Key Takeaways

- Accelerated integration and product innovation, especially with AI and remote connectivity, are driving faster revenue growth, higher margins, and stronger earnings than expected.

- TeamViewer's SaaS model and expansion efforts position it as a default vendor, fueling sustained growth, high retention, and superior shareholder returns.

- Flat SMB growth, rising costs, competitive threats, customer caution, and regulatory risks collectively threaten TeamViewer's revenue stability, margins, and long-term market position.

Catalysts

About TeamViewer- Develops and distributes remote connectivity solutions worldwide.

- Analyst consensus expects cross-selling synergies between TeamViewer and 1E to drive incremental revenue, but the pace of integration and immediate launch of integrated add-ons like DEX Essentials indicate that go-to-market and product synergies will materialize faster and on a broader customer base than anticipated, potentially resulting in an earlier and sharper acceleration of revenue and enterprise ARR growth.

- While consensus views AI-powered automation and product innovation as margin tailwinds, current execution-marked by early AI rollout, rapid customer adoption, and streamlined operations-suggests TeamViewer could structurally lift net margins well above 45 percent within a few years, outperforming peers and driving superior EBITDA and earnings growth.

- The global expansion of IoT-connected devices, combined with TeamViewer's proven ability to secure multi-million Euro "Frontline" and AR-enabled deals across industries, sets the stage for a multi-year step change in the number and size of contracts, underpinning sustained double-digit topline growth and higher average selling prices.

- The normalization of remote and hybrid work, alongside mounting cybersecurity demands, is powering a secular shift in IT budgets toward robust, enterprise-grade remote connectivity; TeamViewer's platform consolidation strategy positions it as the default vendor for large organizations and government entities, driving higher retention rates, reduced churn, and an expanding addressable market.

- The company's SaaS business model, high cash conversion, and disciplined capital allocation-including ongoing share buybacks-could rapidly deleverage the balance sheet, unlocking capacity for additional M&A or accelerated dividend growth, amplifying per-share earnings and shareholder returns well beyond market expectations.

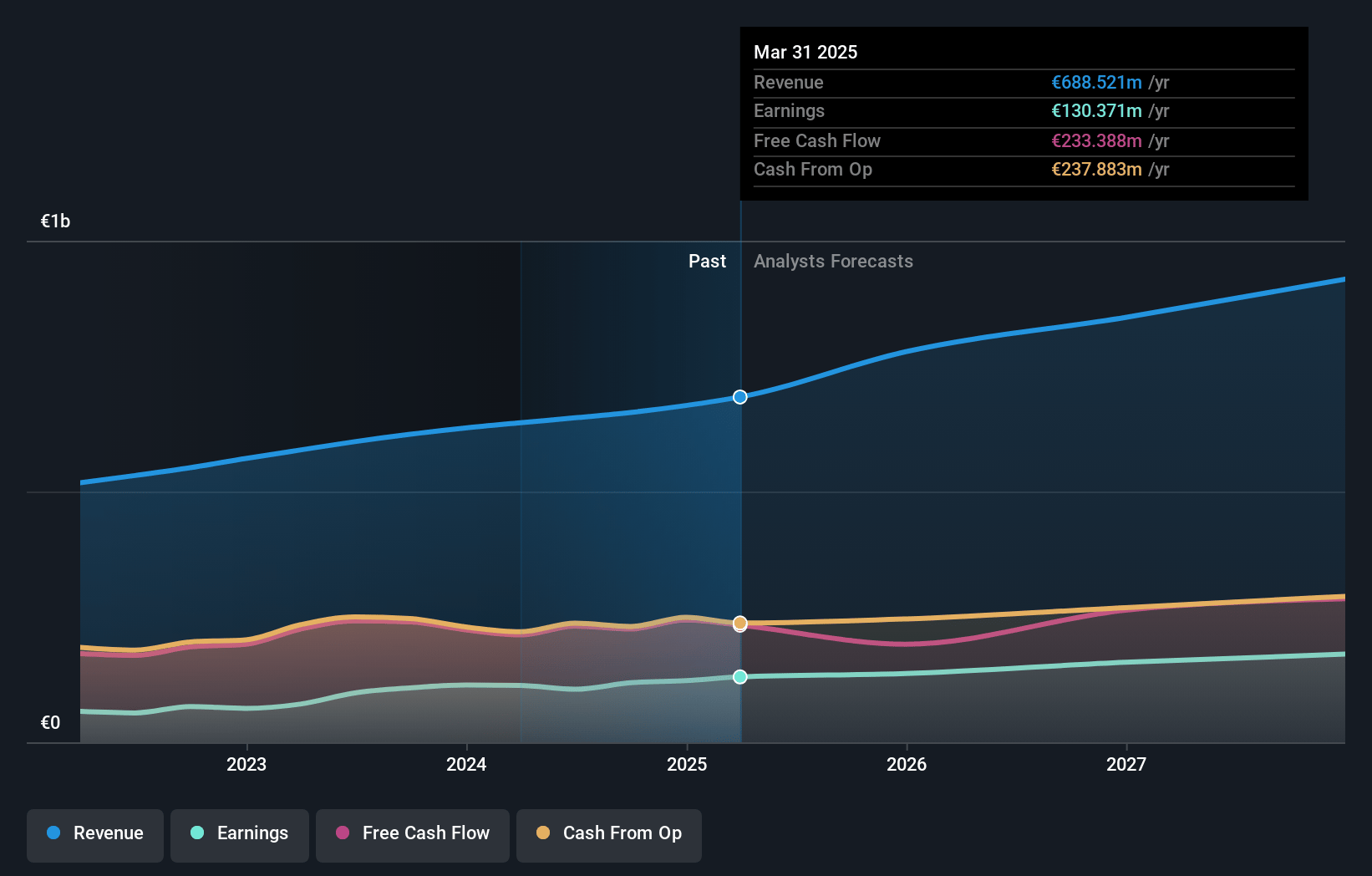

TeamViewer Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TeamViewer compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TeamViewer's revenue will grow by 12.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.9% today to 21.5% in 3 years time.

- The bullish analysts expect earnings to reach €212.9 million (and earnings per share of €1.5) by about July 2028, up from €130.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, up from 11.7x today. This future PE is lower than the current PE for the DE Software industry at 30.2x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.06%, as per the Simply Wall St company report.

TeamViewer Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces elevated levels of customer churn in the SMB segment, as indicated by a churn rate of 15.3% and flat or only modest growth in the lower-value SMB customer bucket, suggesting ongoing pressure on recurring revenues and a risk of future topline deterioration.

- TeamViewer must continue significant marketing and R&D investments to maintain competitiveness, with management explicitly guiding for increased marketing costs in Q2 and noting persistent R&D expansion, which could compress net margins and earnings over time as competition intensifies.

- Integrated IT management platforms from larger vendors and increasing consolidation toward single-platform solutions were cited by management, with customers seeking fewer tools, which poses a risk to TeamViewer's market share and could contribute to downward pressure on both pricing power and revenues.

- There was repeated management commentary on cautious customer behavior, lengthening sales cycles, and high deal seasonality, especially in Enterprise, with guidance implying growth will be back-end loaded and dependent on uncertain second-half pipeline conversions, introducing execution risk and the potential for revenue or earnings shortfall if macro headwinds persist.

- Regulatory and data security challenges are growing, with significant exposure to the US Federal sector (around 4-5% of total revenue), exposing TeamViewer to potential regulatory or policy shifts that could increase compliance costs or restrict operations, thereby negatively impacting net income and cash flow in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TeamViewer is €19.86, which represents two standard deviations above the consensus price target of €15.0. This valuation is based on what can be assumed as the expectations of TeamViewer's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.0, and the most bearish reporting a price target of just €11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €992.0 million, earnings will come to €212.9 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of €9.52, the bullish analyst price target of €19.86 is 52.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.