Key Takeaways

- Accelerated growth is possible via network effects, fintech integration, and dominant platform advantages in Europe's used car market.

- Digital adoption and regional expansion reduce market reliance, enabling scalable, high-margin revenue and long-term earnings strength.

- Exposure to regulatory changes, inventory risks, and high operating costs threatens profitability as competition intensifies and the EV transition undercuts core internal combustion engine business.

Catalysts

About AUTO1 Group- A technology company, operates a digital automotive platform for buying and selling used cars online in Germany, France, Italy, and internationally.

- Analyst consensus sees the expansion of AUTO1 Group's sourcing network driving revenue growth, but this likely understates the potential for rapid market share gains if AUTO1 leverages its growing branch density to become the dominant "first-touch" platform for used cars in Europe, resulting in an accelerated, compounding effect on transaction volumes, gross profit, and margin expansion.

- Analyst consensus expects merchant financing to provide higher-margin growth, but the real catalyst is the opportunity for AUTO1 to build a closed-loop financial ecosystem, increasing the penetration of both merchant and consumer finance products, dramatically boosting recurring high-margin revenue and improving group net margins as fintech attach rates approach 50% for consumers and penetrate further into the 29,500 merchant base.

- AUTO1 is uniquely positioned to benefit from the sustained shift of big-ticket purchases to e-commerce and digital transactions, with early operational investments in logistics automation and express delivery giving the company structural advantages that can drive above-industry volume growth and rising profitability as online penetration accelerates across Europe.

- The increasing digital adoption in emerging European markets will enable AUTO1 to scale across regions with reduced incremental investment, reducing its reliance on core Western European markets and unlocking additional revenue streams and operational leverage as lower-competition geographies ramp up.

- The migration of market power from fragmented local dealers to large, transparent platforms like AUTO1-combined with consumer demand for trust, transparency, and speed-presents the company with a rare opportunity to consolidate the European used car ecosystem, setting the stage for substantial long-term earnings growth driven by network effects and superior brand equity.

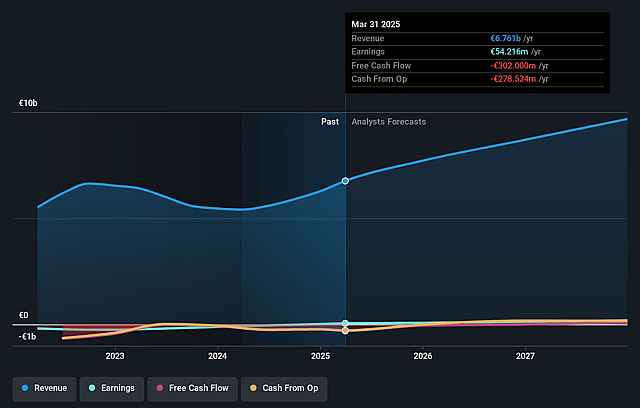

AUTO1 Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on AUTO1 Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming AUTO1 Group's revenue will grow by 15.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.9% today to 2.7% in 3 years time.

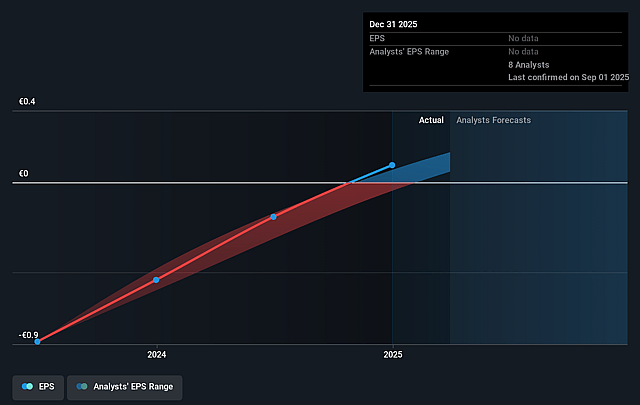

- The bullish analysts expect earnings to reach €302.0 million (and earnings per share of €1.38) by about September 2028, up from €67.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.0x on those 2028 earnings, down from 85.6x today. This future PE is greater than the current PE for the DE Specialty Retail industry at 21.1x.

- Analysts expect the number of shares outstanding to grow by 1.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.49%, as per the Simply Wall St company report.

AUTO1 Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing transition to electric vehicles, combined with stricter emissions regulations, could accelerate the decline in demand and resale value for internal combustion engine vehicles, which make up a significant portion of AUTO1's current inventory and transaction volumes, negatively affecting both future revenue and net margins.

- The company's strategy of heavy investment in growth-such as expanding branches, increasing marketing spend, and building out logistics and workforce-poses the risk of sustained high OpEx and capital intensity, making it challenging to achieve operating leverage and possibly compressing net margins if revenue growth slows.

- AUTO1 Group relies heavily on holding and turning large amounts of vehicle inventory, leaving it exposed to used car price volatility and depreciation, and in the event of oversupply, particularly from returning ICE vehicles as the EV transition accelerates, this could lead to inventory write-downs and reduced earnings.

- AUTO1 operates in a competitive landscape where traditional automotive OEMs and emerging digital-first used car platforms are intensifying direct-to-consumer efforts, which could erode market share and force margin compression, directly impacting revenue growth and long-term profitability.

- The growing regulatory burden around cross-border sales, consumer data privacy, and vehicle logistics in Europe may further increase costs and restrict operational flexibility, leading to higher compliance costs that could weigh on both net margins and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for AUTO1 Group is €35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of AUTO1 Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €35.0, and the most bearish reporting a price target of just €20.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €11.2 billion, earnings will come to €302.0 million, and it would be trading on a PE ratio of 32.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of €26.36, the bullish analyst price target of €35.0 is 24.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.