Key Takeaways

- Rising interest rates, regulatory actions, and demographic trends are pressuring profitability, cash flow, and long-term rental income growth.

- Increased supply, stricter environmental requirements, and higher capital spending threaten occupancy, asset values, and return on equity.

- Strong rental income, property value recovery, government policy support, value-add segment growth, and experienced leadership all position Vonovia for solid long-term earnings expansion.

Catalysts

About Vonovia- Operates as an integrated residential real estate company in Europe.

- The continued increase in interest rates across Europe poses a direct threat to Vonovia's highly leveraged capital structure, increasing refinancing costs and potentially forcing higher interest payments as legacy low-cost debt rolls off. This dynamic is set to pressure net margins and reduce free cash flow, particularly as debt-to-EBITDA remains elevated.

- While current rent growth appears robust, demographic shifts such as aging populations and slowing household formation in Germany and key markets threaten to restrict long-term rental demand, undermining revenue growth and reducing the likelihood of sustained increases in rental income in the future.

- Persistent political and societal focus on rent control and housing affordability is driving European governments toward stricter rental regulations. Extended or intensified rent caps and regulatory commissions could severely limit Vonovia's ability to increase rents, leading to stagnating or declining rental income and EBITDA over the long term.

- Structural oversupply risk is increasing as state and private actors ramp up development to address housing shortages. If these housing initiatives succeed, it could flood certain urban markets and result in lower occupancy rates, eroding rental pricing power and compressing sector profitability, translating into weaker earnings and lower asset values for Vonovia.

- Escalating requirements for energy efficiency upgrades and climate adaptation will demand very significant capital expenditures. Even as Vonovia invests heavily to maintain legal compliance and asset quality, surging capex obligations-combined with uncertain government subsidy levels-will weigh on free cash flow and constrain return on equity, ultimately limiting long-term growth in net income.

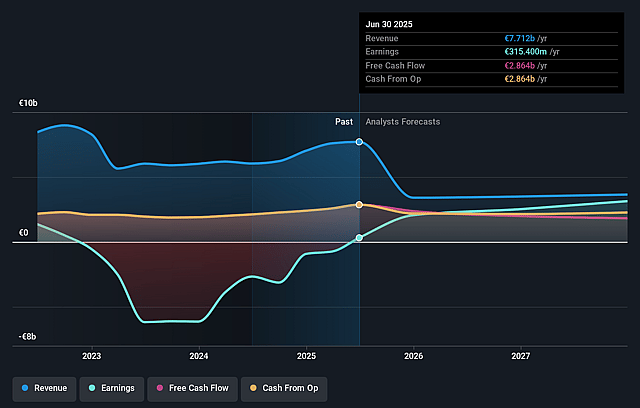

Vonovia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Vonovia compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Vonovia's revenue will decrease by 26.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -9.7% today to 100.5% in 3 years time.

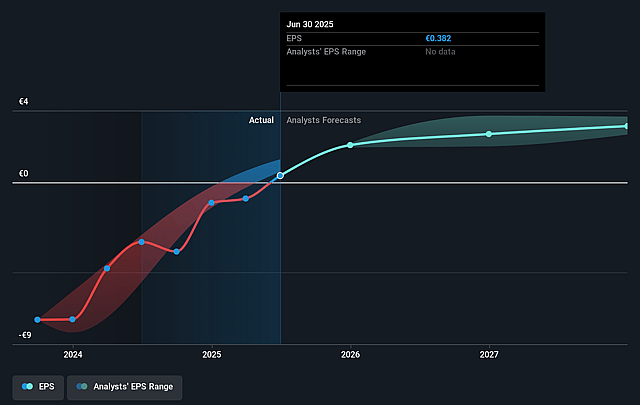

- The bearish analysts expect earnings to reach €3.0 billion (and earnings per share of €3.42) by about July 2028, up from €-736.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, up from -31.9x today. This future PE is lower than the current PE for the GB Real Estate industry at 18.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.93%, as per the Simply Wall St company report.

Vonovia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust rental growth well above inflation, supported by low vacancies, high rent collection rates, and significant organic Mietspiegel-driven uplifts, points to stable and growing revenue streams in coming years.

- Investor demand and transaction market strength, with valuations recovering and transaction volumes up 180% year-over-year, indicate stabilization and potential appreciation in property values, directly benefiting Vonovia's asset base and net asset value.

- Structural government support for housing construction, modernization, and energy efficiency-backed by the climate transformation fund and new pro-construction policy initiatives-may ease cost pressures and drive new revenue opportunities and margin expansion.

- Growth in value-add and recurring sales segments-including manage-to-green strategies with high margins and the ramp-up in services and asset recycling-is increasing contribution to EBITDA, supporting long-term earnings growth and cash flow stability.

- Incoming CEO with strong B2C, digitalization, and operational background (including experience at Vodafone and SAP), and a stable wider management team, is positioned to drive further cost efficiencies, scalability, and tenant service improvements, which could lift net margins and enhance long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Vonovia is €24.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vonovia's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €52.8, and the most bearish reporting a price target of just €24.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €3.0 billion, earnings will come to €3.0 billion, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 9.9%.

- Given the current share price of €28.14, the bearish analyst price target of €24.0 is 17.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.