Key Takeaways

- Unique network architecture and digital ecosystem position the company for sector-leading efficiency, premium pricing, and outsized revenue and margin growth versus competitors.

- Service innovation, bundled offerings, and rapid adoption of emerging trends drive higher customer value, lower churn, and multiple potential new high-margin revenue streams.

- Execution delays in 5G rollout, heavy dependency on wholesale agreements, and intense market competition threaten margins, cash flow, and long-term profitability.

Catalysts

About 1&1- Operates as a telecommunications provider in Germany.

- Analyst consensus expects revenue stabilization as customer migration concludes, but this likely underestimates the magnitude of ARPU uplift and subscriber rebound possible from Q4 2025 onwards, as friction from migration disappears and 1&1 resumes net adds in both fixed and mobile, which could result in outsized service revenue acceleration ahead of expectations.

- Analysts broadly expect margin expansion driven by network virtualization and lower wholesale costs, yet this may significantly understate the degree of future margin leverage, as 1&1's architecture is uniquely future-ready (with real-time, low-latency open RAN and dense fiber) to deliver best-in-class efficiency gains, positioning the company for sector-leading EBITDA margin expansion as data consumption rises.

- As demand for high-speed connectivity accelerates due to surging video and IoT usage, 1&1's state-of-the-art network architecture provides a defensible premium position, enabling the company to capture premium pricing and gain share from legacy providers, which should drive above-market revenue and ARPU growth.

- The fusion of 1&1's robust broadband base, virtualized 5G mobile, and large digital ecosystem uniquely enables compelling bundled offerings and cross-selling, driving higher customer lifetime value and materially reducing churn, translating to improving earnings visibility and steady top-line growth.

- 1&1's flexible, software-defined network delivers rapid, cost-effective service innovation, positioning the company to quickly monetize emerging trends such as edge computing, smart home, and e-health applications, which could unlock entirely new high-margin revenue streams and incremental EBITDA growth beyond current consensus forecasts.

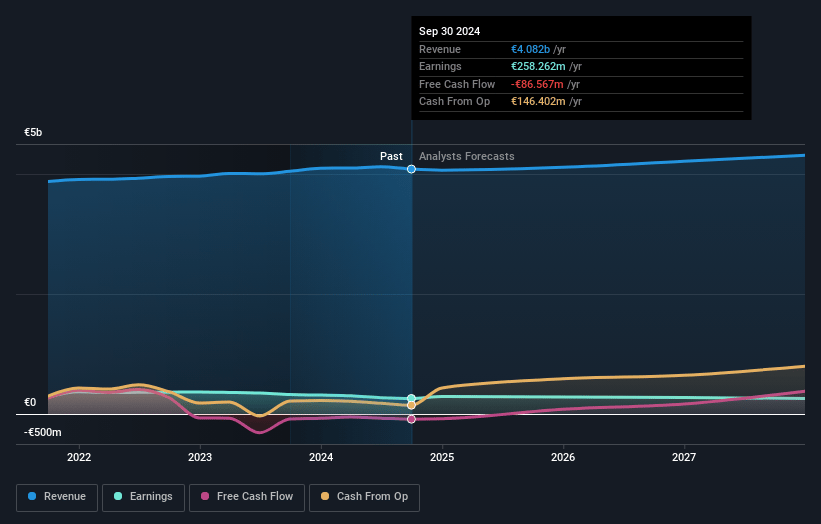

1&1 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on 1&1 compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming 1&1's revenue will grow by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.4% today to 7.5% in 3 years time.

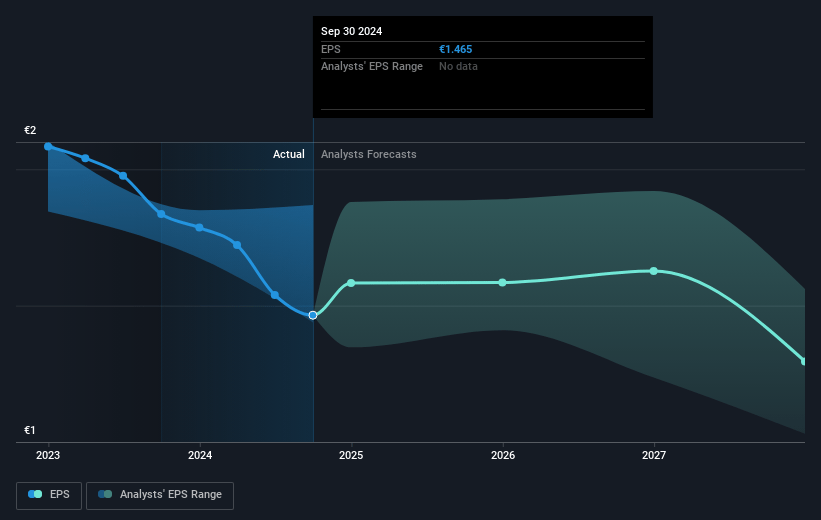

- The bullish analysts expect earnings to reach €336.5 million (and earnings per share of €1.76) by about July 2028, up from €177.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, down from 18.4x today. This future PE is greater than the current PE for the DE Wireless Telecom industry at 15.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.73%, as per the Simply Wall St company report.

1&1 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing execution risks and delays associated with 1&1's 5G network rollout, as shown by the slow pace in achieving mast deployment targets and network outages, threaten to inflate capital expenditures and pressure free cash flow and net margins for several years.

- Industry-wide migration to capital-intensive 5G and fiber infrastructure is driving up depreciation, amortization, and lease expenses, which is evident in 1&1's increasing noncurrent liabilities and substantial negative EBIT contribution from the mobile network segment; this raises doubts about long-term profitability.

- Heavy reliance on wholesale agreements for network access, particularly with Telefónica and Vodafone, exposes 1&1 to adverse pricing changes and challenging renegotiations, as demonstrated by the recent switch in national roaming partners and unclear future spectrum access, potentially squeezing gross margins and reducing future earnings.

- The saturated and highly competitive German telecom market, exacerbated by low-cost MVNOs and aggressive discounting, continues to result in stagnant or declining subscriber growth and falling ARPU, as reflected by 1&1's declining high-margin service revenues and lack of customer growth outlook, thereby constraining long-term revenue potential.

- Growing regulatory scrutiny and the potential for more aggressive intervention in telecom markets, as highlighted by protracted antitrust proceedings and regulatory delays around spectrum allocation, are likely to increase compliance costs, prolong uncertainty and limit pricing power, all of which may compress margins and impact future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for 1&1 is €28.93, which represents two standard deviations above the consensus price target of €19.14. This valuation is based on what can be assumed as the expectations of 1&1's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €30.0, and the most bearish reporting a price target of just €10.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €4.5 billion, earnings will come to €336.5 million, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 4.7%.

- Given the current share price of €18.48, the bullish analyst price target of €28.93 is 36.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives