Catalysts

- Banco Santander is present in Europe (Germany, Austria, Belgium, Denmark, Spain, Finland, Isle of Man, Italy, Norway, Poland, Portugal and the UK); North America (USA, Mexico); South America (Argentina, Brazil, Chile, Uruguay)

- Active customer base: 103 million.

- ONE Transformatio Project: transformation to an integrated digital model for all markets. Every year they change the name of the digitization and integration project, but it does not end up materializing in better results in online banking.

- In 2025, the objectives are to maintain capital revenues of 62,000 million; increase commission income to mid-to-high digits; reduce costs in euros; cost of risk of c.1.15%; RoTE of >17% (c.16.5% post-AT1), and CET1 of 13%.

- Fiscal years 2025-26 share buybacks worth 10000 million. (capitalization on February 5, 75000 million). Buyback of approximately 13.33% capitalization. Profitable mergers or acquisitions are not envisaged.

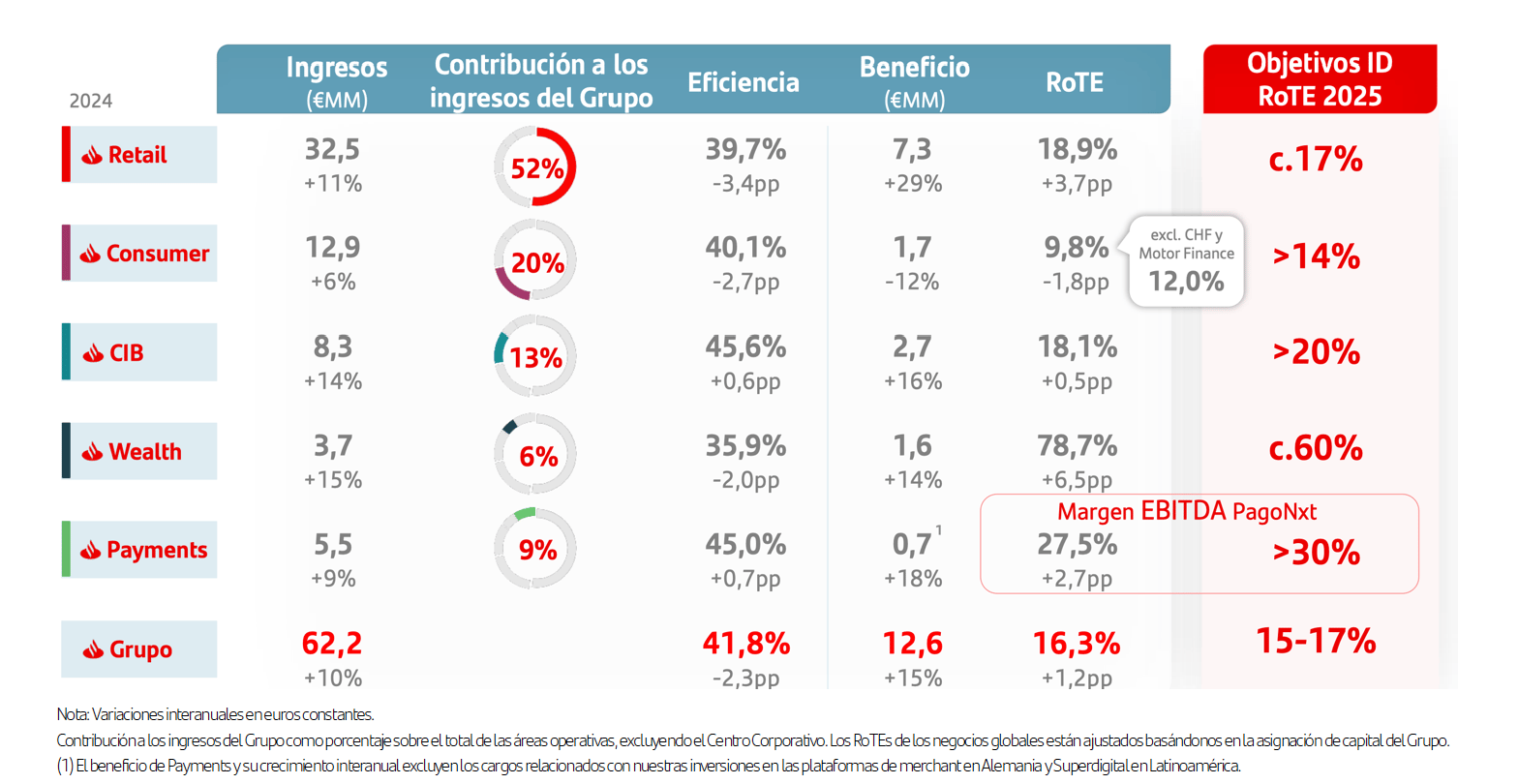

Global Business Evolution 23-24

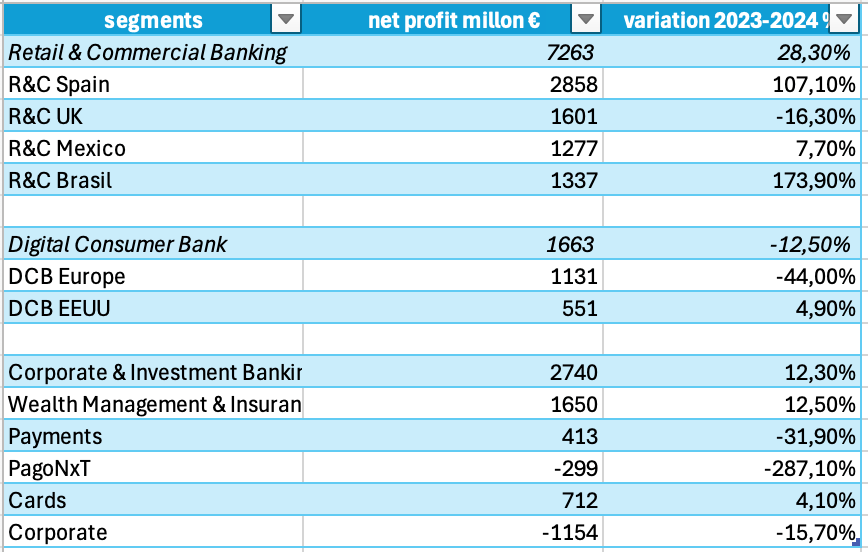

Retail & Commercial Banking

Net attributable profit in Retail & Commercial Banking grew by 29% to €7,263 million, thanks to the good performance of revenues in all regions (+11%), the efficiencies resulting from the bank's transformation programme and the reduction in provisions in Europe.

Digital Consumer Bank

It recorded a net attributable profit of €1,663 million, down 12% mainly due to additional provisions for Swiss franc mortgages in Poland, as well as claims on vehicle finance agent fees in the UK, announced at the end of 2024.

During the last quarter of 2024, Openbank was launched in the United States and Mexico.

CIB obtained a net attributable profit of €2,740 million (+16%) thanks to double-digit growth in net interest income and fee income.

Wealth Management & Insurance, which brings together the group's private banking, asset management and insurance businesses, increased its net attributable profit by 14% to €1,650 million, thanks to the good performance of net interest income and fee income in all businesses. This was reflected in a general growth in revenues in both Private Banking (+14%) and Santander Asset Management (+23%) and Insurance (+12%). In addition, Wealth's assets under management reached €498,000 million (+13%).

Payments generated a net attributable profit of €413 million, down 26%.

The 2023 strategy has not yielded good results, to compete with Fintechs, it bought 54% of Ebury, a Fintech specializing in cross-border payments, and has the Getnet platform for companies and PagoNxt Payments for companies and institutions. Turnover has increased in all segments but at the cost of reduced margins.

