Key Takeaways

- Deutsche Post anticipates growth in e-commerce and parcel segments, driven by last-mile delivery volume increases and effective yield management strategies.

- Strategic investments and geographical expansion, particularly in Asia and fast-growing sectors, are key to anticipated revenue and earnings growth.

- Economic challenges in Europe and declining mail volumes, paired with competitive pressures, jeopardize Deutsche Post's revenue growth and profitability.

Catalysts

About Deutsche Post- Operates as a mail and logistics company in Germany, rest of Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

- Despite challenges in the B2B freight markets, Deutsche Post anticipates continued positive growth in their e-commerce and B2C parcel segments, driven by strong volume growth in the last-mile delivery services and effective yield management strategies with competitive surcharges. This trend is expected to support revenue growth.

- The company is focusing on cost measures and productivity improvements, especially in the Express division with successful demand surcharges and in Global Forwarding with targeted productivity enhancements. These efforts aim to improve net margins and contribute to higher earnings.

- Strong free cash flow generation is enabling Deutsche Post to continue providing shareholder returns through dividends, supporting EPS growth and maintaining investor confidence.

- The group’s strategy includes expanding market share in fast-growing sectors like supply chain services with investments in automation and real estate, which are expected to drive revenue and margin growth.

- Deutsche Post is committed to its Strategy 2030, focusing on geographical expansion, particularly in regions like Asia and sectors such as life sciences, renewable energy, and e-commerce. This strategic focus is poised to increase revenue and earnings in the medium to long term.

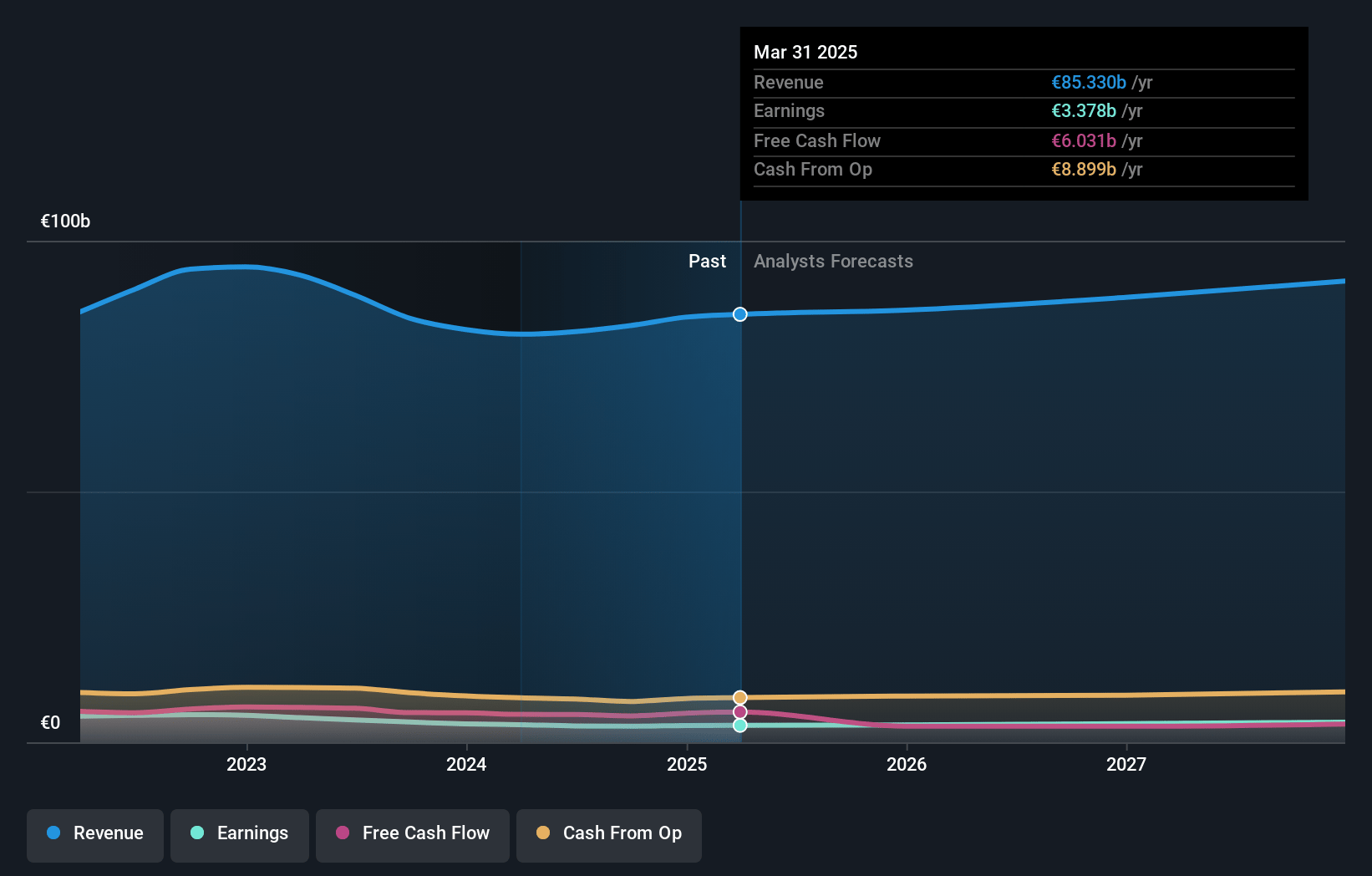

Deutsche Post Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Deutsche Post's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.9% today to 4.4% in 3 years time.

