Key Takeaways

- Rising cybersecurity demands, customer preferences, and evolving technologies threaten TeamViewer's long-term growth and competitiveness despite digital workplace momentum.

- High competition, reliance on SMBs, and market pressures could limit profitability, while costlier investments may challenge sustainable margin improvements.

- Prolonged macroeconomic uncertainty, customer churn, reliance on unpredictable large deals, rising financing costs, and high marketing spend threaten sustained revenue and margin growth.

Catalysts

About TeamViewer- Develops and distributes remote connectivity solutions worldwide.

- Although TeamViewer is benefiting from the shift toward remote and hybrid work, with strong enterprise growth and increasing demand for digital workplace enablement, the company still faces significant headwinds from tightening cybersecurity regulations and enterprise customers increasingly preferring on-premise or zero-trust solutions, which could restrict its addressable market and depress long-term revenue growth.

- Despite the acceleration in digital transformation and proliferation of connected devices fueling near-term market expansion, TeamViewer's core remote access offering may risk obsolescence as AI-powered automation and integrated device management platforms evolve, leading to downward pressure on average revenue per user and overall top-line growth in the next several years.

- While recent integration of 1E has diversified revenue and temporarily enhanced net margins through synergies, persistent exposure to high-churn SMB customers and intensifying competition from large IT and collaboration software vendors threaten to erode gross margins and increase pricing pressure, undermining sustainable improvements in profitability.

- Even with ongoing efforts to capture growth through cross-selling, product innovation, and new vertical solutions, the need for substantial investment in marketing and R&D may challenge the company's ability to simultaneously maintain operating leverage and deliver significant, sustained EBITDA expansion over the medium term.

- Although industry-wide momentum behind automation and remote monitoring creates tailwinds for TeamViewer's offerings, the widespread availability of lower-cost, freemium, and open-source alternatives could push the company to reduce prices or enhance free-tier offerings, constraining both customer lifetime value and long-term earnings potential.

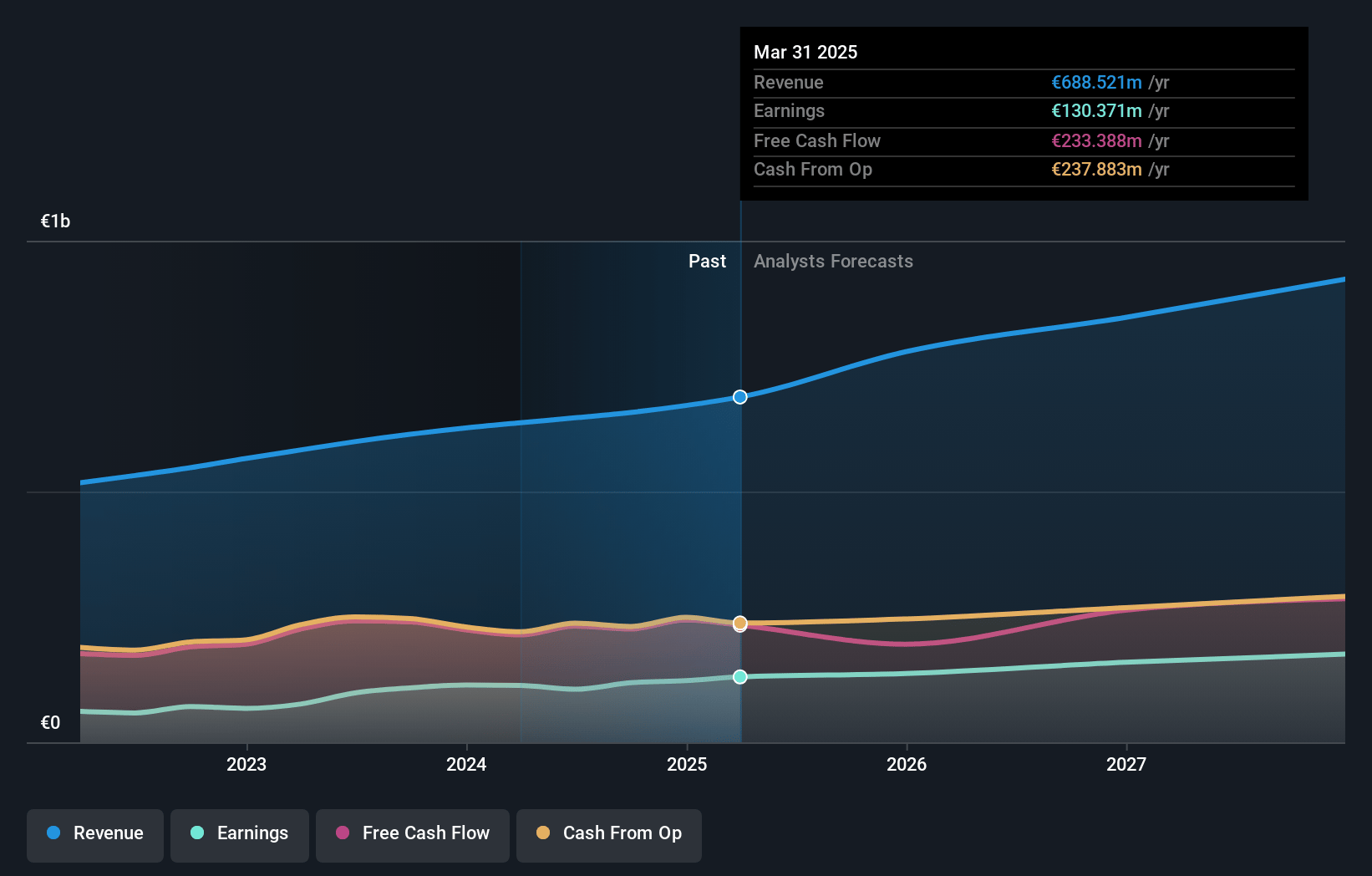

TeamViewer Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on TeamViewer compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming TeamViewer's revenue will grow by 9.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 18.9% today to 17.7% in 3 years time.

- The bearish analysts expect earnings to reach €160.0 million (and earnings per share of €1.02) by about July 2028, up from €130.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 11.5x today. This future PE is lower than the current PE for the DE Software industry at 29.7x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.09%, as per the Simply Wall St company report.

TeamViewer Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing macroeconomic uncertainty, longer customer sales cycles, and reduced visibility are repeatedly cited as risks, making it more difficult to forecast or accelerate revenue growth, which could weigh on both top-line revenue and net margins if the environment remains volatile.

- TeamViewer's SMB segment is experiencing flat growth in its lower-value customer bucket, higher churn rates of 15.3 percent, and weaker contributions from free-to-paid conversion campaigns, threatening SMB customer inflows and putting pressure on revenue and net margins as the company tries to transition more SMB clients to enterprise.

- The company acknowledges tougher year-over-year comparisons due to large, lumpy deals in prior periods, especially in 1E, which could result in slower ARR and revenue growth in the near term and highlights dependence on unpredictable, non-recurring high-value contracts for growth.

- Elevated interest expenses stemming from the 1E acquisition have nearly doubled year-on-year to 8.6 million euros, increasing the burden of financing costs on earnings and putting pressure on net income and cash flow until deleveraging targets are met.

- The need for continued large-scale marketing spend and sponsorships to drive brand visibility-without a guarantee of proportional customer acquisition or upsell-represents an earnings risk if these investments do not yield meaningful growth in either revenue or margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for TeamViewer is €11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of TeamViewer's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.0, and the most bearish reporting a price target of just €11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €904.1 million, earnings will come to €160.0 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.1%.

- Given the current share price of €9.4, the bearish analyst price target of €11.0 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.