Catalysts

About PATRIZIA

PATRIZIA is a global investment manager focused on smart real assets across real estate and infrastructure for institutional clients.

What are the underlying business or industry changes driving this perspective?

- Although the integrated investment platform is starting to show operating leverage, with management fees now covering operating expenses, the slower than expected recovery in real estate transaction volumes and equity deployment could cap near term fee growth and limit further expansion in EBITDA margins.

- Despite structural demand in modern living segments such as affordable housing and senior living, constrained client risk appetite and competition for core residential assets may slow AUM growth in the Living strategy and temper the uplift in recurring management fee revenue.

- While policy support and capital demand for energy transition infrastructure and district heating platforms are increasing, longer lead times to close infrastructure deals and potential regulatory delays could postpone AUM scaling in this area and defer the associated contribution to earnings.

- Although cost efficiency programs have materially reset the expense base and delivered significant savings, the greatest efficiencies have already been realized. Further optimization will likely be incremental, reducing the scope for additional margin expansion from cost alone and putting more pressure on revenue growth to drive future earnings.

- While technology enabled platforms and digital infrastructure investments are well aligned with client priorities, ongoing market volatility, currency headwinds and the shift toward all in fee structures can compress transaction and performance fee pools, limiting upside to total revenues and net income.

Assumptions

This narrative explores a more pessimistic perspective on PATRIZIA compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

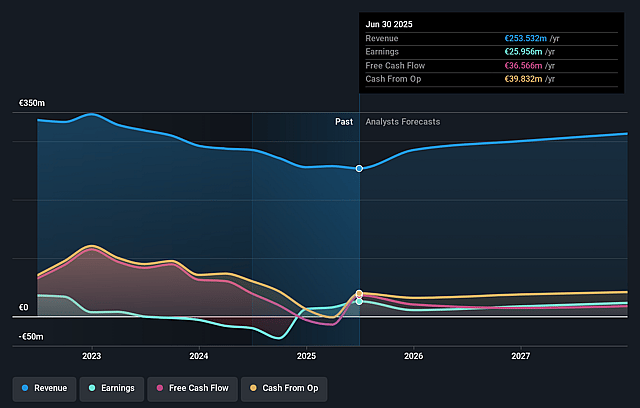

- The bearish analysts are assuming PATRIZIA's revenue will grow by 2.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 15.1% today to 6.0% in 3 years time.

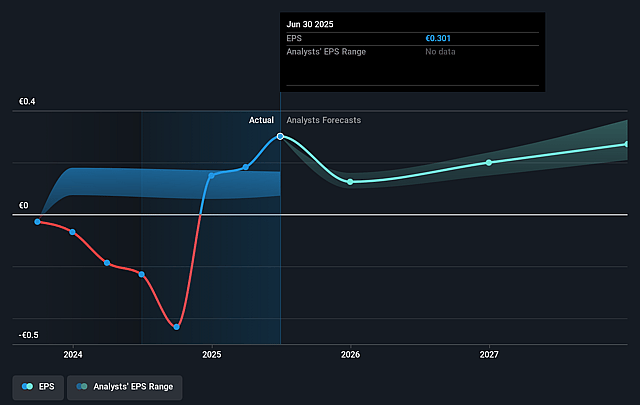

- The bearish analysts expect earnings to reach €16.8 million (and earnings per share of €0.2) by about December 2028, down from €39.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €27.7 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 75.3x on those 2028 earnings, up from 18.2x today. This future PE is greater than the current PE for the GB Real Estate industry at 10.9x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.58%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company is already demonstrating strong operating leverage with EBITDA up over 500 percent year on year and the EBITDA margin rising from 3.5 percent to 22.1 percent, so if this structurally higher profitability proves sustainable, the market may rerate the stock upward as confidence grows in higher quality earnings and recurring management fee coverage of operating expenses, supporting higher earnings and net margins.

- Client appetite for real assets appears to be recovering, with equity raised up 7.6 percent year on year, open equity commitments increasing to EUR 1.1 billion and transaction volumes and acquisitions accelerating along the dual megatrends in living and infrastructure, which could drive faster than expected AUM expansion and, in turn, higher management fee revenue and earnings.

- Long term secular trends in modern living and energy transition, including structural demand for affordable housing, student housing, senior living, digital infrastructure and Nordic district heating platforms, position PATRIZIA to capture substantial growth as institutional investors allocate more capital to these areas, potentially lifting both AUM growth and fee based revenue above current conservative expectations.

- The strategy to decouple profitability from volatile market driven revenues through a more efficient integrated investment platform, strict cost discipline and a dual engine model that combines asset light investment management with co investments may create significant positive operating leverage when the cycle improves, which could accelerate growth in EBITDA and net income beyond what is currently priced in.

- Management’s reaffirmed North Star of EUR 100 billion in AUM supported by a more international platform, access to larger institutional capital pools and potential inorganic opportunities or strategic partnerships suggests upside optionality, so if even part of this growth path materializes, it could materially increase recurring fee income and long term earnings power, leading to share price appreciation rather than a flat trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for PATRIZIA is €8.2, which represents up to two standard deviations below the consensus price target of €10.22. This valuation is based on what can be assumed as the expectations of PATRIZIA's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €12.2, and the most bearish reporting a price target of just €8.2.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be €277.8 million, earnings will come to €16.8 million, and it would be trading on a PE ratio of 75.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of €8.22, the analyst price target of €8.2 is 0.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PATRIZIA?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.