Last Update01 May 25Fair value Increased 4.60%

AnalystConsensusTarget has increased revenue growth from 4.6% to 6.6%, decreased profit margin from 17.9% to 16.1% and increased future PE multiple from 14.8x to 16.3x.

Read more...Key Takeaways

- Growing demand in China and expanding design wins in advanced automotive sensors are strengthening market position and boosting pricing power for future growth.

- Cost optimization efforts and increased localization are improving margins and supply chain resilience, supporting sustained earnings despite external headwinds.

- Volatile auto demand, heavy China exposure, high customer concentration, and limited scale create risks for revenue stability, margin growth, and long-term profitability.

Catalysts

About Elmos Semiconductor- Develops, manufactures, and distributes microelectronic components and system parts, and technological devices for automotive industry in Germany, other European Union countries, the Americas, Asia/Pacific, and internationally.

- Continued strong momentum in China, driven by rising local demand for advanced driver-assist features and local OEM initiatives, positions Elmos for double-digit booking growth and new long-term customer wins, directly supporting revenue expansion.

- The ramp-up of design wins in cutting-edge automotive sensor applications (e.g., multiple ultrasonic sensors across models at BYD) validates Elmos’s innovation pipeline and supports higher semiconductor content per vehicle, structurally increasing revenues and improving pricing power.

- Ongoing operational cost optimization—including material and personnel cost reductions—is expected to improve net margins sequentially in coming quarters, enhancing earnings potential even in a flat top-line environment.

- Strengthening localization strategy in China (with first products in local fabs and a growing local brand) increases supply chain resilience and opens access to domestic automotive projects, which could buffer against international trade volatility and sustain future revenue growth.

- Order book trends and a book-to-bill ratio above 1, combined with easing automotive inventory headwinds, point to an imminent return to sequential growth, which should drive improving top-line and operating margin performance through the remainder of the year.

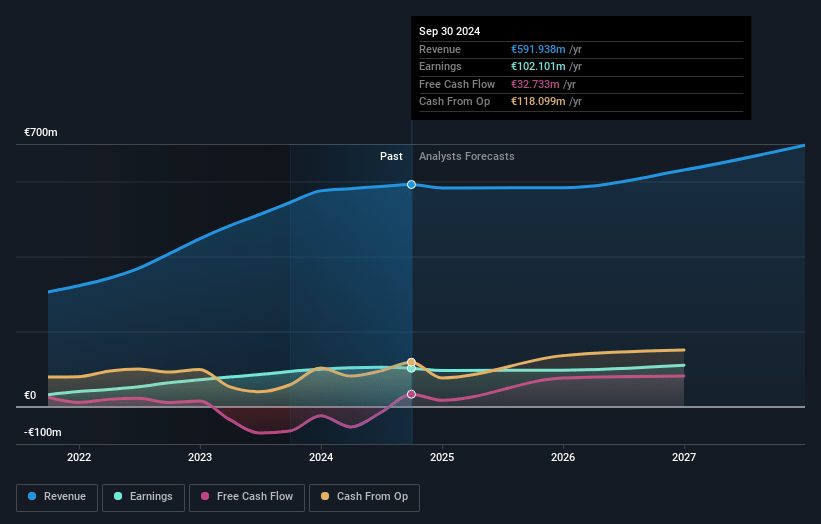

Elmos Semiconductor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Elmos Semiconductor's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 21.5% today to 16.1% in 3 years time.

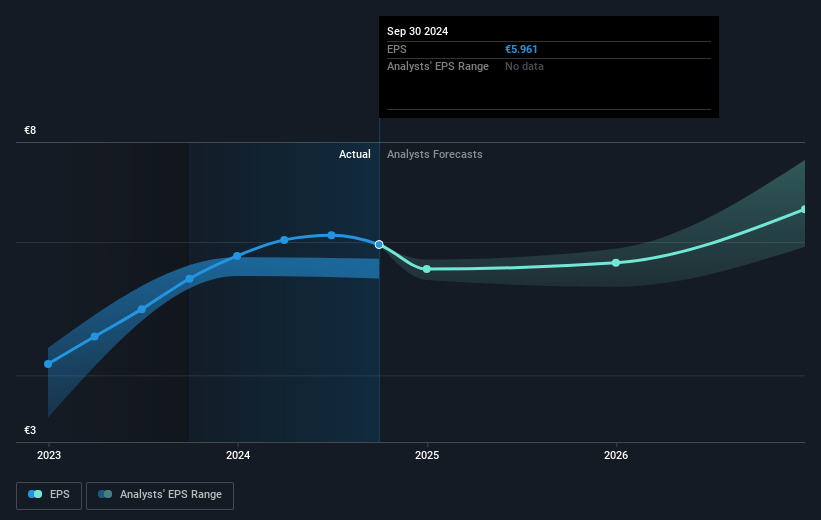

- Analysts expect earnings to reach €111.3 million (and earnings per share of €6.89) by about May 2028, down from €122.7 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €130 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, up from 9.7x today. This future PE is greater than the current PE for the GB Semiconductor industry at 13.9x.

- Analysts expect the number of shares outstanding to grow by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.75%, as per the Simply Wall St company report.

Elmos Semiconductor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Automotive semiconductor demand remains volatile and visibility is weak due to ongoing inventory destocking and customers’ short-term ordering behavior, indicating there is risk of further revenue and earnings fluctuations if auto demand weakens or normalization takes longer than expected. (Impacts revenue, net margins, and earnings)

- Rising geopolitical tensions, global trade conflict, and new tariffs—while currently limited in direct exposure—create heightened uncertainty for future customer demand and supply chain stability, especially in the event that Elmos’s products become subject to new restrictions or indirect effects, potentially harming future revenues and margins. (Impacts revenue and net margins)

- Heavy focus on China for growth (currently double-digit growth in bookings) increases Elmos’s exposure to regional risks, including intensifying competition from local or Asian semiconductor providers and potential for price pressure, which could undermine pricing power and erode revenues and margins in the long term. (Impacts revenue and net margins)

- High customer concentration in the automotive sector and reliance on a few key Tier 1 clients exposes Elmos to sharp revenue and earnings volatility if OEMs/OEM strategies change, industry volumes drop, or customers shift to alternative suppliers or vertically integrate. (Impacts revenue and earnings)

- Limited scale relative to global competitors and reference to cost optimization programs, including personnel reductions, suggest challenges in maintaining cost competitiveness and absorbing rising regulatory/compliance expenses, which could constrain net margin improvement and overall long-term profitability. (Impacts net margins and earnings)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €85.429 for Elmos Semiconductor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €110.0, and the most bearish reporting a price target of just €60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €692.5 million, earnings will come to €111.3 million, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 7.8%.

- Given the current share price of €69.3, the analyst price target of €85.43 is 18.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.