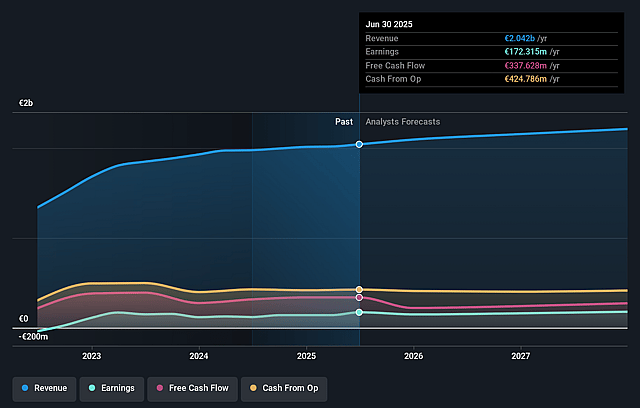

How have these above catalysts been quantified?- Analysts are assuming Meliá Hotels International's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.4% today to 8.0% in 3 years time.

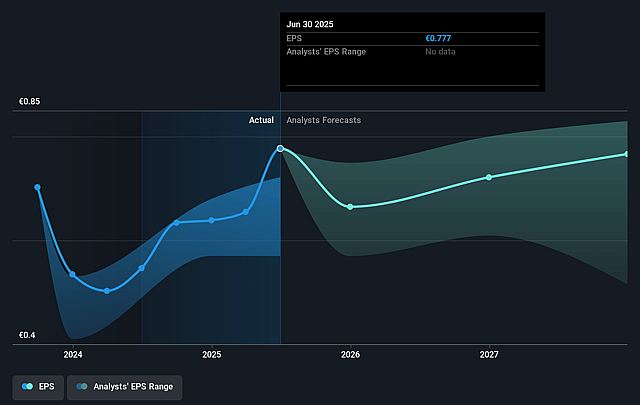

- Analysts expect earnings to reach €176.0 million (and earnings per share of €0.82) by about September 2028, up from €172.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €200 million in earnings, and the most bearish expecting €157 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, up from 10.1x today. This future PE is greater than the current PE for the GB Hospitality industry at 13.0x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.37%, as per the Simply Wall St company report.

Meliá Hotels International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overexposure to Mediterranean and Spanish resort markets increases risk from regional economic downturns, political instability, and climate-related disruptions (e.g. heatwaves, water shortages), which could create RevPAR volatility and negatively affect revenue and earnings.

- The company continues to experience underperformance and limited growth in several international markets such as Germany, Cuba, and parts of Asia, indicating persistent challenges in broad-based geographic diversification that could hamper stable long-term revenue and margin growth.

- Rising labor costs, particularly following new agreements in the Balearic and Canary Islands that are "slightly worse than expected," may pressure operating expenses and erode net margins unless fully offset by further efficiency gains or price increases.

- Exposure to foreign exchange fluctuations-particularly USD/EUR-affects revenue and EBITDA, with recent results already showing negative impacts, and persistent currency volatility could continue to weigh on reported financials.

- While the company is focused on an asset-light expansion strategy, the closure or ramp-up of newly acquired and renovated properties (e.g., Paradisus Cancun, recent JVs) presents execution risk; delays or underperformance in these new hotels could mute expected revenue gains and depress cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €9.081 for Meliá Hotels International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €11.0, and the most bearish reporting a price target of just €6.54.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.2 billion, earnings will come to €176.0 million, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 15.4%.

- Given the current share price of €7.89, the analyst price target of €9.08 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.