Key Takeaways

- Growing trade tensions, regionalization, and onshoring trends threaten market access, disrupt supply chains, and constrain future revenue growth opportunities.

- Reliance on niche technologies and rising price competition increase technological risk, margin pressure, and earnings volatility.

- Robust demand, expanding production capacity, geographic diversification, and ongoing innovation position the company for sustained growth, margin improvement, and reduced market risk exposure.

Catalysts

About SUSS MicroTec- Develops, manufactures, markets, and maintains systems to produce microelectronics, microelectromechanical systems, and related applications.

- The escalation of global trade tensions and protectionist policies, particularly between the US, China, and the EU, is increasing business uncertainty and the risk of new or more restrictive tariffs. This could materially constrain SUSS MicroTec's access to its largest regional market in Asia-Pacific, drive up operational costs, disrupt supply chains, and reduce potential revenue growth for future quarters.

- The trend toward regionalization and onshoring of semiconductor manufacturing-especially in the US and Asia-threatens to reduce demand for European equipment suppliers over the long term. This limits SUSS MicroTec's addressable market and could lead to declining top-line growth as more fab investments bypass European toolmakers.

- SUSS MicroTec's reliance on a niche set of lithography and advanced packaging technologies leaves it exposed to concentrated technological risk; any rapid adoption of disruptive alternatives such as nanoimprint lithography or changing standards in hybrid bonding would threaten long-term order inflow, undermine pricing power, and compress net profit margins.

- Despite short-term growth, the company faces considerable volatility in order intake due to cyclicality and lumpy customer CapEx patterns, with management having to admit that large orders may be pulled forward or delayed unpredictably. This instability increases the risk of volatile earnings, saps investor confidence, and could increase future financing costs.

- Rising commoditization and standardization of semiconductor manufacturing equipment drives persistent price competition. Over time, this will likely erode SUSS MicroTec's ability to command premium margins on its tools, resulting in squeezed gross profit margins and limiting long-term profitability even if volumes hold steady.

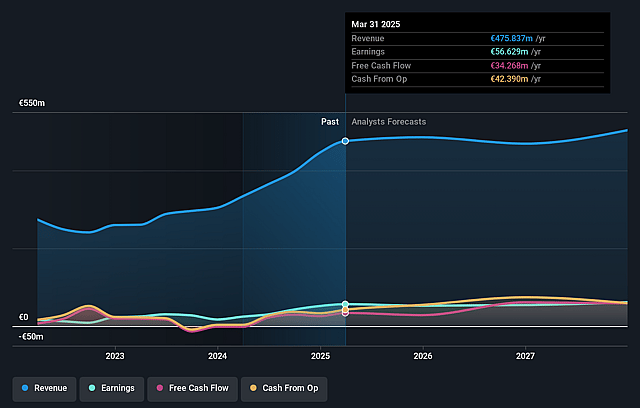

SUSS MicroTec Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SUSS MicroTec compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SUSS MicroTec's revenue will decrease by 6.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.9% today to 13.2% in 3 years time.

- The bearish analysts expect earnings to reach €51.9 million (and earnings per share of €2.72) by about July 2028, down from €56.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 10.9x today. This future PE is lower than the current PE for the GB Semiconductor industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 0.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

SUSS MicroTec Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid growth in demand for UV projection scanners, especially for AI and CoWoS processes, has resulted in SUSS MicroTec's production capacity being fully utilized through the end of 2025, indicating continued strong revenue visibility and the potential for further order growth as the digitalization and AI wave expands.

- The upcoming new production facility in Taiwan is set to double current manufacturing capacity, enhancing operational efficiency and providing the headroom to capture additional market demand, which could drive significant top-line and EBIT margin improvement as utilization ramps up over the next years.

- The Photomask Solutions segment delivered an exceptional EBIT margin of 32.8% and continues to be fully booked for 2025, reflecting robust customer demand and encouraging higher-margin, longer-duration contracts that support sustained earnings and margin stability.

- Strategic diversification in geographies, with nearly 79% of order intake from Asia/Pacific and a solid flow of orders from Chinese customers, reduces dependence on any single market and mitigates risk from regional cyclicality, supporting steadier revenue streams.

- Continuous innovation, such as ongoing co-development and the scheduled launch of the MaskTrack Smart platform and mid-range cleaning equipment, positions SUSS MicroTec at the forefront of key secular trends in advanced packaging and photonics, enhancing the ability to capture high-growth, high-margin opportunities and improve net profit over the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SUSS MicroTec is €30.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SUSS MicroTec's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €68.4, and the most bearish reporting a price target of just €30.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €392.9 million, earnings will come to €51.9 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of €32.3, the bearish analyst price target of €30.0 is 7.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.