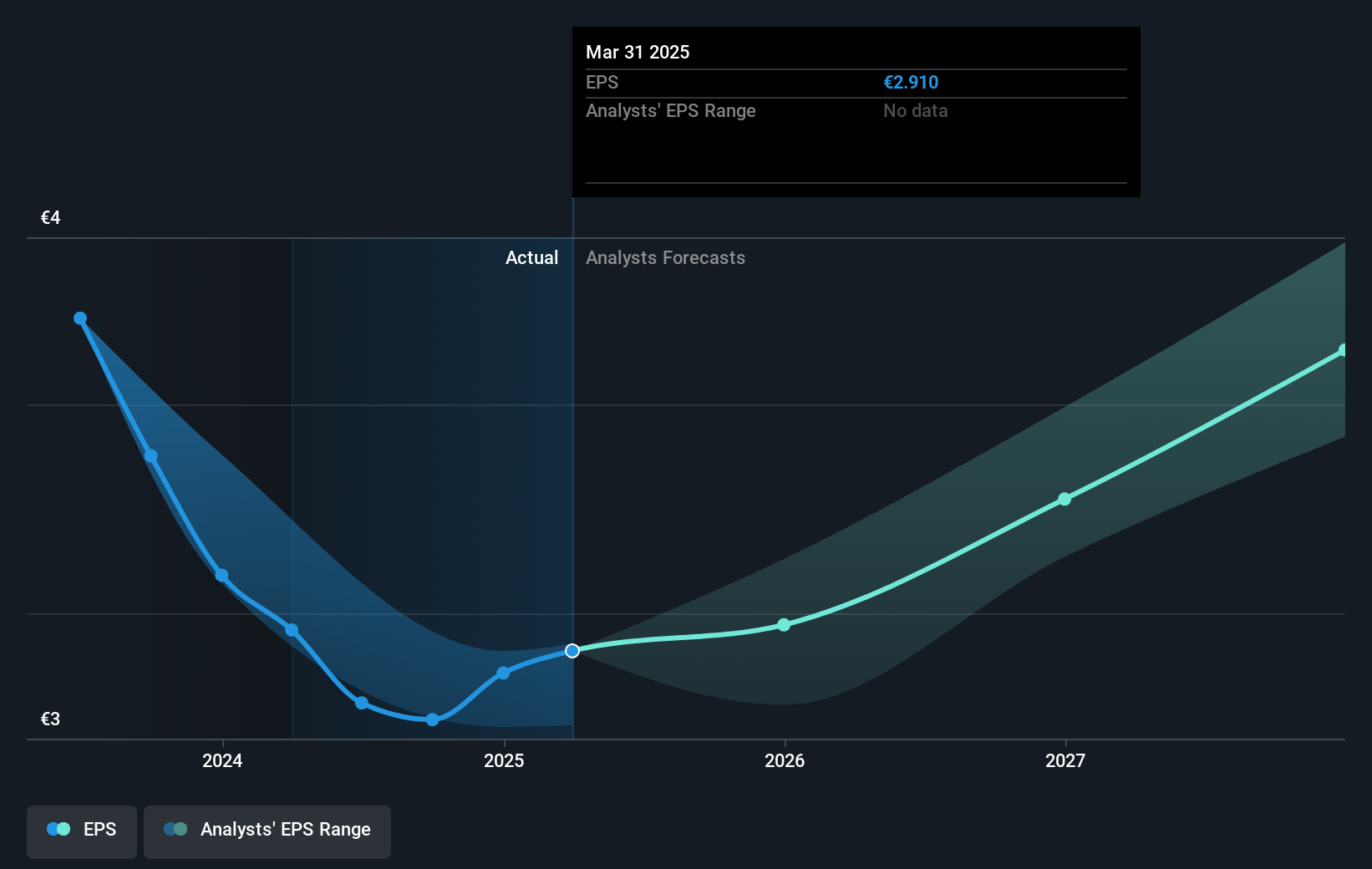

- Analysts expect earnings to reach €4.1 billion (and earnings per share of €3.53) by about January 2028, up from €3.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €3.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from 12.8x today. This future PE is greater than the current PE for the GB Logistics industry at 9.9x.

- Analysts expect the number of shares outstanding to grow by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.53%, as per the Simply Wall St company report.

Deutsche Post Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macro environment is falling short of expectations, especially in Europe, affecting freight markets and potentially impacting future revenue and net margins.

- The adjustments in guidance, now €5.8 billion EBIT from a previous range of €6.0 billion to €6.6 billion, highlight slower economic recovery, which may negatively influence earnings.

- The mail volume decline in Germany is sharper than expected, driven by structural trends and accelerated drop in Dialogue Marketing, which could adversely affect net earnings and margins.

- DGF (Global Forwarding) faces challenges with airfreight GP per unit, reflecting an unsatisfactory performance that could impact profitability and earnings.

- Increased competitive pressure and continuation of yield pressure in various markets, such as e-commerce, could hinder revenue growth and adversely affect net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €41.21 for Deutsche Post based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €50.0, and the most bearish reporting a price target of just €33.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €92.3 billion, earnings will come to €4.1 billion, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 5.5%.

- Given the current share price of €35.77, the analyst's price target of €41.21 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives