Key Takeaways

- Shifting industry dynamics and evolving consumer mobility preferences threaten AUTO1's growth outlook and hamper its ability to scale profitably.

- Rising competition, regulatory burdens, and high spending pressure margins and challenge sustained earnings improvement.

- Significant investments in technology, network expansion, and digital finance are driving scalable growth, increased customer engagement, and improving profitability in the evolving online automotive market.

Catalysts

About AUTO1 Group- A technology company, operates a digital automotive platform for buying and selling used cars online in Germany, France, Italy, and internationally.

- Rapid acceleration in the adoption of electric vehicles combined with tightening emissions regulations is likely to undermine the residual values of AUTO1's large internal combustion engine inventory, increasing write-down risks and pressuring gross profit and earnings over the coming years.

- As consumer mobility preferences shift further away from private car ownership to carsharing, ride-hailing, and subscription models, AUTO1's long-term volume growth could lag expectations, limiting revenue expansion and resulting in structurally weaker operating leverage.

- Rising compliance costs and regulatory scrutiny over cross-border data flows and digital transaction platforms in the EU could erode margins, dampen scalability, and require ongoing heavy investments in technology and legal resources, persistently weighing on net margins and profitability.

- Intensifying competition from OEM-backed certified pre-owned platforms and aggressively expanding digital-only rivals may result in margin compression due to higher customer acquisition costs and lower average selling prices, challenging AUTO1's ability to achieve sustained profitable growth and market share gains.

- Despite recent strong quarters, AUTO1's continued heavy OpEx and CapEx spend-particularly for Autohero's expansion-combined with evidence of only intermittent segment profitability, suggests the business could face ongoing challenges scaling profitably, risking a return to negative net income and suppressing long-term earnings potential.

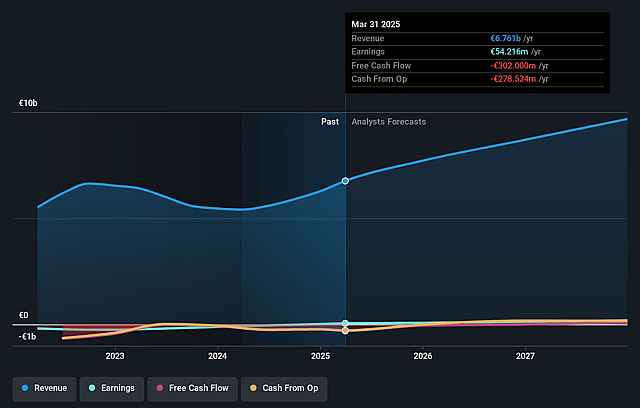

AUTO1 Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on AUTO1 Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming AUTO1 Group's revenue will grow by 10.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.8% today to 2.1% in 3 years time.

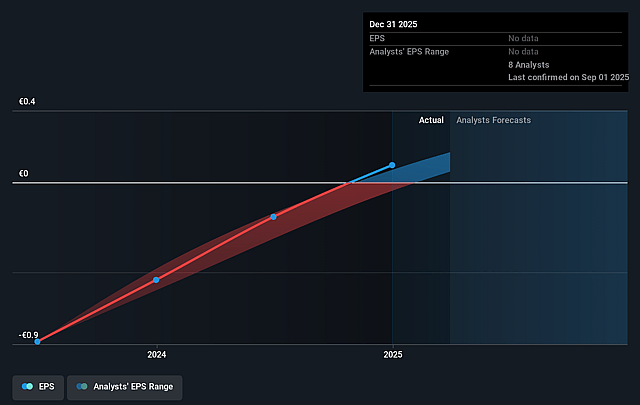

- The bearish analysts expect earnings to reach €193.2 million (and earnings per share of €nan) by about September 2028, up from €54.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, down from 106.2x today. This future PE is greater than the current PE for the DE Specialty Retail industry at 20.0x.

- Analysts expect the number of shares outstanding to grow by 1.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

AUTO1 Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AUTO1 Group is demonstrating strong operating leverage, rapid year-on-year unit growth above 20 percent, and margin expansion, with record adjusted EBITDA and positive net income, which indicates improving earnings power and challenges the likelihood of a sustained share price decrease.

- The company's ongoing investments in logistics, refurbishment centers, merchant and consumer finance, and brand marketing are enabling capacity growth as well as higher platform engagement, which supports higher future sales volumes and expansion of gross profit, putting upward pressure on long-term revenues.

- AUTO1's penetration of digital financing products, both on the merchant and consumer side, is fueling demand by making large-ticket purchases more accessible and convenient, enhancing customer stickiness, potentially supporting gross margins and recurring revenue streams as the business scales further.

- Expansion of the drop-off branch and express delivery network across Europe increases geographic reach, platform accessibility, and service differentiation relative to offline peers and online rivals, which sustains the company's growth runway, underpins long-term market share gains, and supports stable or rising gross profit and revenue.

- The secular trend toward digital used car transactions, coupled with AUTO1's technological focus on pricing intelligence and operational automation, positions the company to capitalize on the growing online automotive retail market, supporting long-term improvements in unit economics, net margins, and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for AUTO1 Group is €20.59, which represents two standard deviations below the consensus price target of €29.24. This valuation is based on what can be assumed as the expectations of AUTO1 Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €35.0, and the most bearish reporting a price target of just €20.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €9.2 billion, earnings will come to €193.2 million, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 6.4%.

- Given the current share price of €26.14, the bearish analyst price target of €20.59 is 26.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.