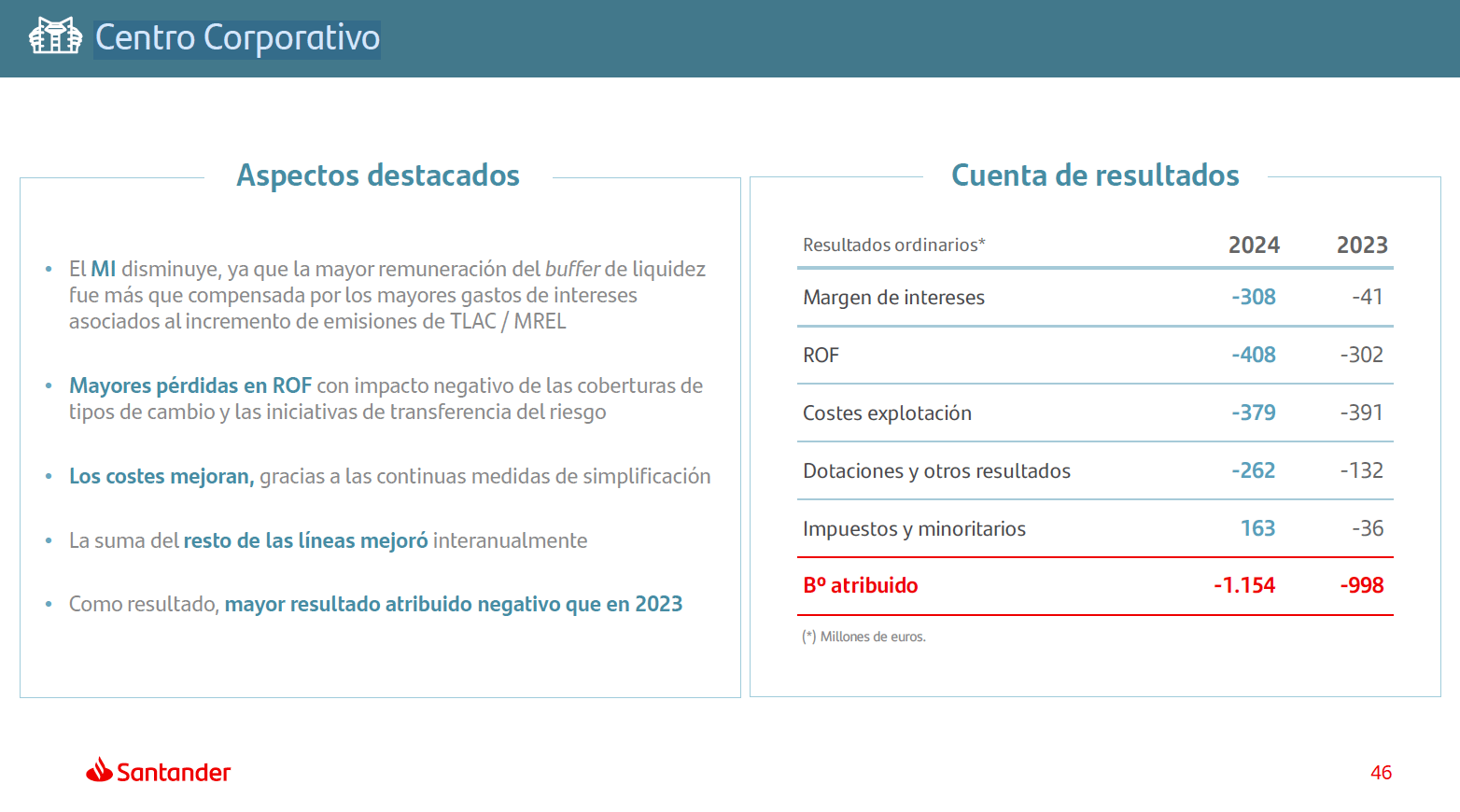

Corporate centre, which incorporates centrally managed businesses relating to financial holdings, the financial management of the structural foreign exchange position, as a result of the decisions taken within the scope of the Group's corporate asset and liability management committee, as well as the management of liquidity and equity through issuances.

As the Group's holding company, it manages total capital and reserves, capital and liquidity allocations to the rest of the businesses.

The write-down part includes goodwill impairment. It does not include the expenses of the Group's central services that are charged to the areas, with the exception of corporate and institutional expenses related to the Group's operation.

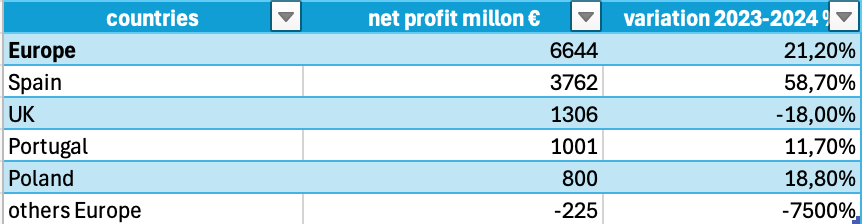

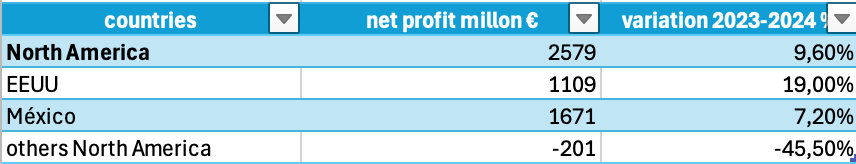

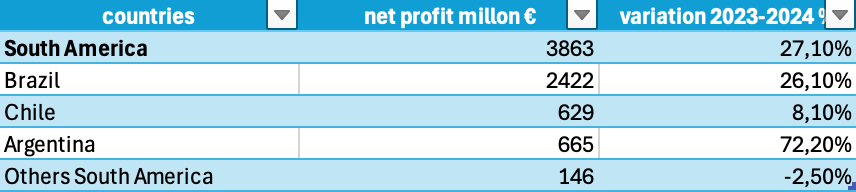

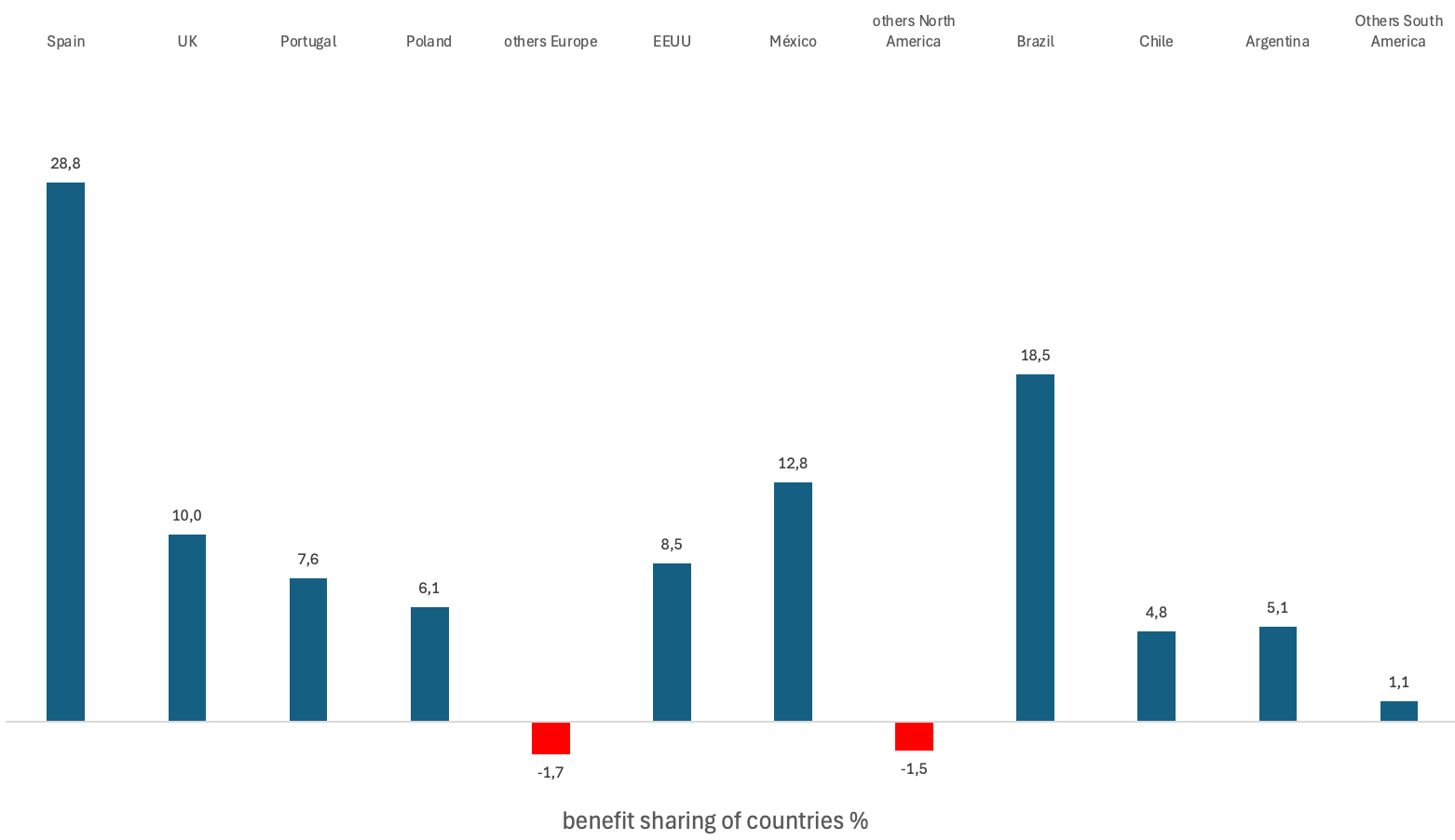

Business performance by geographical area

Assumptions

We will assume that the next 5 years will maintain a payout of 50%, a return of 14% on the expanded capital base in 2024 (down 2 points compared to the estimates of the third quarter of 2024), a RoTE of 17% and a fully-loaded CET1 of 13%. As projected by the bank until 2026.

Sectoral risks

Business has declined in the following markets: the United Kingdom, with lower mortgage volumes (in line with the strategy) and higher deposit costs (competitive market), and the United States due to lower volumes.

Big tech companies compete with banks by offering financing for their products and services. For this reason, Zinia, Openbank's consumer finance platform, closed agreements with Apple and Amazon. It remains to be seen who is the winner in these agreements, since they have not been explained in the presentation of results.

Shadow banking is providing credit in segments where capital requirements are constraining banks' ability to compete.

Fintech companies are increasingly able to offer cheaper and more attractive digital financial services to customers.

Increased capital requirements in 2025 due to the implementation of Basil III.

Global risks

New tariffs and limitations on free trade. Russia, China, USA, EU, Latan.

Geopolitical risks of Latin American countries, due to their proximity to the US and the presence of Spanish companies that facilitate access to European and North American markets.

If U.S. and European companies reduce their exposure to China, it will benefit Latin America, but U.S. tariffs on Mexico, Canada and possibly Brazil create uncertainty about future demand.

Argentina seems to be the big winner at the time of this report due to its good diplomatic relations with the United States, and the good macro management of the Argentine government

Pandemics.

Country risks.

Asteroid 2024 YR4 has 5 chances of a collision with Earth, the closest for December 22, 2032 of 2.3%. It has dimensions between 40 and 100 meters wide, dimensions that fit into the average of asteroids that impact the Earth every several thousand years. According to experts, the impact of a meteorite of this size with our planet could cause serious damage to a local region, similar to that of an atomic bomb.

Although it is still early days – and most likely still not to impact – among the possible impact zones are the eastern Pacific Ocean and the Atlantic Ocean. Also, although still less likely, it could make landfall in northern South America, Africa or South Asia

In some regions of Latin America, there are serious problems of citizen security and legal insecurity that can undermine liberal democracies and private property. This may lead to a slowdown in the growth of the Latin American middle class, which is a customer of Banco Santander.

Attention should be paid to the stability of the exchange rate in the area and, above all, to interest rates. As long as interest rates fall, Brazil will allow the Bank to increase its customer base. This 2024 financial year has been disastrous for the corporate area, the losses have largely been caused by the management of the currency.

Valuation

I estimate that revenues will increase by 5% over the next 5 years. The net margin will be reduced to 22% and the PER will be around 5%.

How well do narratives help inform your perspective?

Disclaimer

The user kapirey holds no position in BME:SAN. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.