Key Takeaways

- Expanded capacity, automation, and regional demand uniquely position SUSS MicroTec for long-term margin improvement and sustained revenue outperformance.

- Strong market share gains and recurring revenue streams from advanced semiconductor solutions drive superior growth and financial profile transformation.

- Heavy reliance on Asian markets and advanced packaging exposes SUSS MicroTec to geopolitical risks, market shifts, margin volatility, and mounting competitive pressure amid high fixed costs.

Catalysts

About SUSS MicroTec- Develops, manufactures, markets, and maintains systems to produce microelectronics, microelectromechanical systems, and related applications.

- While analysts broadly agree the new Taiwan production site will double capacity and drive margin improvements, this significantly understates the impact: not only will consolidation and high automation boost gross and EBIT margins beyond current guidance, but the increased capacity uniquely positions SUSS MicroTec to capitalize on surging regional demand from both AI-related and wider advanced packaging customers, potentially resulting in sustained, accelerating topline outperformance over multiple years.

- Analyst consensus highlights strong demand for UV projection scanners supporting advanced semiconductor processes, yet current market signals point to even stronger structural tailwinds: SUSS MicroTec is not just benefitting from the CoWoS ramp, but appears to be rapidly gaining share from competitors due to superior throughput and cost of ownership, implying materially outsized revenue growth and superior gross profit margin expansion as industry adoption accelerates.

- The convergence of AI, IoT, and edge computing is driving exponential growth in demand for highly complex, miniaturized semiconductors, and SUSS MicroTec's leading position in heterogeneous integration and precision assembly solutions places it at the epicenter of this multi-decade innovation cycle – this is likely to power sustained, above-market revenue compound annual growth rates and eventually higher recurring revenues as its tools become mission critical.

- The accelerating re-shoring and diversification of semiconductor manufacturing across Europe, the United States, and Asia is expected to create a wave of greenfield fab construction and equipment upgrades, meaning SUSS MicroTec will face years of elevated order books, reduced cyclicality, and stronger earnings visibility as regional players prioritize local process tool suppliers.

- SUSS MicroTec's expanding suite of long-term service contracts, upgrade offerings, and software-enabled features is transforming its financial profile toward higher-margin, recurring revenue streams, set to both smooth earnings and lift net margins sustainably above historical levels as customer reliance and installed base penetration deepen.

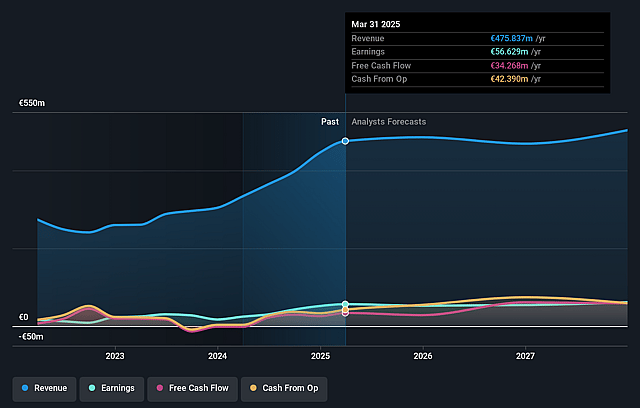

SUSS MicroTec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SUSS MicroTec compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SUSS MicroTec's revenue will grow by 6.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.9% today to 13.4% in 3 years time.

- The bullish analysts expect earnings to reach €76.0 million (and earnings per share of €3.99) by about July 2028, up from €56.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.5x on those 2028 earnings, up from 13.7x today. This future PE is greater than the current PE for the GB Semiconductor industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

SUSS MicroTec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical de-risking and escalating tariffs between the US and China are creating significant uncertainty, and with Asia/Pacific representing nearly 80% of order intake and China making up about a third of orders, any further trade restrictions or supply chain localization could directly impact SUSS MicroTec's access to key markets, risking future revenue growth and overall top-line stability.

- The company's order book is heavily reliant on Advanced Backend Solutions and UV projection scanners tied to AI and advanced packaging, so any slowdown in the adoption of current packaging technologies, or a rapid industry transition toward alternative or next-generation methods like hybrid bonding, could leave SUSS MicroTec exposed and result in declining sales and margin compression.

- Margin volatility remains a risk due to product and customer mix effects, as evidenced by frequent swings in gross and operating margins-this dependency on delivering a few high-value systems means even minor fluctuations in order timing or mix can cause significant swings in net margin and bottom-line earnings.

- SUSS MicroTec's scaling ambitions, such as the large new Taiwan facility, require increased capital expenditures that are set to rise significantly in coming quarters; these fixed cost increases could pressure profitability if industry demand weakens or if recurring revenue streams do not ramp sufficiently to offset the inherently cyclical nature of their equipment sales.

- Intensifying competition from larger global and especially Asian equipment vendors with deeper R&D budgets, combined with ongoing consolidation in the semiconductor industry, could reduce SUSS MicroTec's pricing power and ability to innovate, threatening long-term revenue growth and eroding gross and operating margins as customers seek more advanced or cost-effective solutions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SUSS MicroTec is €68.4, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SUSS MicroTec's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €68.4, and the most bearish reporting a price target of just €30.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €566.0 million, earnings will come to €76.0 million, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 7.9%.

- Given the current share price of €40.6, the bullish analyst price target of €68.4 is 40.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.