Last Update04 Oct 25Fair value Decreased 6.33%

ProSiebenSat.1 Media's fair value target has been lowered by analysts to €7.03 from €7.51. This change reflects tempered revenue growth expectations as well as a more cautious outlook on profit margins and discount rates.

Analyst Commentary

Bullish Takeaways- Bullish analysts see potential for upward momentum in the stock, as some are raising their price targets and maintaining positive outlooks.

- Recent increases in target valuations from major firms suggest confidence in management’s execution and company strategy.

- Expectations for stable or improving market share support optimism for growth in core revenue streams.

- Analysts highlight resilience in certain business segments, which contributes positively to the company’s overall valuation outlook.

- Bearish analysts have shown caution by lowering recommendations and adjusting price targets slightly downward, signaling concerns about near-term upside.

- There are ongoing concerns about the sustainability of profit margins given competitive pressures and changing market dynamics.

- Analysts remain wary of execution risks related to broader macroeconomic uncertainty and evolving consumer media consumption patterns.

- Some note that more conservative discount rates and modest revenue growth expectations continue to affect fair value estimates.

What's in the News

- ProSiebenSat.1 Media SE revised its financial guidance for 2025, now targeting group revenues of around €3.65 to €3.80 billion, lower than the previous outlook of approximately €3.85 billion. (Key Developments)

- MFE-MediaForEurope N.V. completed the acquisition of an additional 29.86% stake in ProSiebenSat.1, raising its total ownership to 60%. (Key Developments)

- PPF IM Ltd finalized the acquisition of an additional 2.7% stake in ProSiebenSat.1, bringing its shareholding closer to the maximum targeted in its public offer. (Key Developments)

- Earlier in 2025, ProSiebenSat.1 had confirmed higher group revenue guidance of around €3.85 billion for the year, before the recent downward revision. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target: Decreased modestly from €7.51 to €7.03, reflecting a more cautious outlook on the stock's fair value.

- Discount Rate: Increased slightly from 7.04% to 7.24%, indicating greater perceived risk or higher required return.

- Revenue Growth: Lowered from 1.75% to 1.30%, suggesting revised expectations for the company's pace of sales expansion.

- Net Profit Margin: Declined from 7.52% to 6.90%, pointing to tighter margins and potential profitability challenges.

- Future P/E: Rose from 7.69x to 8.00x, implying higher earnings multiples projected for the company going forward.

Key Takeaways

- Strong digital transformation and content strategy is increasing user engagement, advertising revenue, and solidifying market position across both traditional and online platforms.

- Commerce diversification, tech partnerships, and tax efficiencies are enhancing group profitability, stability, and long-term cash flow growth beyond core media operations.

- Heavy dependence on declining traditional TV ads, fragmented audiences, rising costs, and uncertain digital growth threaten earnings, stability, and long-term profitability.

Catalysts

About ProSiebenSat.1 Media- Operates as a media company in Germany, Austria, Switzerland, the United States, and internationally.

- The substantial 62% year-over-year growth in Joyn's ad-supported streaming revenues, along with ongoing momentum in user and watch time, indicates ProSiebenSat.1 is successfully capitalizing on the shift from traditional TV to online video, positioning the company for digital revenue growth and higher future earnings as this segment scales.

- Strategic expansion of local-language and culturally relevant content, both on linear TV and digital platforms like Joyn, along with strengthened sports rights through 2031, is driving increased audience share and engagement, which should translate into higher advertising revenues and improved market position over the long term.

- Partnerships and technological investments-such as the Freewheel collaboration enabling pan-European programmatic ad sales and cross-media campaigns-position ProSiebenSat.1 to benefit from rising demand for data-driven and programmatic advertising, supporting stronger monetization and potentially lifting net margins.

- Ongoing growth and internationalization of the Commerce & Ventures portfolio, notably Flaconi's 33% revenue growth in Q2 and its cohort-based scaling model, suggest robust top-line expansion and improving profitability beyond traditional media, diversifying and strengthening group-wide earnings stability.

- The merger of Seven.One Entertainment into Joyn and utilization of €460 million in tax loss carryforwards is expected to deliver material cash tax savings and deferred tax income (with a €124 million benefit recognized in Q3 and ongoing positive cash flow effects until 2029), directly boosting net income and operational cash flows.

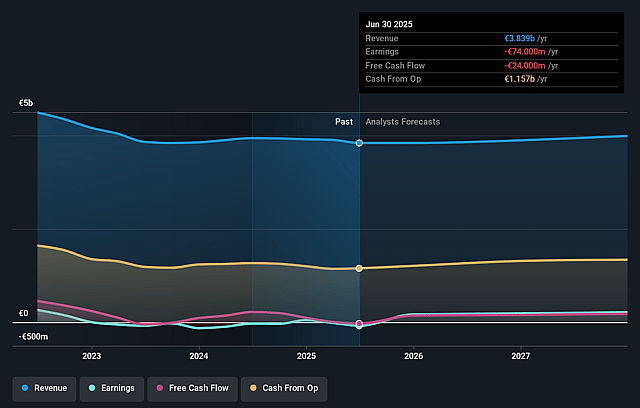

ProSiebenSat.1 Media Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ProSiebenSat.1 Media's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.9% today to 8.2% in 3 years time.

- Analysts expect earnings to reach €332.1 million (and earnings per share of €0.94) by about September 2028, up from €-74.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.4x on those 2028 earnings, up from -23.3x today. This future PE is lower than the current PE for the GB Media industry at 27.5x.

- Analysts expect the number of shares outstanding to grow by 2.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.58%, as per the Simply Wall St company report.

ProSiebenSat.1 Media Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent structural declines in core TV advertising revenues due to the ongoing macroeconomic weakness in the German (DACH) region, combined with only gradual and uncertain digital revenue offset, continue to pressure group revenues and threaten high-margin profit pools.

- Overreliance on the DACH advertising market exposes the company to regional economic volatility and secular declines in linear TV, increasing the risk of revenue volatility and limiting sustainable earnings growth.

- Competition from global streaming players (e.g., Netflix, Amazon Prime, RTL-Sky JV), alongside intensified local and international competition for both viewers and premium content, fragments ProSiebenSat.1's audience and pressures advertising pricing, undermining long-term revenue and net margins.

- High investment and content costs (including premium local and international rights, sports, and original programming) may not be adequately covered by growth in newer digital and AVOD segments, putting further downward pressure on net margins and reducing free cash flow.

- Ongoing underperformance in segments like Dating & Video and the execution risk around strategic repositioning (especially delayed timeline for recovery), along with potential regulatory or ownership changes (e.g., change of control impacting tax benefits or financing), introduces significant uncertainty and threatens earnings visibility and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €8.169 for ProSiebenSat.1 Media based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €11.4, and the most bearish reporting a price target of just €6.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.1 billion, earnings will come to €332.1 million, and it would be trading on a PE ratio of 7.4x, assuming you use a discount rate of 6.6%.

- Given the current share price of €7.61, the analyst price target of €8.17 is 6.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.