Key Takeaways

- Increased regulatory pressure and high compliance costs threaten profit margins and limit future expansion plans.

- Competitive and technology shifts favor larger players, putting downward pressure on revenue and weakening 1&1's market position.

- Expanded 5G infrastructure and converged services are set to drive cost savings, higher margins, and improved growth amid shifting telecom market dynamics and favorable competition trends.

Catalysts

About 1&1- Operates as a telecommunications provider in Germany.

- Growing regulatory scrutiny and upcoming EU data privacy and competition legislation are set to impose substantial compliance costs, directly pressuring net margins and constraining 1&1's plans for market expansion.

- Rising consumer demands for next-generation connectivity and integrated digital services favor larger incumbents with greater economies of scale, which threatens 1&1's ability to defend its customer base and sustain ARPU, likely leading to stagnant or declining revenue over the long term.

- Persistent and high up-front capital expenditures for 5G network rollout, combined with the slow pace of customer migration and delays in achieving network independence, will prolong free cash flow constraints and may keep net margins depressed for years, especially as guidance indicates elevated capex through 2025 and ongoing EBITDA losses for the Mobile Network segment.

- Tech giants and hyperscalers accelerating vertical integration in cloud, IoT, and AI could render traditional telecom networks like 1&1's less central to future value creation, risking long-term erosion of earnings power as these players bypass or marginalize pure network operators.

- Industry consolidation and the structural commoditization of core mobile and broadband services are set to intensify, driving down sector-wide ARPU and limiting 1&1's pricing power, with continued regulatory pressure on wholesale rates further eating into ancillary income streams and crimping EBITDA.

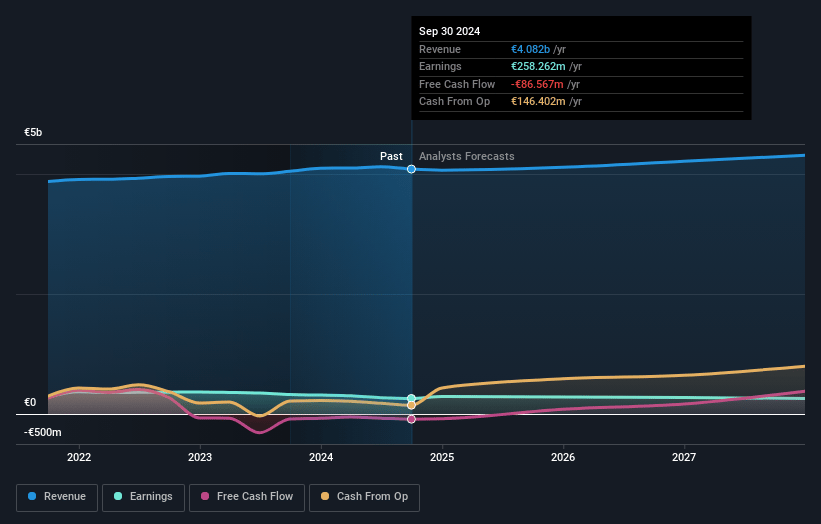

1&1 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on 1&1 compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming 1&1's revenue will decrease by 1.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 4.4% today to 3.5% in 3 years time.

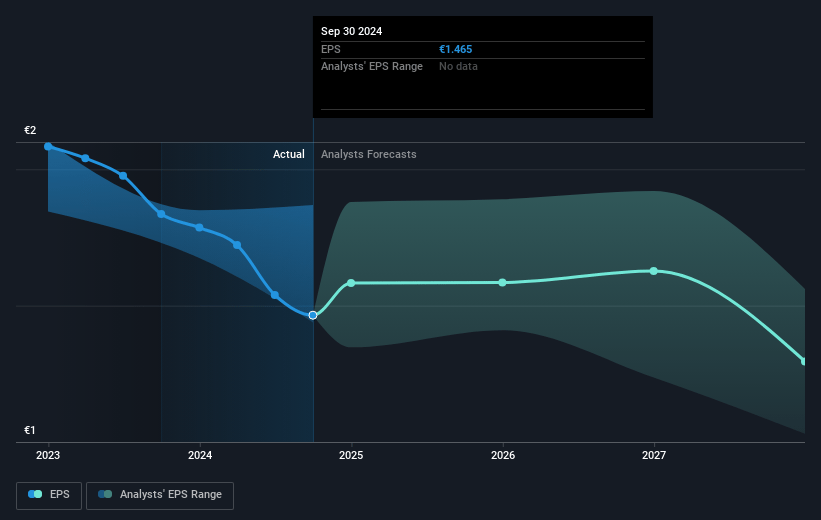

- The bearish analysts expect earnings to reach €137.0 million (and earnings per share of €1.16) by about July 2028, down from €177.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, down from 18.4x today. This future PE is greater than the current PE for the DE Wireless Telecom industry at 15.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.73%, as per the Simply Wall St company report.

1&1 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing rapid rollout and maturity of the 5G network, including open RAN and extensive fiber-connected data centers, positions 1&1 to capitalize on high-value, low-latency services and the expected proliferation of IoT and real-time applications, creating opportunities for future revenue growth and margin improvement.

- As migration is completed and the company transitions customers onto its proprietary infrastructure, reliance on more expensive leased network access will diminish, likely leading to material operating cost savings and higher long-term EBITDA.

- Company leadership projects that, after absorbing one-off migration expenses, customer losses will stabilize and normal net add levels could return as soon as 2026, underpinning service revenue stability and setting the stage for future organic growth.

- The move toward converged service offerings and the bundling of mobile, broadband, and cloud services positions 1&1 to increase average revenue per user and improve revenue resilience in a shifting telecom market.

- Industry-wide trends toward network virtualization, automation, and a regulatory push for stronger competition in Europe give agile entrants like 1&1 a competitive tailwind, potentially driving market share gains and supporting both top line revenue and net margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for 1&1 is €10.4, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of 1&1's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €30.0, and the most bearish reporting a price target of just €10.4.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €3.9 billion, earnings will come to €137.0 million, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 4.7%.

- Given the current share price of €18.48, the bearish analyst price target of €10.4 is 77.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.