Key Takeaways

- Structural cost reductions, digital innovation, and sustainability efforts position Hapag-Lloyd for stronger margins and competitive gains beyond market expectations.

- Network expansion, tech-driven services, and industry consolidation enable superior revenue growth, enhanced pricing power, and profit stability.

- Structural overcapacity, regulatory pressures, and higher costs threaten Hapag-Lloyd's revenue and margins, while volatile freight rates and capital expenditures constrain investment and financial stability.

Catalysts

About Hapag-Lloyd- Operates as a liner shipping company worldwide.

- Analyst consensus identifies cost pressures from rerouting and regulatory compliance, but Hapag-Lloyd's new $1 billion cost-cutting program, along with efficiency gains from the Gemini network and advanced digital asset tracking, is set to structurally lower the cost base and expand net margins more than anticipated by the market.

- While analysts broadly worry investments in modernizing the fleet could weigh on near-term returns, Hapag-Lloyd's rapid adoption of digitally enabled, LNG and dual-fuel ships uniquely positions it to gain share and pricing power as emissions regulations accelerate, providing a long-term uplift to earnings and cash flow that is underappreciated.

- Hapag-Lloyd's robust growth in emerging markets and its expanding global terminal network position the company as a prime beneficiary of rising global trade volumes and increasingly complex supply chains, driving above-market revenue growth.

- The ongoing expansion and integration of Hapag-Lloyd's digital portal and service automation is increasing customer retention and capturing higher-value, tech-savvy customers, setting the stage for higher revenue per TEU and sustained improvement in net margins.

- Industry-wide capacity discipline and accelerating industry consolidation are likely to support healthier freight rates and lower volatility, favoring Hapag-Lloyd's profit stability and enabling more aggressive capital returns over time.

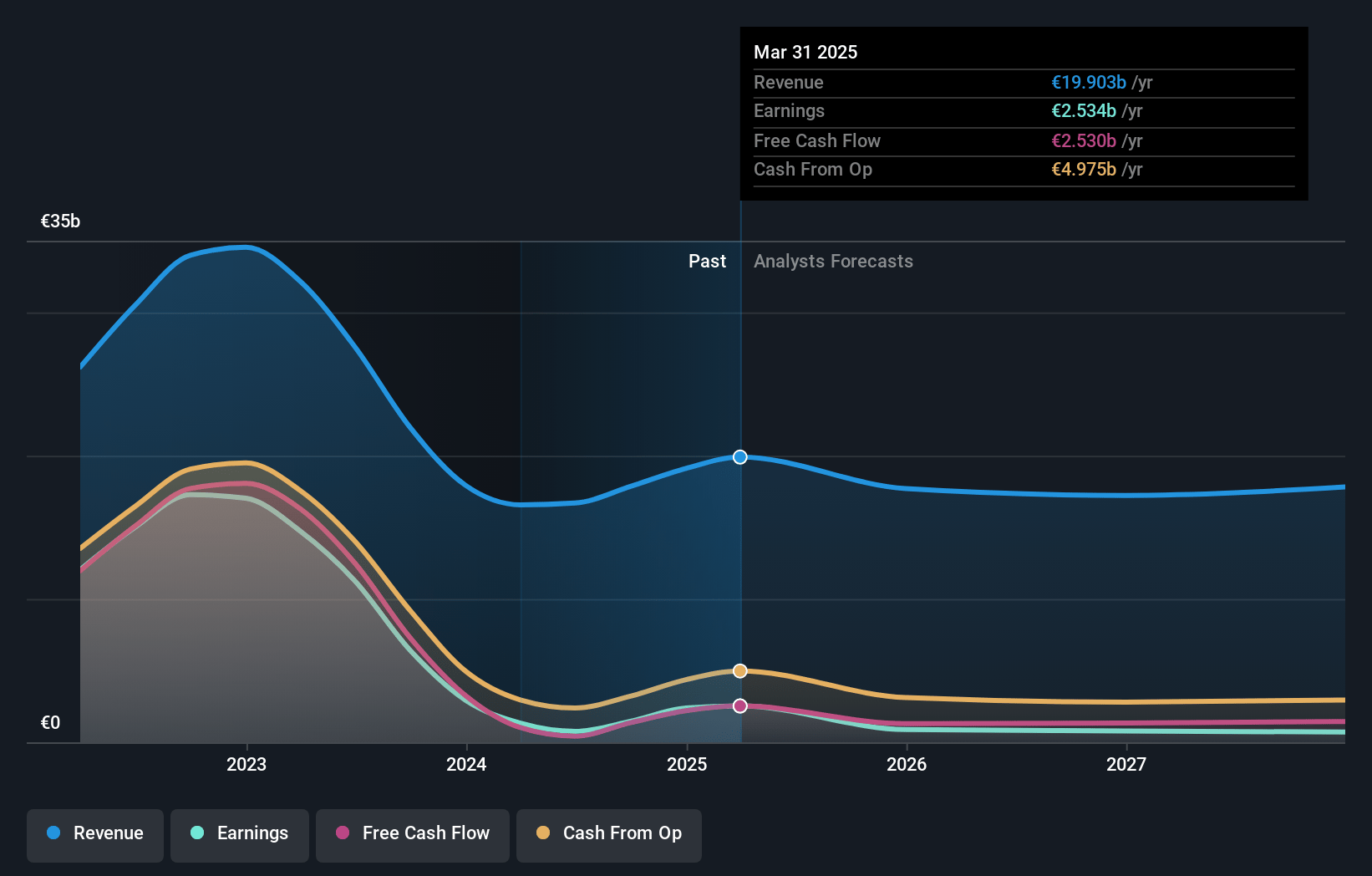

Hapag-Lloyd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hapag-Lloyd compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hapag-Lloyd's revenue will grow by 1.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 12.7% today to 4.8% in 3 years time.

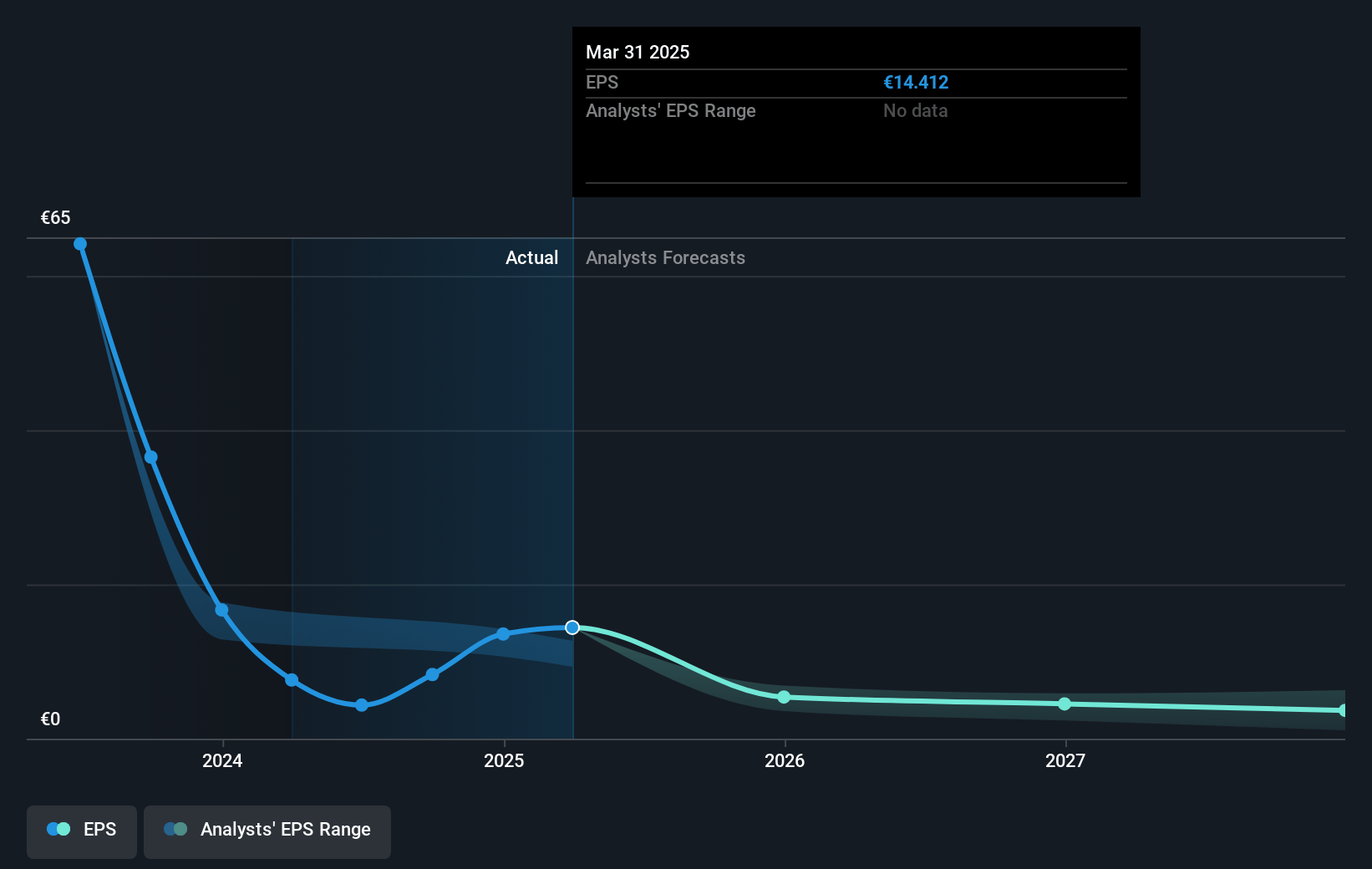

- The bullish analysts expect earnings to reach €988.0 million (and earnings per share of €5.52) by about July 2028, down from €2.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 35.2x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the GB Shipping industry at 7.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.39%, as per the Simply Wall St company report.

Hapag-Lloyd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural overcapacity in the container shipping industry, combined with a sizable order book and anticipated peaks in vessel deliveries in 2027 and 2028, is likely to exert downward pressure on freight rates in coming years, risking lower revenue and profitability for Hapag-Lloyd.

- Decarbonization pressures and the tightening of environmental regulations (such as the increasing cost of EU emissions certificates and anticipated global regulatory measures) will significantly raise compliance and operating costs, which will compress net margins over the long term.

- The trend toward regionalized manufacturing and supply chain nearshoring, as evidenced by uncertainty in global demand and fluctuating U.S.-China trade volumes, threatens to reduce the distance and frequency of long-haul container shipping, negatively impacting overall transport volumes and future revenue.

- Hapag-Lloyd's exposure to volatile spot freight rates, particularly on key routes such as Transpacific and Transatlantic, means that even short-term declines or instability-like the steep spot rate drops post-Chinese New Year-directly threaten earnings predictability and could result in significant swings in both revenue and profit.

- Elevated capital expenditures on fleet expansion and modernization, required to meet both market demand and emissions standards, combined with persistently rising unit costs (up 5 percent year-over-year in Q1 2025 despite efforts to cut costs), will put pressure on free cash flow and may constrain future investment capacity, ultimately dampening returns on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hapag-Lloyd is €170.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hapag-Lloyd's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €170.0, and the most bearish reporting a price target of just €75.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €20.5 billion, earnings will come to €988.0 million, and it would be trading on a PE ratio of 35.2x, assuming you use a discount rate of 5.4%.

- Given the current share price of €127.3, the bullish analyst price target of €170.0 is 25.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.